Rshermr

VIP Member

Also - the OP speaks like a true liberal underachiever.

As one of those "rich" folks who doesn't pay their "fair share"I am sure if he had any success in his life and actually paid $40-$60k in income taxes a year he would be able to understand the frustration of shelling out that kind of money..and having half the population say you need to pay more! (many of which pay ZERO income tax)

By Obama's measure my wife and I are rich. Whatever. I sure don't feel rich.

Let him put a 2nd mortgage on his home bankrolling a business venture...or work on a business idea at night while working a full time job during the day.

Obama has never done anything of the sort - and neither do most people who want to punish those who do better than them.

How many companies has obama worked 60 hours a week trying to grow the business??

Myself - I currently have 19 families depending on the business I operate.

I can tell you for an absolute fact - raise my taxes, the businesses taxes and let the Obama care hammer fall in 2014 - I doubt very seriously 19 will be left.

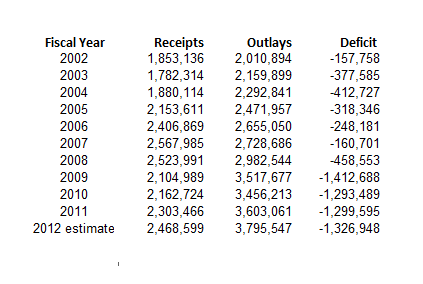

So, let me understand this. You are screaming like a stuck pig about the possibility of having to pay an additonal 4% income tax on taxable income over $250K? And that was probably what made things so economically bad during the Clinton administration, correct? Except for a couple of inconvenient facts, such as very, very low unemployment, and very, very good economic growth. And of course there was that damned deficit. You know, like has never happened in a republican administration.

So you say you pay up to $60K in income taxes. So, at a low 20% tax rate, that would indicate you had taxable income of $300K. So, with a $250K base on which you will have to pay no additional income taxes, that would mean that you are paying an additonal 4% on $50K of taxable income. That would be an additional $2,000 per year. Or 0.667% on taxable income. So, at your upper end, that would be going from $60K to $62K. And when you pay $40K in taxes, it would indicate that you will pay exactly the same income taxes.

And then, there is the inconvenient truth that oldfart pointed out. You know, the whole 50 employee thing related to healthcare.

Looks to me like Obama is just going to kill your business.

So, lets all get together and sing Cry Me A River for IAm.......

Last edited: