Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

So....Bush Tax Cuts included the rich AND middle class?????????

- Thread starter bucs90

- Start date

elvis

Rookie

- Sep 15, 2008

- 25,881

- 4,472

- 0

- Banned

- #42

For 10 years we've heard that Bush simply cut taxes for the rich.

But now, we hear that if the Bush Tax Cuts are not extended, that taxes on the middle class will also go up January 1st.

How is that so? I thought Bush only cut taxes for the rich? If so, then why are taxes going up on the middle class on January 1? The Dem's keep saying they are willing to renew the middle class portion of it, but not for the rich? But.......I thought the cuts included ONLY the rich, according the left wings rants over the last decade?

So Bush's crime wasn't cutting taxes for the rich. The crime was merely including the rich into his tax cuts that applied to everyone who wasn't on government welfare already?

I'm confused. So....basically, Bush cut everyones taxes? But his inclusion of rich people in that tax break is what made him so hated by the left?

If you tell the same lie enough times, people will believe it......

For 10 years we've heard that Bush simply cut taxes for the rich.

According to Google, you're the only one who has ever said, "Bush simply cut taxes for the rich."

"Bush simply cut taxes for the rich." - Google Search

Getting back to the OP we see that Elvis was right!! If you tell the same lie enough times (such as someone said that Bush only cut taxes for the rich) then people will start to believe it.

So now we know that nobody ever said that except for the OP.

Have you said your prayers to Obama yet this morning?

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

What can we say about taxes that have not been said six times already, now seven threads on tax.

Bingo!!!!

I'm guessing the (above) neophyte-"conservatives" assume everyone (else) has the same short-term-memory issues (most) "conservatives" have (proven-to) possess.

I'm guessing the (above) neophyte-"conservatives" assume everyone (else) has the same short-term-memory issues (most) "conservatives" have (proven-to) possess.

elvis

Rookie

- Sep 15, 2008

- 25,881

- 4,472

- 0

- Banned

- #44

What can we say about taxes that have not been said six times already, now seven threads on tax.Bingo!!!!

I'm guessing the (above) neophyte-"conservatives" assume everyone (else) has the same short-term-memory issues (most) "conservatives" have (proven-to) possess.

have a good day, Sheman.

For 10 years we've heard that Bush simply cut taxes for the rich.

But now, we hear that if the Bush Tax Cuts are not extended, that taxes on the middle class will also go up January 1st.

How is that so? I thought Bush only cut taxes for the rich? If so, then why are taxes going up on the middle class on January 1? The Dem's keep saying they are willing to renew the middle class portion of it, but not for the rich? But.......I thought the cuts included ONLY the rich, according the left wings rants over the last decade?

So Bush's crime wasn't cutting taxes for the rich. The crime was merely including the rich into his tax cuts that applied to everyone who wasn't on government welfare already?

I'm confused. So....basically, Bush cut everyones taxes? But his inclusion of rich people in that tax break is what made him so hated by the left?

According to Google, you're the only one who has ever said, "Bush simply cut taxes for the rich."

"Bush simply cut taxes for the rich." - Google Search

Getting back to the OP we see that Elvis was right!! If you tell the same lie enough times (such as someone said that Bush only cut taxes for the rich) then people will start to believe it.

So now we know that nobody ever said that except for the OP.

Have you said your prayers to Obama yet this morning?

Yeah. That's the kind of reply I would give too if I was getting my ass kicked.

What the heck do you want? I was agreeing with you!!

Last edited:

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

Another example of the first quote in my sig!If you tell the same lie enough times, people will believe it......

It is a CON$ervative lie that Libs said there were NO tax cuts for people who weren't rich! Libs said MOST of the tax cuts went to the rich. MOST is not ALL!!!!!! A small percent of the tax cuts went to the middle class and below.

What CON$ did to make it appear that the tax cuts were spread across the whole spectrum of tax payers was to average the big tax cuts the rich got with the small tax cuts the middle class got. Not only that, they didn't include the 25% who didn't get a tax cut in the average to make the average as deliberately misleading as possible, it was an average only of people who got cuts. Bush claimed an AVERAGE tax cut of $1,586.00. If you average ALL tax payers whether they got a refund or not, it was $1,217.00. To get a tax cut of $1,586.00 you need an income of over $75,000.00.

A more HONEST representation of the tax cuts is the MEDIAN tax cut of $407.00, or about $9.00 per week. That means 50% of tax payers got less than $407 and 50% got more.

For someone to average a $2,600.00 tax cut for 8 years they would need an average income of over $100,000.00 for the 8 years. Maybe that's not rich, but it certainly is well above the median income most Americans earn.

Wrong. I didn't make 100k a year. Sorry.

....Which points to the obvious-conclusion....you're WRONG about your (supposed) understanding of tax-rates....or, you're a liar.

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

Then you didn't get a $2600 tax cut. Sorry.Another example of the first quote in my sig!

It is a CON$ervative lie that Libs said there were NO tax cuts for people who weren't rich! Libs said MOST of the tax cuts went to the rich. MOST is not ALL!!!!!! A small percent of the tax cuts went to the middle class and below.

What CON$ did to make it appear that the tax cuts were spread across the whole spectrum of tax payers was to average the big tax cuts the rich got with the small tax cuts the middle class got. Not only that, they didn't include the 25% who didn't get a tax cut in the average to make the average as deliberately misleading as possible, it was an average only of people who got cuts. Bush claimed an AVERAGE tax cut of $1,586.00. If you average ALL tax payers whether they got a refund or not, it was $1,217.00. To get a tax cut of $1,586.00 you need an income of over $75,000.00.

A more HONEST representation of the tax cuts is the MEDIAN tax cut of $407.00, or about $9.00 per week. That means 50% of tax payers got less than $407 and 50% got more.

For someone to average a $2,600.00 tax cut for 8 years they would need an average income of over $100,000.00 for the 8 years. Maybe that's not rich, but it certainly is well above the median income most Americans earn.

Wrong. I didn't make 100k a year. Sorry.

Combined Effect of Bush Tax Cuts 2003

Income

(in thousands) Percent of Households Average Tax Change

Less than 10 23.7 -$8

10-20 16.6 -$307

20-30 13.3 -$638

30-40 9.7 -$825

40-50 7.6 -$1,012

50-75 13.0 -$1,403

75-100 6.8 -$2,543

100-200 6.6 -$3,710

200-500 1.6 -$7,173

500-1,000 0.3 -$22,485

More than 1,000 0.1 -$112,925

Source: Tax Policy Center table Table T03-0123

http://www.taxpolicycenter.org/TaxModel/tmdb/Content/Excel/T03-0123.xls

WELL DONE!!!!!!

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

those are averages.Then you didn't get a $2600 tax cut. Sorry.Wrong. I didn't make 100k a year. Sorry.

Combined Effect of Bush Tax Cuts 2003

Income

(in thousands) Percent of Households Average Tax Change

Less than 10 23.7 -$8

10-20 16.6 -$307

20-30 13.3 -$638

30-40 9.7 -$825

40-50 7.6 -$1,012

50-75 13.0 -$1,403

75-100 6.8 -$2,543

100-200 6.6 -$3,710

200-500 1.6 -$7,173

500-1,000 0.3 -$22,485

More than 1,000 0.1 -$112,925

Source: Tax Policy Center table Table T03-0123

http://www.taxpolicycenter.org/TaxModel/tmdb/Content/Excel/T03-0123.xls

I know what I got you disingenuous fuck. Look up the tax brackets the IRS provides and compare 2000 to 2008. Otherwise find out where Obama is so you can face that direction while praying to him, dipshit.

C'mon...c'mon....take your ASS-WHUPPIN', like a MAN!!!!!

Less than 10 23.7 -$8

10-20 16.6 -$307

20-30 13.3 -$638

30-40 9.7 -$825

40-50 7.6 -$1,012

50-75 13.0 -$1,403

75-100 6.8 -$2,543

100-200 6.6 -$3,710

200-500 1.6 -$7,173

500-1,000 0.3 -$22,485

More than 1,000 0.1 -$112,925

Look at the TOP TWO income levels.

Note how much the over $1 million a year rate jumps?

This is exactly why I say the progressive rate of taxation has to be continued right up to the top wage levels.

I guaranteed you that the highly productive upper middle and lower-ipperclasses people who made $1,000,001 dollars did not get anywhere near that $112,000 tax break.

BUT THEY ARE included in these dummied down computations, are they not?

It is precisely THOSE people who our current simplified tax system (at the top levels) is SCREWING.

If you make a million a year, you are a flea compared to the people who are REALLY rich.

10-20 16.6 -$307

20-30 13.3 -$638

30-40 9.7 -$825

40-50 7.6 -$1,012

50-75 13.0 -$1,403

75-100 6.8 -$2,543

100-200 6.6 -$3,710

200-500 1.6 -$7,173

500-1,000 0.3 -$22,485

More than 1,000 0.1 -$112,925

Look at the TOP TWO income levels.

Note how much the over $1 million a year rate jumps?

This is exactly why I say the progressive rate of taxation has to be continued right up to the top wage levels.

I guaranteed you that the highly productive upper middle and lower-ipperclasses people who made $1,000,001 dollars did not get anywhere near that $112,000 tax break.

BUT THEY ARE included in these dummied down computations, are they not?

It is precisely THOSE people who our current simplified tax system (at the top levels) is SCREWING.

If you make a million a year, you are a flea compared to the people who are REALLY rich.

Last edited:

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

That's true, averages don't take into account tax cheats.those are averages.

I know what I got you disingenuous fuck. Look up the tax brackets the IRS provides and compare 2000 to 2008. Otherwise find out where Obama is so you can face that direction while praying to him, dipshit.

bite me, asshole.

rightwinger

Award Winning USMB Paid Messageboard Poster

- Aug 4, 2009

- 289,008

- 170,543

- 2,615

Where are all those jobs that were supposed to trickle down from these tax cuts?

Borrowing $2 trillion to pay for these cuts did not seem to help

Borrowing $2 trillion to pay for these cuts did not seem to help

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

The numbers expose you as an America-hating tax cheat, a liar or both.That's true, averages don't take into account tax cheats.

bite me, asshole.

ooooooooooooooooooooooooooo.....BOTH BARRELS!!!!!!!

BlindBoo

Diamond Member

- Sep 28, 2010

- 56,946

- 16,751

- 2,180

For 10 years we've heard that Bush simply cut taxes for the rich.

But now, we hear that if the Bush Tax Cuts are not extended, that taxes on the middle class will also go up January 1st.

How is that so? I thought Bush only cut taxes for the rich? If so, then why are taxes going up on the middle class on January 1? The Dem's keep saying they are willing to renew the middle class portion of it, but not for the rich? But.......I thought the cuts included ONLY the rich, according the left wings rants over the last decade?

So Bush's crime wasn't cutting taxes for the rich. The crime was merely including the rich into his tax cuts that applied to everyone who wasn't on government welfare already?

I'm confused. So....basically, Bush cut everyones taxes? But his inclusion of rich people in that tax break is what made him so hated by the left?

So how did it really breakdown?

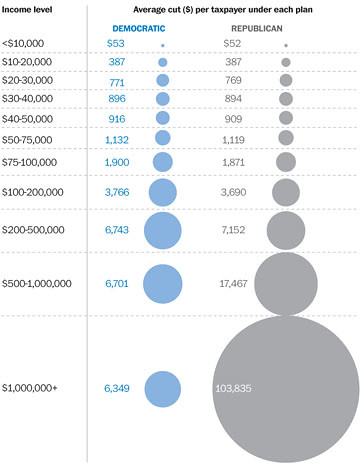

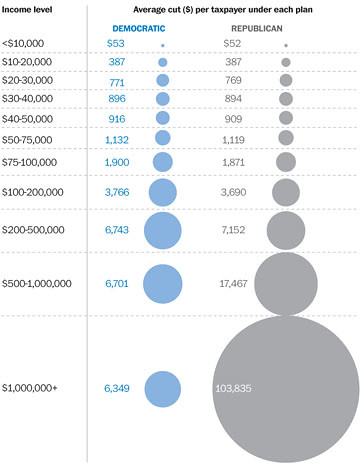

Distribution of Tax-Cut Benefits

The benefits that the tax cuts provide to different groups vary dramatically. New data from the TaxPolicyCenter show the effects in 2004 of the tax cuts that have already been enacted, including the corporate and estate tax cuts, as well as the individual income tax cuts. The TaxPolicyCenter data show that the combined effect of the tax cuts in 2004 is as follows:

The one-fifth of households in the middle of the income spectrum will receive an average tax cut of $647.

The top one percent of households will receive tax cuts averaging almost $35,000 or 54 times as much as that received on average by those in the middle of the income spectrum.

Households with incomes above $1 million will receive tax cuts averaging about $123,600. The tax cuts for millionaires will cause their after-tax income to jump by 6.4 percent, nearly three times the percentage increase received by the middle fifth.

The overall shares of the tax cuts that are going to different households also are illuminating. The TaxPolicyCenter data show that:

In 2004, the middle 20 percent of households will receive 8.9 percent of the tax cuts.

By contrast, millionaires totaling just 0.2 percent of U.S. households will receive 15.3 percent of the tax cuts.[3] In other words, the small handful of millionaires will receive total tax cuts far larger than those received by the entire middle 20 percent of households.

The tax cuts will confer more than $30 billion on the nations 257,000 millionaires in 2004 alone.

Tax Returns: A Comprehensive Assessment of the Bush Administration's Record on Cutting Taxes — Center on Budget and Policy Priorities

BlindBoo

Diamond Member

- Sep 28, 2010

- 56,946

- 16,751

- 2,180

Where are all those jobs that were supposed to trickle down from these tax cuts?

Borrowing $2 trillion to pay for these cuts did not seem to help

China, Mexico, Korea.....

only one bracket, the 15% bracket, got NO REDUCTION in the tax bracket tax rate.... all other tax brackets got a reduction in their bracket tax rates.

A new tax bracket was created of 10% for everyone's first 6k earned, or there abouts....

The child tax credit, was the big kicker for the lower middle class tax reductions...

A new tax bracket was created of 10% for everyone's first 6k earned, or there abouts....

The child tax credit, was the big kicker for the lower middle class tax reductions...

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

I still think that that tax cut should disappear ... not just for Elvis but for everyone else who got a tax cut on China's dime 7 years ago. Time to pay the piper, America.

Bingo!!!!!

It's time "conservatives" bit-the-bullet....and, TRY to show a lil' economic-MATURITY!!!!!

It's time "conservatives" bit-the-bullet....and, TRY to show a lil' economic-MATURITY!!!!!

edthecynic

Censored for Cynicism

- Oct 20, 2008

- 43,044

- 6,883

- 1,830

Another example of the first quote in my sig!If you tell the same lie enough times, people will believe it......

It is a CON$ervative lie that Libs said there were NO tax cuts for people who weren't rich! Libs said MOST of the tax cuts went to the rich. MOST is not ALL!!!!!! A small percent of the tax cuts went to the middle class and below.

What CON$ did to make it appear that the tax cuts were spread across the whole spectrum of tax payers was to average the big tax cuts the rich got with the small tax cuts the middle class got. Not only that, they didn't include the 25% who didn't get a tax cut in the average to make the average as deliberately misleading as possible, it was an average only of people who got cuts. Bush claimed an AVERAGE tax cut of $1,586.00. If you average ALL tax payers whether they got a refund or not, it was $1,217.00. To get a tax cut of $1,586.00 you need an income of over $75,000.00.

A more HONEST representation of the tax cuts is the MEDIAN tax cut of $407.00, or about $9.00 per week. That means 50% of tax payers got less than $407 and 50% got more.

For someone to average a $2,600.00 tax cut for 8 years they would need an average income of over $100,000.00 for the 8 years. Maybe that's not rich, but it certainly is well above the median income most Americans earn.

Wrong. I didn't make 100k a year. Sorry.

Using your calculator, a married couple filing jointly with a taxable income of $400k in 2000, Clinton's last tax year, paid $131,068 in taxes. After Bush's first tax cut in 2001 the same couple paid $128,443 or about $2,600 less.Here's a link to an income tax calculator that you can adjust year, income, and filing status to determine your tax payment.

Elvis' numbers don't seem unreasonable to me.

A married couple filing jointly with a taxable income of 70k in 2002 paid $12,696.

The same return in 2008 paid $10,188 or about $2400 less.

So if he makes in that neighborhood $2600 a year seems about right.

In 2002 an income of $300k saved $2,600. After Bush's 2003 tax cut an income of $120k saved $2,600. In 2004 $115k saved $2,600. 2005 - $110k, 2006 - $100k, 2007 - $85k, 2008 - $77k for an average income of over $160k for Bush's 8 years to average a $2,600 savings each year. Even if you drop Bush's first 2 years and use only 2003 to 2008 as you did it averages $102k, so I was in the ballpark with my over $100k figure all along.

Article 15

Dr. House slayer

- Jul 4, 2008

- 24,673

- 4,916

- 183

Another example of the first quote in my sig!

It is a CON$ervative lie that Libs said there were NO tax cuts for people who weren't rich! Libs said MOST of the tax cuts went to the rich. MOST is not ALL!!!!!! A small percent of the tax cuts went to the middle class and below.

What CON$ did to make it appear that the tax cuts were spread across the whole spectrum of tax payers was to average the big tax cuts the rich got with the small tax cuts the middle class got. Not only that, they didn't include the 25% who didn't get a tax cut in the average to make the average as deliberately misleading as possible, it was an average only of people who got cuts. Bush claimed an AVERAGE tax cut of $1,586.00. If you average ALL tax payers whether they got a refund or not, it was $1,217.00. To get a tax cut of $1,586.00 you need an income of over $75,000.00.

A more HONEST representation of the tax cuts is the MEDIAN tax cut of $407.00, or about $9.00 per week. That means 50% of tax payers got less than $407 and 50% got more.

For someone to average a $2,600.00 tax cut for 8 years they would need an average income of over $100,000.00 for the 8 years. Maybe that's not rich, but it certainly is well above the median income most Americans earn.

Wrong. I didn't make 100k a year. Sorry.

Using your calculator, a married couple filing jointly with a taxable income of $400k in 2000, Clinton's last tax year, paid $131,068 in taxes. After Bush's first tax cut in 2001 the same couple paid $128,443 or about $2,600 less.Here's a link to an income tax calculator that you can adjust year, income, and filing status to determine your tax payment.

Elvis' numbers don't seem unreasonable to me.

A married couple filing jointly with a taxable income of 70k in 2002 paid $12,696.

The same return in 2008 paid $10,188 or about $2400 less.

So if he makes in that neighborhood $2600 a year seems about right.

In 2002 an income of $300k saved $2,600. After Bush's 2003 tax cut an income of $120k saved $2,600. In 2004 $115k saved $2,600. 2005 - $110k, 2006 - $100k, 2007 - $85k, 2008 - $77k for an average income of over $160k for Bush's 8 years to average a $2,600 savings each year. Even if you drop Bush's first 2 years and use only 2003 to 2008 as you did it averages $102k, so I was in the ballpark with my over $100k figure all along.

Ed, you were wrong to call Elvis a liar or a cheat based on what he said. The numbers I posted prove that.

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

I still think that that tax cut should disappear ... not just for Elvis but for everyone else who got a tax cut on China's dime 7 years ago. Time to pay the piper, America.

and we can discuss that...the deficit is huge. but I get tired of hearing that only the rich got the cuts.

Then quit listening to FAUX Noise & Porky Limbaugh!!!!!!!!

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

and we can discuss that...the deficit is huge. but I get tired of hearing that only the rich got the cuts.

The weren't the only one to get a tax cut, this is true, but they certainly got the largest tax cut. The two lowest brackets went unchanged and the next tier (which most of us fall under) got a 2% cut while the highest bracket got nearly twice that cut at 3.8%. The cuts favored the wealthy, IMO.

That is a total falsehood.

Keep tellin' yourself, that, Mudd-Butt!!

*

*

Similar threads

- Replies

- 18

- Views

- 137

- Replies

- 10

- Views

- 114

- Replies

- 2

- Views

- 118

- Replies

- 5

- Views

- 106

Latest Discussions

- Replies

- 186

- Views

- 2K

- Replies

- 14

- Views

- 74

Forum List

-

-

-

-

-

Political Satire 8880

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 492

-

-

-

-

-

-

-

-

-

-