danielpalos

Diamond Member

- Banned

- #461

Can you cite any crime, drug, or terror clause in the republican doctrine or our Constitution?Already said why, go back and glean for the answer.

No, you didn't say why. You gave no economic reason for cutting spending. I think you are just dogmatically supporting tax cuts because it's your religion now, which would explain why you're impervious to facts. Talking to you about taxes is like talking to a fundamentalist about creationism. You're all wrapped up in dogma and you refuse to consider facts. Because you're a zealot. Because you've given up thinking critically.

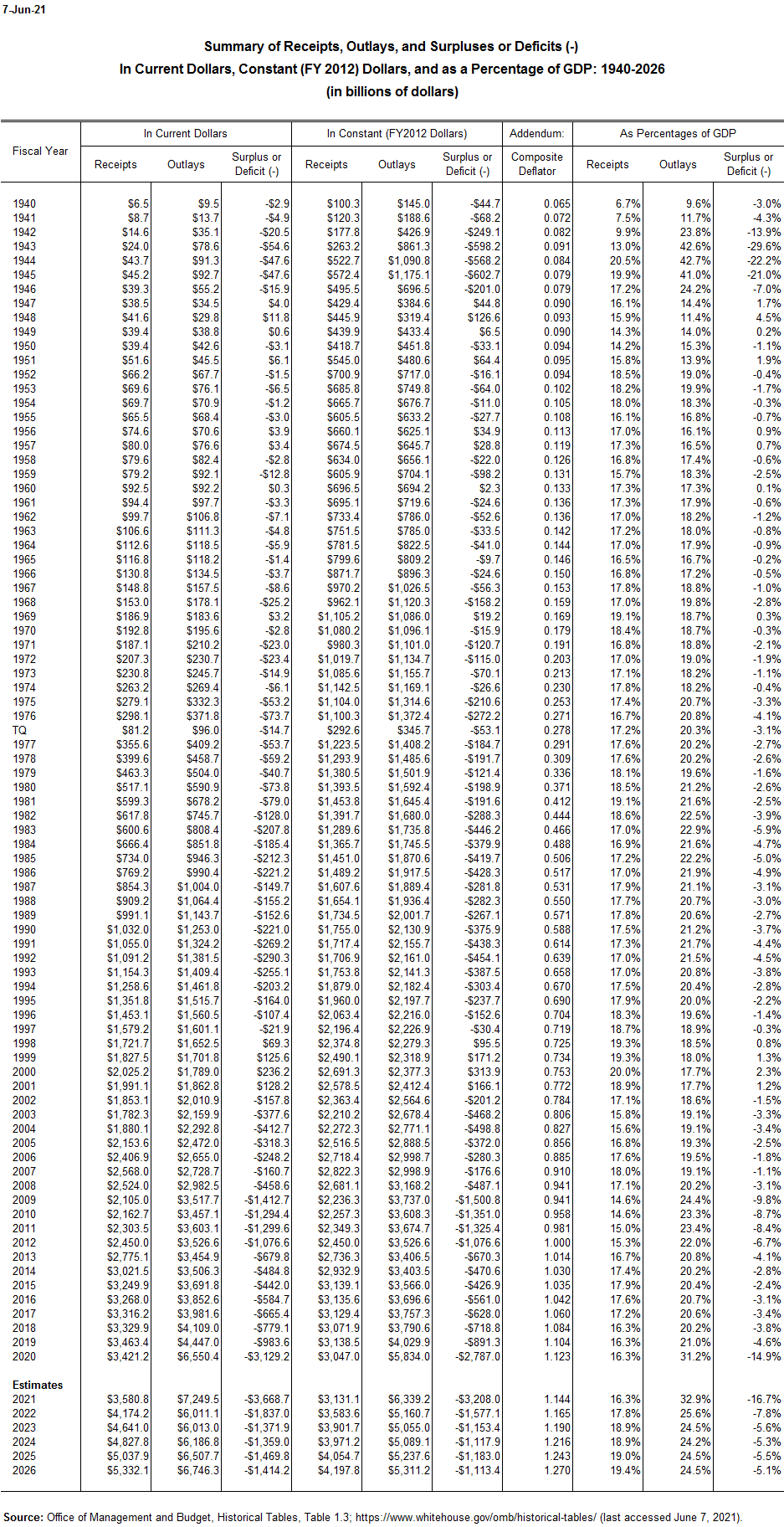

I am supporting reduced budgets across the board, I am supporting lower government debt, we can’t keep spending without an effect. I’m for raising taxes if we cut the spending 2-1.