Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tax the Rich: Fix Jobs and Deficits

- Thread starter georgephillip

- Start date

Avorysuds

Gold Member

Someone making $250,000 per year has more influence than the homeless in your example. Of course you once again ignore that I used the example of millionaires and billionaires; I'm beginning to believe your defense of your opinions is more important to you than an honest debate on the merits of two widley different means of attacking our nations economic woes.

This still goes away from the original premise of taxation, which is to fund the government, not to have people pay for more access, or because they have a nicer car than you, or because you think some poor people can use the money more than the "rich" person can.

Taxes pay to fund government, on this we agree. Today, taxes also pay our debt, a debt incurred because our representatives engaged in deficit spending for the last 10 years. An amount which cannot be satisfied in one year, nor can our annual deficit be balanced in one year as the TP faction of the Republican Party pretends. To cut the Federal Budget by a 100 billion dollars simply exacerbates a serous unemployment problem.

In my opinion too much wealth concentrated in too few is the bane for a republic. You may disagree but the direction of our county for the past ten years is too amass greater wealth into the hands of the few and take from the many.

It's an old story, not unique to this century or our continent. I see the New Right as a reactonary force in American politics, seeking the good old days of the gilded age where we came as close to a plutocracy as never before.

I see it as a correction that has to happen or the country fails... Let’s do it your way and spend 50 trillion in 10 years and claim we saved 5 trillion in 10 years by spending "smart!"

But hey, "It could have been 55 trillion!" Your kind of Government is not unique, it has failed throughout history repeatedly and yet here we are watching people claim we need to give it another shot and if they only had more money it would have worked last time it failed.

Remember, Obama’s stimulus might have failed on all accounts but the new goal was to accidently save us from a depression! Bush’s Iraq was fail but hey, it saved us from WWIII! I dare you to argue it didn’t! LOL~

Wiseacre

Retired USAF Chief

This still goes away from the original premise of taxation, which is to fund the government, not to have people pay for more access, or because they have a nicer car than you, or because you think some poor people can use the money more than the "rich" person can.

Taxes pay to fund government, on this we agree. Today, taxes also pay our debt, a debt incurred because our representatives engaged in deficit spending for the last 10 years. An amount which cannot be satisfied in one year, nor can our annual deficit be balanced in one year as the TP faction of the Republican Party pretends. To cut the Federal Budget by a 100 billion dollars simply exacerbates a serous unemployment problem.

In my opinion too much wealth concentrated in too few is the bane for a republic. You may disagree but the direction of our county for the past ten years is too amass greater wealth into the hands of the few and take from the many.

It's an old story, not unique to this century or our continent. I see the New Right as a reactonary force in American politics, seeking the good old days of the gilded age where we came as close to a plutocracy as never before.

I see it as a correction that has to happen or the country fails... Lets do it your way and spend 50 trillion in 10 years and claim we saved 5 trillion in 10 years by spending "smart!"

But hey, "It could have been 55 trillion!" Your kind of Government is not unique, it has failed throughout history repeatedly and yet here we are watching people claim we need to give it another shot and if they only had more money it would have worked last time it failed.

Remember, Obamas stimulus might have failed on all accounts but the new goal was to accidently save us from a depression! Bushs Iraq was fail but hey, it saved us from WWIII! I dare you to argue it didnt! LOL~

It's like when the wife goes shopping and buys $500 worth of stuff and then says "But I saved you $300!". sigh. What're you gonna do?

It's inarguable that in order to fix the fiscal mess, sacrifices have to be made.

It's reasonable and sensible that the sacrifice should be shared.

The problem with the conservative consensus is that the wealthy should be exempted from sharing the sacrifice.

Let the conservatives here tell us what the wealthy's share of the necessary sacrifice should be...

...they will either not answer, or claim that the wealthy shouldn't sacrifice anything.

THAT is class warfare.

Wealth has nothing to do with anything since only income is taxed in this country.

In 2008 the top 5% ( AGI $160,000 and up) paid 59% of all federal income taxes. How much more of the sacrifice do you think they should share?

National Taxpayers Union - Who Pays Income Taxes?

martybegan

Diamond Member

- Apr 5, 2010

- 85,121

- 35,655

- 2,300

Where in the constitution is everyone given access and influence, not to mention a private jet?

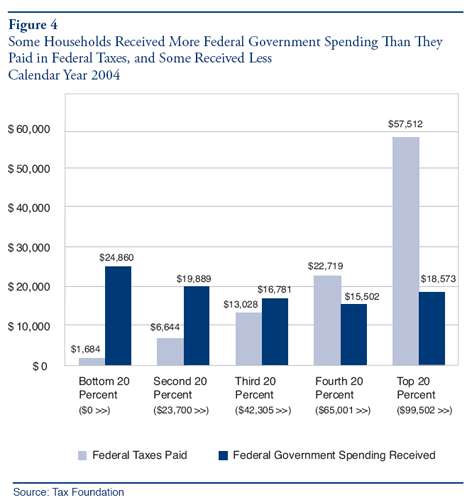

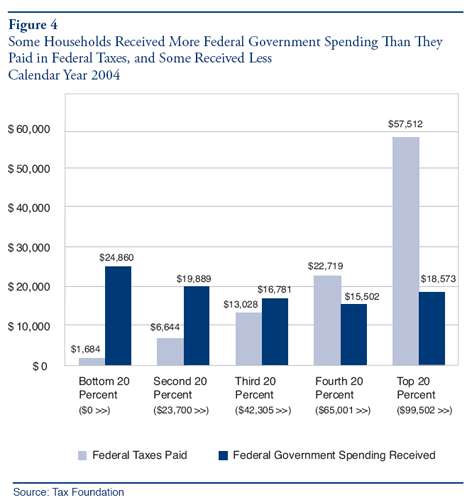

In tangible benefits the poor get more back from the goverment then they give, the middle class usually give more than they get, and the rich give a hell of a lot more than they get.

Some people consider this "fair".

What's fair? When the woman with two kids is working stacking shelves at Walmart on third shift is paying the same percentage of her income as Walmart's CEO?

Or to be really fair, shouldn't she pay the same DOLLAR AMOUNT? Let's face it, even a flat percentage isn't really fair is it?

You don't get your gas and groceries priced at a percentage of your wages, right? You pay the same for a dozen eggs the millionaire pays.

Isn't that how taxes should be? I mean if you really want to talk fair. You and the millionaire should send the exact same dollar amount to the federal government, no matter what your wages.

Fair. lol.

Where in the constitution does it say life is supposed to be fair?

You want to make it more fair? pay for it yourself, dont use the government's gun to make other people pay for your social policies. Or at least do it at the local level, where the people have more control than at the federal level.

Again, taxes are to pay for the government, not to create your utopian society via wealth redistribution.

Wry Catcher

Diamond Member

- Banned

- #106

This still goes away from the original premise of taxation, which is to fund the government, not to have people pay for more access, or because they have a nicer car than you, or because you think some poor people can use the money more than the "rich" person can.

Taxes pay to fund government, on this we agree. Today, taxes also pay our debt, a debt incurred because our representatives engaged in deficit spending for the last 10 years. An amount which cannot be satisfied in one year, nor can our annual deficit be balanced in one year as the TP faction of the Republican Party pretends. To cut the Federal Budget by a 100 billion dollars simply exacerbates a serous unemployment problem.

In my opinion too much wealth concentrated in too few is the bane for a republic. You may disagree but the direction of our county for the past ten years is too amass greater wealth into the hands of the few and take from the many.

It's an old story, not unique to this century or our continent. I see the New Right as a reactonary force in American politics, seeking the good old days of the gilded age where we came as close to a plutocracy as never before.

I see it as a correction that has to happen or the country fails... Lets do it your way and spend 50 trillion in 10 years and claim we saved 5 trillion in 10 years by spending "smart!"

But hey, "It could have been 55 trillion!" Your kind of Government is not unique, it has failed throughout history repeatedly and yet here we are watching people claim we need to give it another shot and if they only had more money it would have worked last time it failed.

Remember, Obamas stimulus might have failed on all accounts but the new goal was to accidently save us from a depression! Bushs Iraq was fail but hey, it saved us from WWIII! I dare you to argue it didnt! LOL~

Ltt's pretend you can offer an argument to fix our economic woes withot offering an opinion on why something won't work. Let's put the hyperbole and sarcasm away and pretend you have some ideas not already parroted by others.

Wry Catcher

Diamond Member

- Banned

- #107

When people live on government handouts paid for by others' taxes, their share of influence and power is disproportional to their level of effort.

Now, explain how somebody making $250,000 per year has all that Access and Influence in their private jets, because that is the current target for tax increases. And once they are plucked, the level is sure to fall to $100,000.

There aren't enough Truly Wealthy to fund your leftwing moonbat Big Government programs.

Someone making $250,000 per year has more influence than the homeless in your example. Of course you once again ignore that I used the example of millionaires and billionaires; I'm beginning to believe your defense of your opinions is more important to you than an honest debate on the merits of two widley different means of attacking our nations economic woes.

Honest? You want to IGNORE the reality of what Obama and the Democrats want, which is to increase taxes on those making more then 200,000 and then claim you want an honest opinion?

When did the $250,000 number become $200,000? I missed that change. What is the reality of what "Obama and the Democrats want"?

martybegan

Diamond Member

- Apr 5, 2010

- 85,121

- 35,655

- 2,300

Someone making $250,000 per year has more influence than the homeless in your example. Of course you once again ignore that I used the example of millionaires and billionaires; I'm beginning to believe your defense of your opinions is more important to you than an honest debate on the merits of two widley different means of attacking our nations economic woes.

This still goes away from the original premise of taxation, which is to fund the government, not to have people pay for more access, or because they have a nicer car than you, or because you think some poor people can use the money more than the "rich" person can.

Taxes pay to fund government, on this we agree. Today, taxes also pay our debt, a debt incurred because our representatives engaged in deficit spending for the last 10 years. An amount which cannot be satisfied in one year, nor can our annual deficit be balanced in one year as the TP faction of the Republican Party pretends. To cut the Federal Budget by a 100 billion dollars simply exacerbates a serous unemployment problem.

In my opinion too much wealth concentrated in too few is the bane for a republic. You may disagree but the direction of our county for the past ten years is to amass greater wealth into the hands of the few and take from the many.

It's an old story, not unique to this century or our continent. I see the New Right as a reactonary force in American politics, seeking the good old days of the gilded age where we came as close to a plutocracy as never before.

I have shown anaylses in other posts that show we cannot tax our way out of it either even by siezing the incomes of everyone over $250,000 a year. The simple fact is we spent years spending money other people paid for, and the increases in taxation is NOT just at the federal level. Property taxes have gone up, state income taxes have gone up, user fees have gone up, sales taxes have gone up.

If you want to try wealth redistribution I challenge you to use the method I told georgie to do it. Go and rob the people instead of using the government's guns to do it for you. Or at least be honest about it and pass laws that take a persons wealth past a certain amount, because, of course, YOU know how thier money should be spent FAR MORE than they do.

Nic_Driver

Active Member

- Mar 25, 2011

- 868

- 76

- 28

If you want to try wealth redistribution I challenge you to use the method I told georgie to do it.

Wealth redistribution is what the Bush tax cuts are. Ending them is a return to better economic times for all and a return to the status quo.

If the name callers would simply shut up and listen, maybe a rational debate would break out.

Taxation is part of the problem, but the greatest problem in need of solution is ignorance. When a poster screams "communist" as a counterpoint to any idea which challenges her/his world view, threads devolve into name calling spats.

It makes no sense to contiue to pay interest on our debt (how many of you tea party conservatives carry debt on your credit cards?). The US Government needs to reduce debt and the only way to reduce debt is to raise revenue and pay it off.

Borrowing to pay interst is STUPID.

Deficit spending must be reduced. It makes no sense not to borrow to repair/replace the roof which risks the entire house. So, it all comes down to priorites.

Cutting taxes is stupid, it reduces revenue and we continue to pay interest on the debt and not fix the roof.

Hiring the unemployed to repair the roof stimulates the economy. The roofer buys lunch, pays his rent, and maybe goes to a movie on Saturday. The deli which sells him the sandwhich benefits, the landlord too and so does the owner of the movie house and the kid who sells the ticket and the other kid who sells the popcorn.

The vendor who sells the popcorn to the theatre owner benefits too. And so the economy goes.

To borrow a pharase, it really is that simple.

its funny that you use the lower rungs of trickle down economics, without really knowing it. One could start at the yacht a rich person buys, or the rediculous avant garde art piece they buy from the artist of the month, and trickle down the economic benefits.

One could, but what would that prove? How many Yachts are sold a month? And even if the seller earns a nice commission, how many deli sandwhiches will s/he eat, shoes, hats, jackets and ties purchased from the mall? More than the worker on the new freeway on ramp?

Maybe the Yacht broker will buy that Art, maybe from a French dealer; don't suggest his profit will trickle down and benefit the economy as 100 workers buying 100 deli sandwhiches a day.

I have a relative that has made a living building yachts for the last 20 years and he is quite pleased that there are millionaires and billionaires that can afford to buy them.

NYcarbineer

Diamond Member

It's inarguable that in order to fix the fiscal mess, sacrifices have to be made.

It's reasonable and sensible that the sacrifice should be shared.

The problem with the conservative consensus is that the wealthy should be exempted from sharing the sacrifice.

Let the conservatives here tell us what the wealthy's share of the necessary sacrifice should be...

...they will either not answer, or claim that the wealthy shouldn't sacrifice anything.

THAT is class warfare.

Wealth has nothing to do with anything since only income is taxed in this country.

In 2008 the top 5% ( AGI $160,000 and up) paid 59% of all federal income taxes. How much more of the sacrifice do you think they should share?

National Taxpayers Union - Who Pays Income Taxes?

Rich? Sacrifice? I've yet to meet a rich person who wanted to trade places with me and my 50 grand a year.

So my point stands. Conservative consensus is, in this time of sacrifice, everyone EXCEPT the rich should share the sacrifice.

daveman

Diamond Member

Weren't you whining earlier about "the rich benefit more from government than the poor"?Where in the constitution is everyone given access and influence, not to mention a private jet?

In tangible benefits the poor get more back from the goverment then they give, the middle class usually give more than they get, and the rich give a hell of a lot more than they get.

Some people consider this "fair".

What's fair? When the woman with two kids is working stacking shelves at Walmart on third shift is paying the same percentage of her income as Walmart's CEO?

Or to be really fair, shouldn't she pay the same DOLLAR AMOUNT? Let's face it, even a flat percentage isn't really fair is it?

You don't get your gas and groceries priced at a percentage of your wages, right? You pay the same for a dozen eggs the millionaire pays.

Isn't that how taxes should be? I mean if you really want to talk fair. You and the millionaire should send the exact same dollar amount to the federal government, no matter what your wages.

Fair. lol.

I showed you that's wrong.

boedicca

Uppity Water Nymph from the Land of Funk

- Feb 12, 2007

- 59,439

- 24,109

- 2,290

Someone making $250,000 per year has more influence than the homeless in your example. Of course you once again ignore that I used the example of millionaires and billionaires; I'm beginning to believe your defense of your opinions is more important to you than an honest debate on the merits of two widley different means of attacking our nations economic woes.

Honest? You want to IGNORE the reality of what Obama and the Democrats want, which is to increase taxes on those making more then 200,000 and then claim you want an honest opinion?

When did the $250,000 number become $200,000? I missed that change. What is the reality of what "Obama and the Democrats want"?

The Obamanoids use both figures. $250,000 is the definition of The Rich for married couples; and $200,000 is the definition of The Rich for a single person. Biden has also claimed it's $150,000 and Bill Richardson says it begins at $120,000, which is a big clue as to where the tax rates are headed for the middle class.

Last edited:

boedicca

Uppity Water Nymph from the Land of Funk

- Feb 12, 2007

- 59,439

- 24,109

- 2,290

It's inarguable that in order to fix the fiscal mess, sacrifices have to be made.

It's reasonable and sensible that the sacrifice should be shared.

The problem with the conservative consensus is that the wealthy should be exempted from sharing the sacrifice.

Let the conservatives here tell us what the wealthy's share of the necessary sacrifice should be...

...they will either not answer, or claim that the wealthy shouldn't sacrifice anything.

THAT is class warfare.

Wealth has nothing to do with anything since only income is taxed in this country.

In 2008 the top 5% ( AGI $160,000 and up) paid 59% of all federal income taxes. How much more of the sacrifice do you think they should share?

National Taxpayers Union - Who Pays Income Taxes?

Rich? Sacrifice? I've yet to meet a rich person who wanted to trade places with me and my 50 grand a year.

So my point stands. Conservative consensus is, in this time of sacrifice, everyone EXCEPT the rich should share the sacrifice.

I doubt that your Income Level is the sole criteria for Not Wanting To Trade Places with you.

Just sayin'.

Someone making $250,000 per year has more influence than the homeless in your example. Of course you once again ignore that I used the example of millionaires and billionaires; I'm beginning to believe your defense of your opinions is more important to you than an honest debate on the merits of two widley different means of attacking our nations economic woes.

Honest? You want to IGNORE the reality of what Obama and the Democrats want, which is to increase taxes on those making more then 200,000 and then claim you want an honest opinion?

When did the $250,000 number become $200,000? I missed that change. What is the reality of what "Obama and the Democrats want"?

It has always been $200,000 for a single person and $250,000 for a couple. There never was a change.

georgephillip

Diamond Member

- Thread starter

- #116

How "fair" is it those who caused the Great Recession have seen their "fair" share of national wealth and income increase during our "recovery?"I have no problem with rich folks.

Wish we had a whole slew more of em.

Since they pay around 60% of the Fed taxes in this country, the more the merrier in my book.

As for fairness, well we have 50% of the folks in this country who pay no Fed taxes whatsoever.

Let let them suck it up and contribute to the cause. Fair is far after all and fair seems to be the word of the day for some folks.

You've just lived through the biggest transfer of private debt into public debt in history.

The richest 2% of Americans have nearly doubled their "fair" share of returns to wealth in less than a generation courtesy of the US taxpayers' $13 billion bail out.

While the rich pay around 60% of all Federal income taxes that are collected, they are also paying at less than half the rate they paid forty years ago, when a single minimum wage job paid the rent on a new one bedroom apartment with enough left over to maintain a car.

Even though it's true life isn't fair, that's not a good reason to make it even more so.

daveman

Diamond Member

Whose fault it is that you're not rich?It's inarguable that in order to fix the fiscal mess, sacrifices have to be made.

It's reasonable and sensible that the sacrifice should be shared.

The problem with the conservative consensus is that the wealthy should be exempted from sharing the sacrifice.

Let the conservatives here tell us what the wealthy's share of the necessary sacrifice should be...

...they will either not answer, or claim that the wealthy shouldn't sacrifice anything.

THAT is class warfare.

Wealth has nothing to do with anything since only income is taxed in this country.

In 2008 the top 5% ( AGI $160,000 and up) paid 59% of all federal income taxes. How much more of the sacrifice do you think they should share?

National Taxpayers Union - Who Pays Income Taxes?

Rich? Sacrifice? I've yet to meet a rich person who wanted to trade places with me and my 50 grand a year.

So my point stands. Conservative consensus is, in this time of sacrifice, everyone EXCEPT the rich should share the sacrifice.

It's inarguable that in order to fix the fiscal mess, sacrifices have to be made.

It's reasonable and sensible that the sacrifice should be shared.

The problem with the conservative consensus is that the wealthy should be exempted from sharing the sacrifice.

Let the conservatives here tell us what the wealthy's share of the necessary sacrifice should be...

...they will either not answer, or claim that the wealthy shouldn't sacrifice anything.

THAT is class warfare.

Wealth has nothing to do with anything since only income is taxed in this country.

In 2008 the top 5% ( AGI $160,000 and up) paid 59% of all federal income taxes. How much more of the sacrifice do you think they should share?

National Taxpayers Union - Who Pays Income Taxes?

Rich? Sacrifice? I've yet to meet a rich person who wanted to trade places with me and my 50 grand a year.

So my point stands. Conservative consensus is, in this time of sacrifice, everyone EXCEPT the rich should share the sacrifice.

You are getting closer, but no cigar. Rich is not a taxable item, income is. Now, answer the question. How much MORE than 59% of all federal taxes that are paid by the top 5% do you think they should pay? It's an easy question.

I will suggest that there are parts of this country where an income of $160,000 AGI is not going to get anyone rich. Check out the price of a home on Long Island or San Francisco and get back to me on that.

How "fair" is it those who caused the Great Recession have seen their "fair" share of national wealth and income increase during our "recovery?"I have no problem with rich folks.

Wish we had a whole slew more of em.

Since they pay around 60% of the Fed taxes in this country, the more the merrier in my book.

As for fairness, well we have 50% of the folks in this country who pay no Fed taxes whatsoever.

Let let them suck it up and contribute to the cause. Fair is far after all and fair seems to be the word of the day for some folks.

You've just lived through the biggest transfer of private debt into public debt in history.

The richest 2% of Americans have nearly doubled their "fair" share of returns to wealth in less than a generation courtesy of the US taxpayers' $13 billion bail out.

While the rich pay around 60% of all Federal income taxes that are collected, they are also paying at less than half the rate they paid forty years ago, when a single minimum wage job paid the rent on a new one bedroom apartment with enough left over to maintain a car.

Even though it's true life isn't fair, that's not a good reason to make it even more so.

I will ask you the same question I asked another poster. What percentage do you think those you refer to as 'rich' ($160,000 AGI) should pay in federal income taxes, keeping in mind that these same 'rich' people pay a lot of other state, Social Security, Medicare, property and local taxes.

georgephillip

Diamond Member

- Thread starter

- #120

Some of the top earners have their tax rate slashed from 70% to 15% over the last forty years.I have no problem with rich folks.

Wish we had a whole slew more of em.

Since they pay around 60% of the Fed taxes in this country, the more the merrier in my book.

As for fairness, well we have 50% of the folks in this country who pay no Fed taxes whatsoever.

Let let them suck it up and contribute to the cause. Fair is far after all and fair seems to be the word of the day for some folks.

Those are mostly low to moderate income households with children. You want to raise their taxes ONLY.

See what I mean about conservatives?

I don't want to raise anyones taxes.

But fair is fair. If the top earners have to pay more then the bottom earners should have to pay as well.

Fair is the word you throw around like a football.

Whats fair about some payin all and some paying nothing???

I haven't.

How about you?

What would you say to new tax brackets which include a 50% rate for incomes between $500,000 and $5 million/year, a 60% rate for incomes between $5 million and $15 million and a 70% bracket for incomes over $15 million per year?

This proposal would pay for substantial rate reductions on incomes below $100,000/year.

Similar threads

- Replies

- 75

- Views

- 892

Latest Discussions

- Replies

- 20

- Views

- 173

- Replies

- 51

- Views

- 130

- Replies

- 58

- Views

- 214

- Replies

- 152

- Views

- 712

Forum List

-

-

-

-

-

Political Satire 8864

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 492

-

-

-

-

-

-

-

-

-

-