JonKoch

VIP Member

- May 14, 2017

- 1,779

- 151

- 65

Your total BS premises have REPEATEDLY been demolished Cupcake, all you have is TRYING to move the goals posts and slight of hand or LIES.

The entire premise YOU support is Gov't created the Bankster BUBBLE AND both parties are equally at fault, both premises are BS based on empirical data and history.

ONE party supports "markets self regulate" BS. One party was in charge of the executive branch who had oversight of the Banksters during the time period the Banksters credit bubble blew up. One party had Dubya's home ownership society credit bubble that fed off of housing ALWAYS going up "belief" and dropping underwriting standards, completely!

GSE's did get caught up thanks mainly to Dubya's policies that forced F/F to buy the MBS's or allowing them to chase the Banksters drive to the bottom, which clearly F/F were lagging on as they lost market share AND the private markets securitizers went from 10% in 2003 to 40% by 2006 of ALL new mortgages, a 400% increase in just a few years.

But you "keep believing" in your failed ideology and trying to spread blame around and play the victim for the Banksters Cupcake

The entire premise YOU support is Gov't created the Bankster BUBBLE AND both parties are equally at fault,

Bubbles happen whether the government makes them worse or not.

Bush thought it would be a great idea to use government coercion to push more people into homes.

He was wrong.

So were the Dems who agreed it was a great idea.

Yeah Cupcake you keep "believing" the Dems had ANY power to stop Dubya cheering on the Banksters subprime bubble

Hint when Dems push more people to become homeowners, they do it with GOOD OVERSIGHT and good outcomes

GOP? Not so much

BTW, Dubya didn't care how it turned out, he was just more interested in hiding his failed economic policies by cheering on the ponzi scheme!

you keep "believing" the Dems had ANY power to stop Dubya cheering on the Banksters

The Dems had no power to stop Bush from doing what the Dems also wanted to do.

Sure Cupcake, the Dems fought ALL 50 states who wanted to reign in predatory lenders, GUTTED the FBI white collar division (MORTGAGE FRAUD DIV) by 1/3rd, REVERSED CLINTON'S 2000 RULE THAT FORBID F/F FROM USING SUBPRIMES FROM COUNTING TOWARDS AFFORDABLE HOUSING GOALS, etc

Keep "believing what the Dems wanted was UNREGULATED FREE MARKET BS CUPCAKE

Which Dems wanted to stop the push for more low-income home owners?

Gimme a list.......

Keep "believing what the Dems wanted was UNREGULATED FREE MARKET BS

Forcing banks to make crappy loans is not UNREGULATED FREE MARKET.

Forcing the GSEs to buy crappy loans is not UNREGULATED FREE MARKET.

Dems supported both.

The U.S. Financial Crisis Inquiry Commission, in January 2011, concluded "the crisis was avoidable and was caused by: Widespread failures in financial regulation"

Conservatives Can't Escape Blame for the Financial Crisis

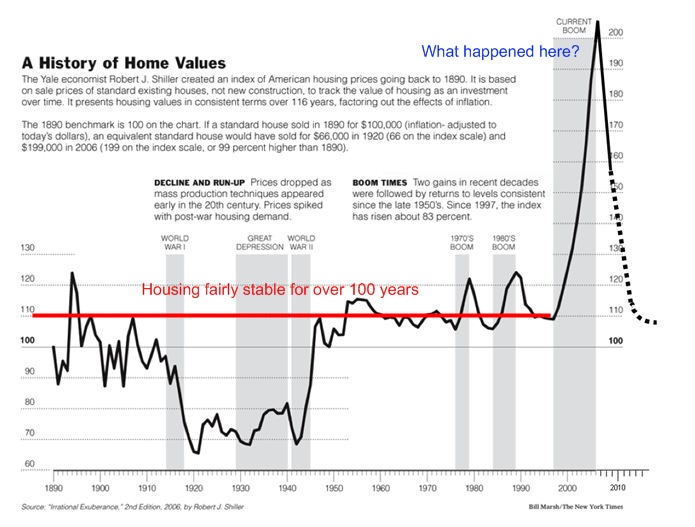

The onset of the recent financial crisis in late 2007 created an intellectual crisis for conservatives, who had been touting for decades the benefits of a hands-off approach to financial market regulation. As the crisis quickly spiraled out of control, it quickly became apparent that the massive credit bubble of the mid-2000s, followed by the inevitable bust that culminated with the financial markets freeze in the fall of 2008, occurred predominantly among those parts of the financial system that were least regulated, or where regulations existed but were largely unenforced.

Predictably, many conservatives sought to blame the bogeymen they always blamed.

Conservatives Can’t Escape Blame for the Financial Crisis - Center for American Progress