The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #361

Well.. YES, it DID! What you are doing is applying revenues for 2001 where the cuts were made retroactive.

No, I'm using the numbers from the Tax Policy Center for receipts collected:

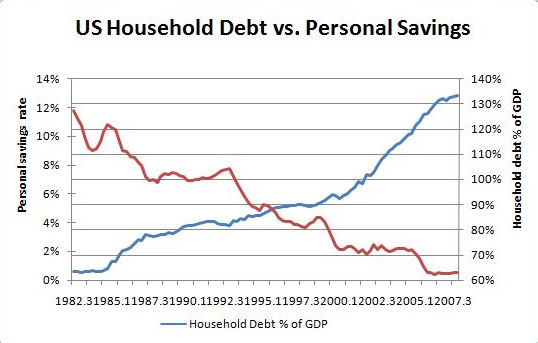

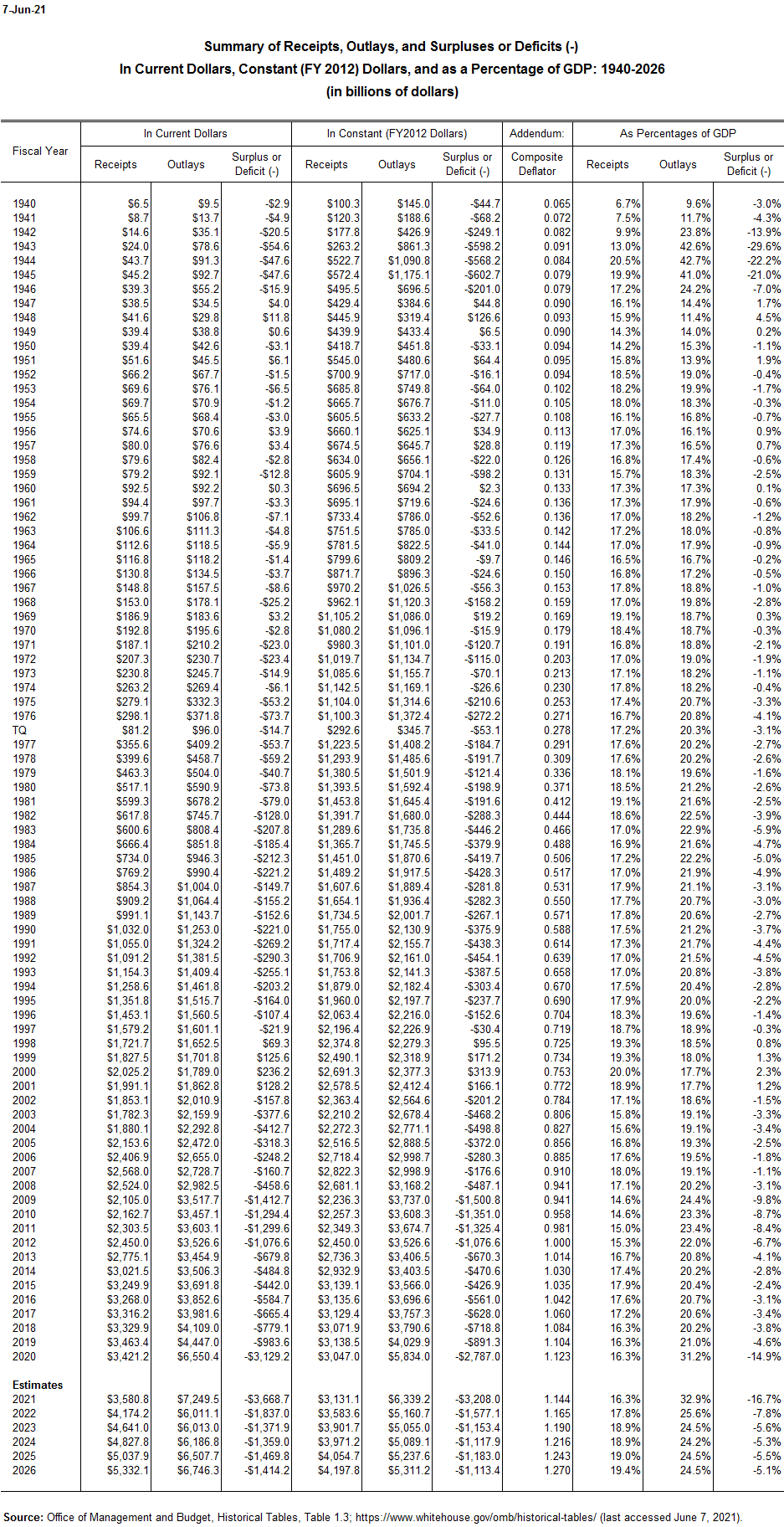

So I see receipts in 2000 above levels for 2001, 2002, 2003, and 2004.

I see receipts in 1983 below levels in 1982.

Also, I see a deficit doubling between 1981 - 1989. In fact, in nearly every instance of tax cuts you talk about, the deficit increases.

1961 - 1968: Deficit increased from $3B to $25B

1981 - 1989: Deficit increased from $79B to $152B

2000 - 2004: Record $236B surplus turned into a Record $412B deficit

See? I told you that you would attempt this. You Democrats ALWAYS want to jump from tax revenues to the deficit and debt. Spending increased the debt, not increased revenues from tax cuts. If anything, the increased tax revenue prevented the deficits from being even greater. The argument is over tax rates and subsequent revenue produced... that has nothing to do with spending and debt.

Spending definitely increased revenues. Why? Because revenues come from spending. You can't say tax cuts created revenue growth when cutting the tax rate cuts revenue. You can't have a discussion about receipts/deficits/and debt without also talking about spending. So here, you're trying to pretend spending has nothing to do with the growth of revenues, even though spending grew by 50% during LBJ.

And you're just flat wrong about Reagan's tax cuts. You're also wrong about your idiotic speculations as to why the economy tanked and what caused it. You're absolutely clueless, as are most Democrats.

Look at the fucking chart you stupid bastard. Receipts for 1983 are less than receipts for 1982. Go spread your Russian propaganda elsewhere.