oldfart

Older than dirt

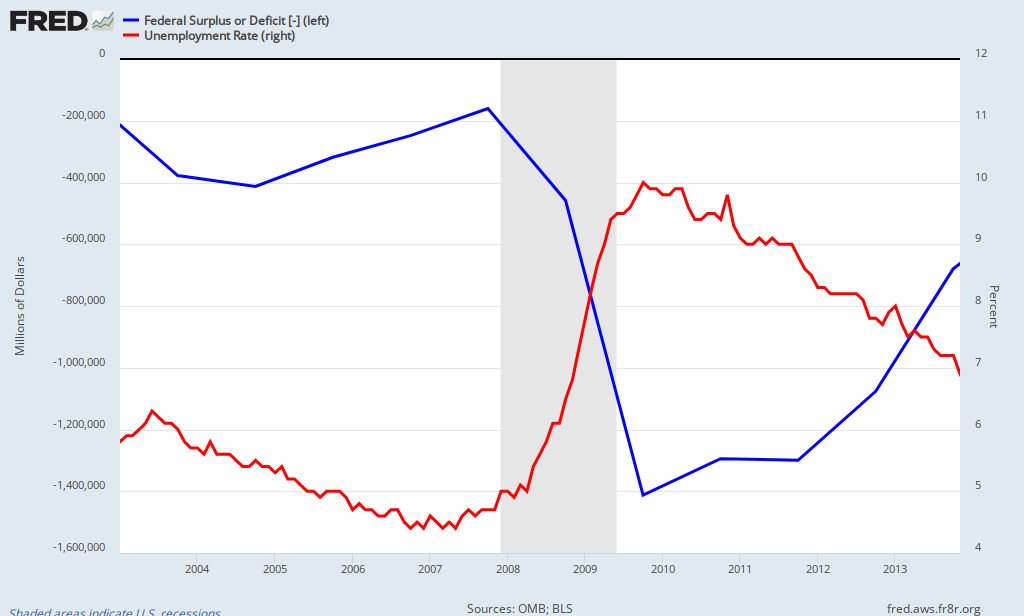

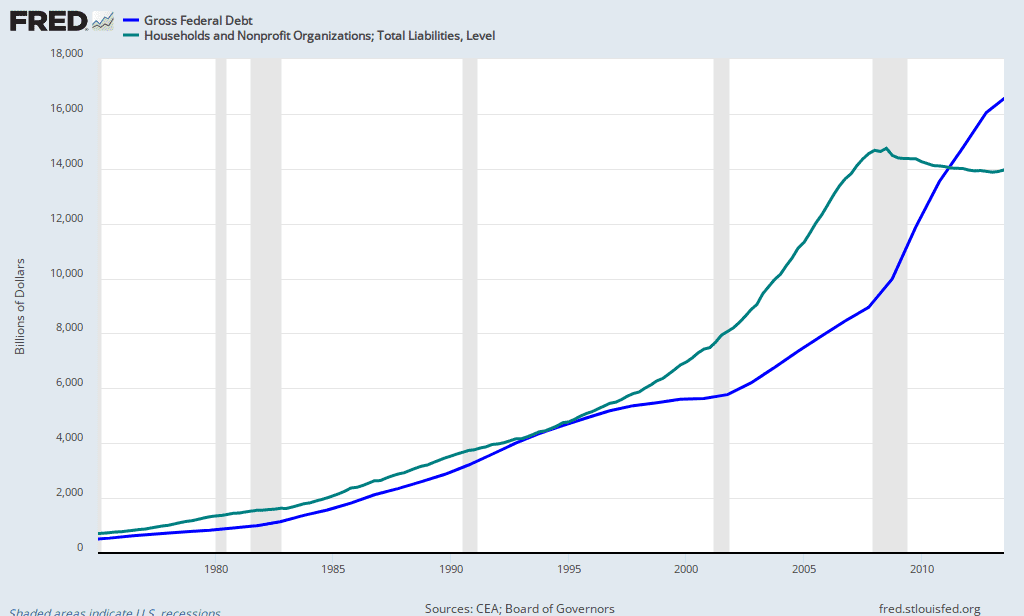

The tech bubble wasn't caused by "artificial interest rates". Urban legend. Look at the Goldilocks economy. Our trade deficit skyrocketed and there was a public sector surplus.This was a bad idea as far as stock flow consistency. The private sector naturally went into deficit as the public sector was in surplus. Private debt loads increased and housed savings evaporated. This is what caused the bubble.

The circular flow of income accounting identity you're using (S+T+C+M=C+I+G+X) does not say anything about a causal relationship (hence one really good reason it's insufficient as a model for determining policy). An identity statement necessarily does not indicate causality. In a closed economy, saying the private sector went into deficit is identical to saying that the public sector went into surplus. Saying the private sector deficit CAUSED the public sector surplus is not derived or warranted from the sectoral balances identity statement.

What you say is a good reminder. I assure you that Kimura's macro model contains a pretty sophisticated production function along with the traditional demand functions for trade balance, consumption, and investment. He also has a pretty detailed grasp of financial markets (as does Toro). Ask us a question if you think the post is underdeveloped, don't think we confuse national accounting identities with functions.