- May 20, 2009

- 144,039

- 66,305

- 2,330

But of course the markets want stimulus, and dont care about our debt atm.

If the markets were concerned about debt you would see the following:

Interest rates climb as our borrowers became less willing to lend, and stocks would fall as interest rates constrain growth.

But what we see is that interest rates and stocks are low. Suggesting interest rates are being driven down by people that would rather invest in low yielding bonds than in risky equities.

In short we should spend to full employment, or until we become constrained by the bond market.

BTW, nice krugman copy-pasta. Half of the people here will crucify you for citing him, the other half think hes a brilliant economist. Count me in with the latter.

Krugman is dumber than you are.

The Markets are huge flight to safety right now. They care about debt that's why Greece and Italy are junk and Germany couldn't find buyers for their bonds; the USA is still the safest place to park money. That's why our rates are so low.

Oh dont even get me started on europe....

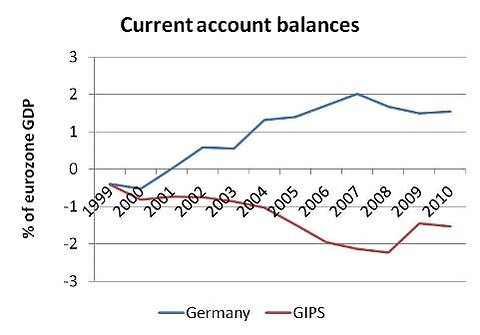

Germany has a surplus. It had to pay extra because the market is preparing for a break up of the euro in which germany returns to its own currency and then repays bonds issued in euros with less valuable deutschmarks. not because it was worried about debt

Italy is a solvent nation. The problem is that it doesnt have control over its own currency so it may become illiquid. Illiquidy scares investors, they demand higher interest rates, higher interest rates maybe lead to insolvency. Its a victim of a self fulfilling cycle because the ECB wont act as a lender of last resort.

But back to US debt...

You partially made my point. If people thought the US had a debt problem like those countries, they wouldnt finance our debt. Of course creditors worry about their delinquent debtors like greece (altough the problem is more complex than you understand). But we arent one of those delinquent debtors, thats why their buying our debt.

And your missing a fundamental point about the bond market. The flight into treasuries show that the market is concerned about GROWTH. When a country has low interest rates the market has little incentive to buy those bonds. Why invest in US treasuries that yield 1.8% over ten years when you could invest in equities that might yield 10% in a year? The fact that the treasury can still find buyers for 10 year notes at 1.86% is because investors dont believe equities or other investments will have higher yields, and may even think theyll have a negative yield.

The markets arent worried about our debt. thats a simple fact.

Italy is solvent? A country with Debt/GDP of 120% is many things, but solvent is not one of them.

The Italy bond is 7%+ because it's an economy in its death throes. Once its off the Euros is will have to pay for things, like say gasoline in liras, which is going to send the economy futher down the crapper.

In the USA airlines are starting to scrap entire fleets of small planes because the cost of fuel makes it uneconomical to continue, what do you think (new word for you, look it up) will happen to the Italian economy once its out of the Euro

Last edited: