MarathonMike

Diamond Member

I just happened to look at my FICO score and noticed it had dropped. The reason provided was the following:

FICO® Scores consider recent non-mortgage installment loans (such as auto or student loans) information on a person's credit report. Your score was impacted because your credit report shows no recent non-mortgage installment loans or insufficient recent information about your loans.

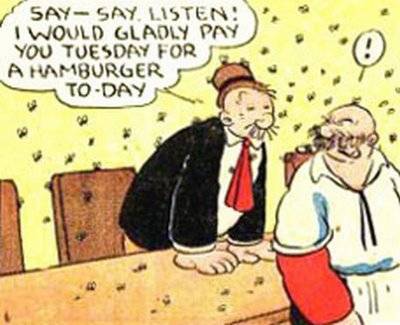

So if I wanted to make my FICO score higher, I could improve it by running up a bunch of debt. That's a very interesting system they have there.

FICO® Scores consider recent non-mortgage installment loans (such as auto or student loans) information on a person's credit report. Your score was impacted because your credit report shows no recent non-mortgage installment loans or insufficient recent information about your loans.

So if I wanted to make my FICO score higher, I could improve it by running up a bunch of debt. That's a very interesting system they have there.