TeaBagger

VIP Member

- Jan 25, 2016

- 1,394

- 161

- 65

Trump and Sanders have the healthcare solution. It's called SINGLE PAYER. It will end the criminal behavior of the insurance companies and their collusion with the criminal medical industry.

Trump Pushes Single Payer Healthcare, Tax Increase on ...

In July 2015, conservative columnist Erick Erickson wrote that Trump "has supported a Canadian-style universal health care system."

Our partners at PunditFact.com issued a rating of True.

Medicare for All: Leaving No One Behind - Bernie Sanders

Obamacare is better than what we had but it did not go far enough. We need to catch more medical fraudsters and prosecute them.

You clearly need it. Whatever treatment they are giving you for brain damage isn't working.

And your fantasy of single payer....is just that....a fantasy.

You vote Republican and you accuse me of brain damage? LOL!

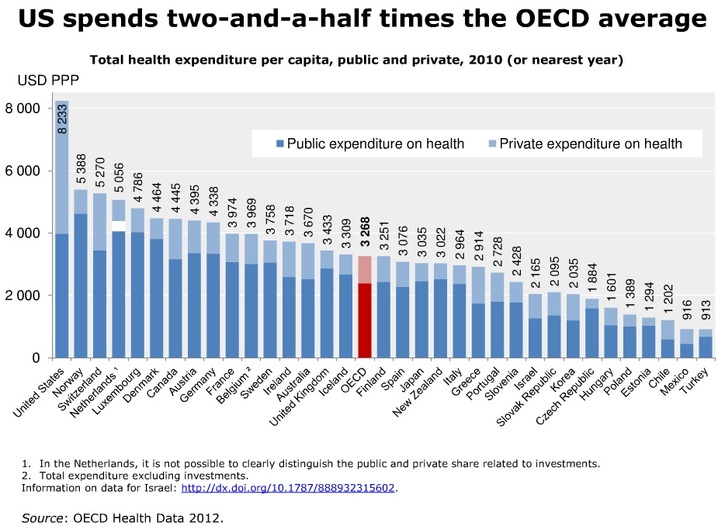

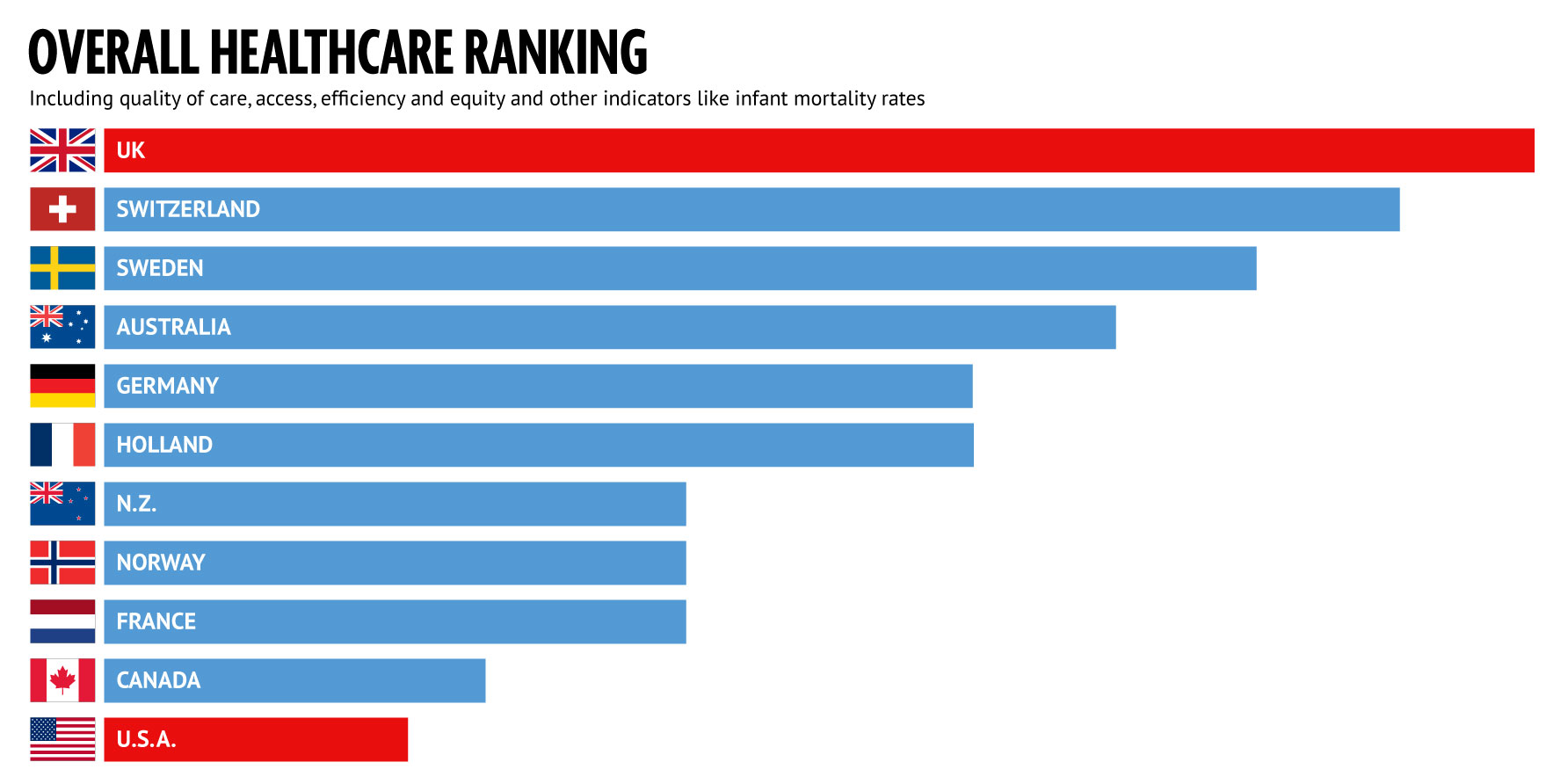

Nearly every other advanced country has single payer and universal health care you fucking moron and all those countries are ranked higher for quality and have far lower costs.

These Are The 36 Countries That Have Better Healthcare ...