kiwiman127

Comfortably Moderate

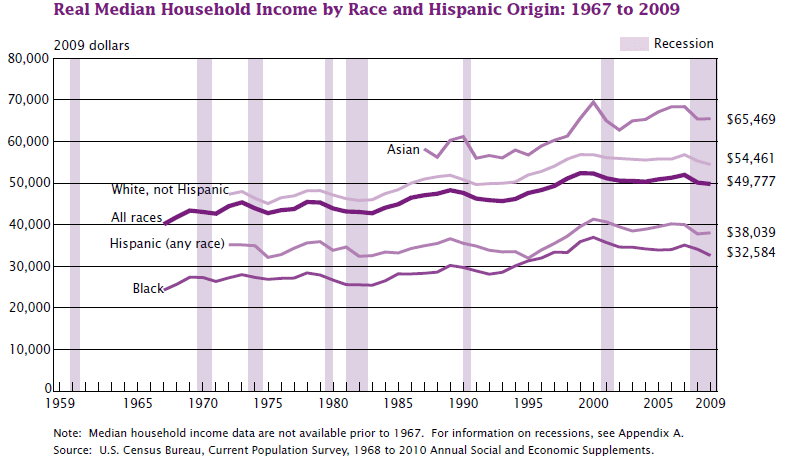

I think this is an apples to oranges argument. Over 20 years we've had significant population growth, so a continuous flow of people coming in at the bottom of the income ladder. Those who increase their skill set, start a business, or otherwise earn more money move up the income ladder, many of today's middle and upper income people were on the low end back in 1990. So of course the per capita household income is going to be fairly stagnant, why would you expect otherwise?

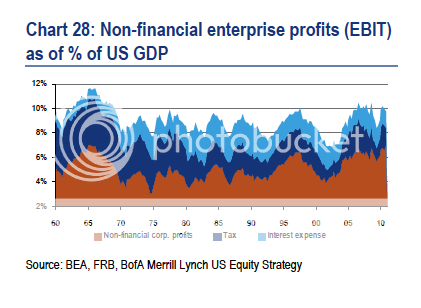

Corp profits are a prerequisite to staying in business. You make money or you're history. Anybody know how they determined this number? So tell me, how much profit do you need to make per year to get to 200% over 20 years? That's not a rhetorical question, I don't really know. What I do know is that money flows to where it can make the most return on investment (ROI). So over the long term you better be doing a lot better than just treading water. One wonders if it included the startups and other businesses that went belly up. Over the past 20 years US companies have greatly expanded overseas, thanks in part to an increasingly poor business environment here but also due to lower costs elsewhere and being closer to emerging markets worldwide.

There's no big mystery here. And it doesn't mean a damn thing. Look at the last few years, household income has done nothing or maybe even declined, yet business profits are good cuz American businessmen know how to cut back on costs to make a profit.

Businesses are sitting on trillions of dollars of capital, that indicates they aren't investing in themselves and are satisfied with the status quo.

Being as over two-thirds of our economy is driven by consumer spending, by holding down wages they are holding down the US economy.