- Nov 26, 2011

- 123,644

- 57,043

- 2,290

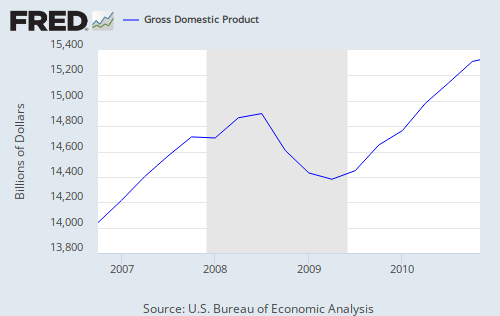

Mandatory spending is expected to increase as a share of GDP. This is due in part to demographic trends, as the number of workers continues declining relative to those receiving benefits. For example, the number of workers per retiree was 5.1 in 1960; this declined to 3.0 in 2010 and is projected to decline to 2.2 by 2030.

United States federal budget - Wikipedia, the free encyclopedia

Baby boomers retiring, sucking up entitlements.