Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Money, Power and Wall Street

- Thread starter AVG-JOE

- Start date

- Thread starter

- #2

"The greed of Wall Street broke Main Street."

That about sums up the first half.

- Thread starter

- #3

These guys, not individually, but as an industry, really screwed up.

The build-up to the crisis was not one sided. The government knew this would happen because they had caused this same thing to happen on a smaller scale in 1972. A major scandal struck the Federal Housing Administration (FHA). Since passage of the Housing and Urban Development Act of 1968 and the creation of the Government National Mortgage Association (Ginnie Mae) had been responsible for helping the poor buy homes in inner-city areas via government-backed mortgages. This was financed by mortgage-backed securities, the first issues of which George Romney had announced in 1970. A number of FHA employees, along with a number of real estate firms and lawyers, were indicted for a scheme in which the value of cheap inner city homes was inflated and sold using those government-backed mortgages to black buyers who could not really afford them, and the government was stuck for the bad loans when owners defaulted. FHA was under Romney's purview, and he conceded that HUD had been unprepared to deal with speculators and had not been alert to earlier signs of illegal activity. By January 1973, all federal housing funds had been frozen.

--October 1992-- Congress, enacting the Federal Housing Enterprises Financial Safety and Soundness Act of 1992, It "established HUD-imposed housing goals for financing of affordable housing and housing in central cities and other rural and underserved areas." Washington Post In a brief debate unfolded on the floor of the House of Representatives over a bill to create a new regulator for Fannie Mae and Freddie Mac. On one side stood Jim Leach, an Iowa Republican concerned that Congress was "hamstringing" this new OFHEO regulator at the behest of the companies. He warned that the two companies were changing "from being agencies of the public at large to money machines for the stockholding few." On the other side stood Barney Frank, a Massachusetts Democrat who said the companies served a public purpose. They were in the business of lowering the price of mortgage loans.

--September 1993-- The Chicago Sun-Times reports an initiative led by ACORN's Talbott with five area lenders "participating in a $55 million national pilot program with affordable-housing group ACORN to make mortgages for low- and moderate-income people with troubled credit histories." Kurtz notes that the initiative included two of her former targets, Bell Federal Savings and Avondale Federal Savings, who had apparently capitulated under pressure.

--July 1994-- Represented by Obama and others, plaintiffs filed a class-action lawsuit alleging Citibank had "intentionally discriminated against the plaintiffs on the basis of race with respect to a credit transaction" and calling its action "racial discrimination and discriminatory redlining practices." Buycks-Roberson v. Citibank

--November 1994-- President Clinton addressed the National Association of Realtors Conference Anaheim, California "I think we all agree that more Americans should own their own homes, for reasons that are economic and tangible and reasons that are emotional and intangible but go to the heart of what it means to harbor, to nourish, to expand the American dream"..."I am determined to see that you have the opportunity and together we can make that opportunity for the young families of our country. I am committed to a new and unprecedented partnership between industry leaders and community leaders and government to recommit our nation to the idea of homeownership and to create more homeowners than ever before." "The Clinton administration announced the bold new homeownership strategy, which included monumental loosening of credit standards and imposition of subprime lending quotas."

--May 1995-- The FDIC's Board of Directors approved a final rule implementing the Community Reinvestment Act (CRA). The Comptroller of the Currency, the Board of Governors of the Federal Reserve System, and the Office of Thrift Supervision have approved parallel regulations for the institutions they supervise. The joint final rule largely retains the principles and structure of the proposals issued in December 1993 and October 1994. The new CRA regulation replaces the 12 assessment factors contained in the old rule with a more performance-based evaluation process to assess whether financial institutions are meeting the credit needs of their communities, including low- and moderate-income neighborhoods. The new rule establishes different tests for large and small institutions, as well as for retail and wholesale or limited purpose banks.

--June 1995-- The Clinton administration, allied with Rep. Frank, Sen. Ted Kennedy, D-Mass., and Rep. Maxine Waters, D-Calif., directed HUD Secretary Andrew Cuomo to inject GSEs into the subprime mortgage market. "ACORN had come to Congress not only to protect the CRA from GOP reforms but also to expand the reach of quota-based lending to Fannie, Freddie and beyond." What resulted was the broadening of the "acceptability of risky subprime loans throughout the financial system, thus precipitating our current crisis."

The administration announced the bold new homeownership strategy, which included monumental loosening of credit standards and imposition of "SUBPRIME LENDING QUOTAS." HUD reported that President Clinton had committed "to increasing the homeownership rate to 67.5% by the year 2000." The plan was "to reduce the financial, information and systemic barriers to homeownership" which was "amplified by local partnerships at work in over 100 cities."

"Urged on by ACORN, congressional Democrats and the Clinton administration helped push tolerance for high-risk loans through every sector of the banking system far beyond the sort of banks originally subject to the CRA. So it was the efforts of ACORN and its Democratic allies that first spread the subprime virus from the CRA to Fannie and Freddie and thence to the entire financial system. Soon, Democratic politicians and regulators actually began to take pride in "LOWERED CREDIT STANDARDS" as a sign of "fairness." Attorney General Janet Reno, who had already won a number of bank lending discrimination settlements, sternly announces, "We will tackle lending discrimination wherever it appears." With the new policy in full force, "No loan is exempt; no bank is immune. For those who thumb their nose at us, I promise vigorous enforcement."

--1997-- HUD Secretary Cuomo said, "GSE presence in the subprime market could be of significant benefit to lower-income families, minorities, and families living in underserved areas. "

--April 1998-- HUD announced a $2.1 billion settlement with AccuBanc Mortgage Corp. for alleged discrimination against minority loan applicants. [ame="http://www.youtube.com/watch?v=ivmL-lXNy64"]Affirmative Action Lending[/ame] The funds would provide poor families with down payments and low interest mortgages. "Discrimination isn't always that obvious," said Secretary Cuomo in announcing the AccuBanc deal. "Sometimes more subtle but in many ways more insidious, an institutionalized discrimination that's hidden behind a smiling face." Before the camera, Cuomo admitted the mandate amounted to "affirmative action" lending that would result in a "higher default rate."

The institution would "take a greater risk on these mortgages, yes; to give families mortgages who they would not have given otherwise, yes; they would not have qualified but for this affirmative action on the part of the bank, yes. It is by income, and is it also by minorities? Yes. "With the $2.1 billion, lending that amount in mortgages which will be a higher risk, and I'm sure there will be a higher default rate on those mortgages than on the rest of the portfolio." The CRA allowed ACORN "organizations to collect a fee from the banks for their services in marketing the loans. The Senate Banking Committee had estimated that, as a result of CRA, $9.5 billion had gone to pay for services and salaries of the organizers."

--May 1999-- The Los Angeles Times reports that African-American homeownership is increasing three times as fast as that of whites, with Latino homeowners growing five times as fast, attributing the growth to breathing "the first real life into enforcement of the Community Reinvestment Act." Mandateing that Fannie Mae and Freddie Mac buy mortgages with deviant down payments and debt-to-income ratios, which allowed lenders to approve mortgages for lower-income families that would have been denied otherwise. By now, all pretense had disappeared and lending practices were based upon concerns of discrimination in the banking system regardless of the consequences. Clinton threatened to veto a bill passed by the Senate that had "shortsightedly voted to retrench" CRA, as the Times put it. Under pressure, Fannie Mae was resisting increased targeting, arguing that the result would be more loan defaults. Barry Zigas, head of Fannie Mae's low-income efforts, argued, "There is obviously a limit beyond which (we) can't push (the banks) to produce," the Times reported.

--Fall 1999-- Treasury Secretary Lawrence Summers issued a warning: "Debates about systemic risk should also now include government-sponsored enterprises, which are large and growing rapidly."

--September 1999-- New York Times "With pressure from the Clinton administration, Fannie Mae eased credit requirements on loans it would purchase from lenders, making it easier for banks to lend to borrowers unqualified for conventional loans. Fannie Mae's Raines explained that "there remain too many borrowers whose credit is just a notch below what our underwriting has required who have been relegated to paying significantly higher mortgage rates in the so-called subprime market."

With this action, Fannie Mae put itself at substantial risk in the event of an economic downturn. "From the perspective of many people, including me, this is another thrift industry growing up around us," warned Peter Wallison, a fellow in financial policy studies at the American Enterprise Institute (AEI). "If they fail, the government will have to step up and bail them out the way it stepped up and bailed out the thrift industry." The danger was known.

A study by Freddie Mac, confirming earlier Federal Reserve and FDIC studies, contradicts race discrimination arguments for CRA. The study found that African-Americans with annual incomes of $65,000-$75,000 have on average worse credit records than whites making under $25,000. This showed that the difficulty in qualifying was not because of race but bad credit records. Accordingly, the Federal Reserve Bank of Dallas entitled a paper "RedLining or Red Herring?"

"City Journal warned that the Clinton administration had turned CRA into 'a vast extortion scheme against the nation's banks,'committing $1 trillion for mortgages and development projects, most of it funneled through the community organizers."

--November 1999-- President Bill Clinton signed into law S.900 Financial Services Modernization Act of 1999 This bill had CRA loan mandates & allowed banks to sell the mandated bad loans to GSEs Fannie, Freddie, pension funds, foreigners & anyone else. This disolved Glass Steagall & made it legal for banks to create bad risky loans with the government backing it allowing it to get a AAA rating. This gave banks a license to steal!!!

--December 2000-- President Bill Clinton signed into law H.R. 4577: Consolidated Appropriations Act, 2001. Consolidated in this bill was Commodity Futures Modernization Act of 2000. This law made most over-the-counter derivatives (OTC derivatives) mortgage risk spreading transactions between sophisticated parties un-regulated as futures under the Commodity Exchange Act (CEA) or as securities under the federal securities laws. Instead, banks and securities firms would continue to have their dealings in OTC derivatives supervised by their federal regulators under general safety and soundness standards. Functional regulation. This was to create an international derivatives market for comodities securities. Clinton & Gore were trying to built the framework for Carbon Cap & Trade Energy Trading Market Scheme with this law. This gave birth to the Enron Loophole.

[ame="http://www.youtube.com/watch?v=vFK-UTGH1Zw"]Gore and the Enron Loophole.[/ame]

--2005-- Fannie Mae CEO Frank Raines affirms partnership with Barack Obama & The Congressional Black Caucus" [ame="http://www.youtube.com/watch?v=usvG-s_Ssb0&feature=related"]Frank Raines[/ame]

--September 2007-- Obama: "Subprime lending started off as a good idea - helping Americans buy homes who couldnt previously afford to. Financial institutions created new financial instruments that could securitize these loans, slice them into finer and finer risk categories and spread them out among investors around the country and around the world. In theory, this should have allowed mortgage lending to be less risky and more diversified." These same financial institutions were Top Contributors to Barack Obama's Campaign

--2008-- Fannie and Freddie have purchased about 80% of all new home mortgages in the United States. Their combined investment portfolios held mortgage assets (loans and MBSs) valued at $1.5 trillion (as of June 30, 2008) - These GSE will never pay back tax payer for losses like all the banks have.

--April 2009-- Obama on his world appology tour in Strasbourg, France "difficult to imagine that the inability of somebody to pay for a house in Florida could contribute to the failure of the banking system in Iceland. Today what's difficult to imagine is that we did not act sooner to shape our future."

--JULY 2009-- Committee on Oversight and Government Reform released a report on The Role of Government Affordable Housing Policy in Creating the Global Financial Crisis of 2008

--October 1992-- Congress, enacting the Federal Housing Enterprises Financial Safety and Soundness Act of 1992, It "established HUD-imposed housing goals for financing of affordable housing and housing in central cities and other rural and underserved areas." Washington Post In a brief debate unfolded on the floor of the House of Representatives over a bill to create a new regulator for Fannie Mae and Freddie Mac. On one side stood Jim Leach, an Iowa Republican concerned that Congress was "hamstringing" this new OFHEO regulator at the behest of the companies. He warned that the two companies were changing "from being agencies of the public at large to money machines for the stockholding few." On the other side stood Barney Frank, a Massachusetts Democrat who said the companies served a public purpose. They were in the business of lowering the price of mortgage loans.

--September 1993-- The Chicago Sun-Times reports an initiative led by ACORN's Talbott with five area lenders "participating in a $55 million national pilot program with affordable-housing group ACORN to make mortgages for low- and moderate-income people with troubled credit histories." Kurtz notes that the initiative included two of her former targets, Bell Federal Savings and Avondale Federal Savings, who had apparently capitulated under pressure.

--July 1994-- Represented by Obama and others, plaintiffs filed a class-action lawsuit alleging Citibank had "intentionally discriminated against the plaintiffs on the basis of race with respect to a credit transaction" and calling its action "racial discrimination and discriminatory redlining practices." Buycks-Roberson v. Citibank

--November 1994-- President Clinton addressed the National Association of Realtors Conference Anaheim, California "I think we all agree that more Americans should own their own homes, for reasons that are economic and tangible and reasons that are emotional and intangible but go to the heart of what it means to harbor, to nourish, to expand the American dream"..."I am determined to see that you have the opportunity and together we can make that opportunity for the young families of our country. I am committed to a new and unprecedented partnership between industry leaders and community leaders and government to recommit our nation to the idea of homeownership and to create more homeowners than ever before." "The Clinton administration announced the bold new homeownership strategy, which included monumental loosening of credit standards and imposition of subprime lending quotas."

--May 1995-- The FDIC's Board of Directors approved a final rule implementing the Community Reinvestment Act (CRA). The Comptroller of the Currency, the Board of Governors of the Federal Reserve System, and the Office of Thrift Supervision have approved parallel regulations for the institutions they supervise. The joint final rule largely retains the principles and structure of the proposals issued in December 1993 and October 1994. The new CRA regulation replaces the 12 assessment factors contained in the old rule with a more performance-based evaluation process to assess whether financial institutions are meeting the credit needs of their communities, including low- and moderate-income neighborhoods. The new rule establishes different tests for large and small institutions, as well as for retail and wholesale or limited purpose banks.

--June 1995-- The Clinton administration, allied with Rep. Frank, Sen. Ted Kennedy, D-Mass., and Rep. Maxine Waters, D-Calif., directed HUD Secretary Andrew Cuomo to inject GSEs into the subprime mortgage market. "ACORN had come to Congress not only to protect the CRA from GOP reforms but also to expand the reach of quota-based lending to Fannie, Freddie and beyond." What resulted was the broadening of the "acceptability of risky subprime loans throughout the financial system, thus precipitating our current crisis."

The administration announced the bold new homeownership strategy, which included monumental loosening of credit standards and imposition of "SUBPRIME LENDING QUOTAS." HUD reported that President Clinton had committed "to increasing the homeownership rate to 67.5% by the year 2000." The plan was "to reduce the financial, information and systemic barriers to homeownership" which was "amplified by local partnerships at work in over 100 cities."

"Urged on by ACORN, congressional Democrats and the Clinton administration helped push tolerance for high-risk loans through every sector of the banking system far beyond the sort of banks originally subject to the CRA. So it was the efforts of ACORN and its Democratic allies that first spread the subprime virus from the CRA to Fannie and Freddie and thence to the entire financial system. Soon, Democratic politicians and regulators actually began to take pride in "LOWERED CREDIT STANDARDS" as a sign of "fairness." Attorney General Janet Reno, who had already won a number of bank lending discrimination settlements, sternly announces, "We will tackle lending discrimination wherever it appears." With the new policy in full force, "No loan is exempt; no bank is immune. For those who thumb their nose at us, I promise vigorous enforcement."

--1997-- HUD Secretary Cuomo said, "GSE presence in the subprime market could be of significant benefit to lower-income families, minorities, and families living in underserved areas. "

--April 1998-- HUD announced a $2.1 billion settlement with AccuBanc Mortgage Corp. for alleged discrimination against minority loan applicants. [ame="http://www.youtube.com/watch?v=ivmL-lXNy64"]Affirmative Action Lending[/ame] The funds would provide poor families with down payments and low interest mortgages. "Discrimination isn't always that obvious," said Secretary Cuomo in announcing the AccuBanc deal. "Sometimes more subtle but in many ways more insidious, an institutionalized discrimination that's hidden behind a smiling face." Before the camera, Cuomo admitted the mandate amounted to "affirmative action" lending that would result in a "higher default rate."

The institution would "take a greater risk on these mortgages, yes; to give families mortgages who they would not have given otherwise, yes; they would not have qualified but for this affirmative action on the part of the bank, yes. It is by income, and is it also by minorities? Yes. "With the $2.1 billion, lending that amount in mortgages which will be a higher risk, and I'm sure there will be a higher default rate on those mortgages than on the rest of the portfolio." The CRA allowed ACORN "organizations to collect a fee from the banks for their services in marketing the loans. The Senate Banking Committee had estimated that, as a result of CRA, $9.5 billion had gone to pay for services and salaries of the organizers."

--May 1999-- The Los Angeles Times reports that African-American homeownership is increasing three times as fast as that of whites, with Latino homeowners growing five times as fast, attributing the growth to breathing "the first real life into enforcement of the Community Reinvestment Act." Mandateing that Fannie Mae and Freddie Mac buy mortgages with deviant down payments and debt-to-income ratios, which allowed lenders to approve mortgages for lower-income families that would have been denied otherwise. By now, all pretense had disappeared and lending practices were based upon concerns of discrimination in the banking system regardless of the consequences. Clinton threatened to veto a bill passed by the Senate that had "shortsightedly voted to retrench" CRA, as the Times put it. Under pressure, Fannie Mae was resisting increased targeting, arguing that the result would be more loan defaults. Barry Zigas, head of Fannie Mae's low-income efforts, argued, "There is obviously a limit beyond which (we) can't push (the banks) to produce," the Times reported.

--Fall 1999-- Treasury Secretary Lawrence Summers issued a warning: "Debates about systemic risk should also now include government-sponsored enterprises, which are large and growing rapidly."

--September 1999-- New York Times "With pressure from the Clinton administration, Fannie Mae eased credit requirements on loans it would purchase from lenders, making it easier for banks to lend to borrowers unqualified for conventional loans. Fannie Mae's Raines explained that "there remain too many borrowers whose credit is just a notch below what our underwriting has required who have been relegated to paying significantly higher mortgage rates in the so-called subprime market."

With this action, Fannie Mae put itself at substantial risk in the event of an economic downturn. "From the perspective of many people, including me, this is another thrift industry growing up around us," warned Peter Wallison, a fellow in financial policy studies at the American Enterprise Institute (AEI). "If they fail, the government will have to step up and bail them out the way it stepped up and bailed out the thrift industry." The danger was known.

A study by Freddie Mac, confirming earlier Federal Reserve and FDIC studies, contradicts race discrimination arguments for CRA. The study found that African-Americans with annual incomes of $65,000-$75,000 have on average worse credit records than whites making under $25,000. This showed that the difficulty in qualifying was not because of race but bad credit records. Accordingly, the Federal Reserve Bank of Dallas entitled a paper "RedLining or Red Herring?"

"City Journal warned that the Clinton administration had turned CRA into 'a vast extortion scheme against the nation's banks,'committing $1 trillion for mortgages and development projects, most of it funneled through the community organizers."

--November 1999-- President Bill Clinton signed into law S.900 Financial Services Modernization Act of 1999 This bill had CRA loan mandates & allowed banks to sell the mandated bad loans to GSEs Fannie, Freddie, pension funds, foreigners & anyone else. This disolved Glass Steagall & made it legal for banks to create bad risky loans with the government backing it allowing it to get a AAA rating. This gave banks a license to steal!!!

--December 2000-- President Bill Clinton signed into law H.R. 4577: Consolidated Appropriations Act, 2001. Consolidated in this bill was Commodity Futures Modernization Act of 2000. This law made most over-the-counter derivatives (OTC derivatives) mortgage risk spreading transactions between sophisticated parties un-regulated as futures under the Commodity Exchange Act (CEA) or as securities under the federal securities laws. Instead, banks and securities firms would continue to have their dealings in OTC derivatives supervised by their federal regulators under general safety and soundness standards. Functional regulation. This was to create an international derivatives market for comodities securities. Clinton & Gore were trying to built the framework for Carbon Cap & Trade Energy Trading Market Scheme with this law. This gave birth to the Enron Loophole.

[ame="http://www.youtube.com/watch?v=vFK-UTGH1Zw"]Gore and the Enron Loophole.[/ame]

--2005-- Fannie Mae CEO Frank Raines affirms partnership with Barack Obama & The Congressional Black Caucus" [ame="http://www.youtube.com/watch?v=usvG-s_Ssb0&feature=related"]Frank Raines[/ame]

--September 2007-- Obama: "Subprime lending started off as a good idea - helping Americans buy homes who couldnt previously afford to. Financial institutions created new financial instruments that could securitize these loans, slice them into finer and finer risk categories and spread them out among investors around the country and around the world. In theory, this should have allowed mortgage lending to be less risky and more diversified." These same financial institutions were Top Contributors to Barack Obama's Campaign

--2008-- Fannie and Freddie have purchased about 80% of all new home mortgages in the United States. Their combined investment portfolios held mortgage assets (loans and MBSs) valued at $1.5 trillion (as of June 30, 2008) - These GSE will never pay back tax payer for losses like all the banks have.

--April 2009-- Obama on his world appology tour in Strasbourg, France "difficult to imagine that the inability of somebody to pay for a house in Florida could contribute to the failure of the banking system in Iceland. Today what's difficult to imagine is that we did not act sooner to shape our future."

--JULY 2009-- Committee on Oversight and Government Reform released a report on The Role of Government Affordable Housing Policy in Creating the Global Financial Crisis of 2008

- Thread starter

- #5

From Wall Street to 'K' Street in D.C. where the lobbyists live, the actual history of the problem is dumbfounding. This information is 'must have' for every voter.

As they said in the show: If you think this crisis is over,

As they said in the show: If you think this crisis is over,

Here's a HEAD$ UP for all of you no matter what the problem or who is in power.

Failure of government to govern rests with the people WHO HAVE OR HAD THE POWER.

I mention this because too often some of us here on this board choose to blame the victims rather than the perps.

IN the case of the meltdown the blames rests both in the government failing to govern and regulate, and the banksters and finaciers who knew exactly what was going on but didn't really give a damn because they were getting richer.

Failure of government to govern rests with the people WHO HAVE OR HAD THE POWER.

I mention this because too often some of us here on this board choose to blame the victims rather than the perps.

IN the case of the meltdown the blames rests both in the government failing to govern and regulate, and the banksters and finaciers who knew exactly what was going on but didn't really give a damn because they were getting richer.

tenthertoo

...worst of all I'm DULL

.... and nobody went to prison

.... and nobody went to prison

The really fun fact is that nearly everyone involved in creating the sub-prime disaster is now way richer than they were before they destroyed the economy.

- Thread starter

- #9

.... and nobody went to prison

The really fun fact is that nearly everyone involved in creating the sub-prime disaster is now way richer than they were before they destroyed the economy.

Isn't that the crying fucking shame of what Paulson did with his TARP checkbook?

He didn't even tell them that things had to change - he just covered their losses with our money.

.... and nobody went to prison

The really fun fact is that nearly everyone involved in creating the sub-prime disaster is now way richer than they were before they destroyed the economy.

Isn't that the crying fucking shame of what Paulson did with his TARP checkbook?

He didn't even tell them that things had to change - he just covered their losses with our money.

Yes it is crying fucking shame & it was not just Paulson. These big financial institutions were charged with regulating the entire financial system. When ask why did you sell trash to client/investors, these institutions said that their client/investors were investing professionals who should have known the risk. But when AIG could not pay the swaps to Goldman who was a professional investing firm, they should have known the risk. Goldman should have known the risk posed by trying to cash in on so many claims to AIG. The medicine that is good for investors is not good for large Wallstreet financial institutions. The USG paid these banks 100% of their AIG claims. The Federal Reserve's balance sheet is still swollen by $2.2 trillion of worthless toxic crap. Then we still own Fannie, Freddie & Gennie.

I don't see anyone proposing stripping all those executives of all their wealth. In my first post in this thread I laid out plenty of proof showing that they knew this would blow-up as it had before. They claimed that risk spreading is less risky. The fact is spreading risk creates more risk & makes it systemic. They knew this. They pulled the biggest scam in the history of mankind & claimed they could not have known the risk. They try to pass the blame on to a groupe of 20 year olds who created this swap system & say they were to young to know the danger. That story is complete BS. The people who knew better allowed the youngsters to do their wet work.

They knew this when the USG created the FDIC. They knew a few bankers would take high risk & pay higher interest to depositors. This would cause most of the depositors to remove their money from the low interest banks & deposit it into the high interest high risk banks. Because after all the FDIC insured all deposits the same, so who cares about risk when the FDIC has your back. This is why the banks were heavily regulated in order to prevent them from risking all the government backed money.

The government should have seized all the Wallstreet financial institutions & their executives assets. They should not have been rewarded for their own failure. The working class has been punished for the failure of sub-prime borrowers & Wallstreet financial institutions. The borrowers made out by not paying back what they borrowed & the fat cats made the most of it. The rest of us got shafted.

Last edited:

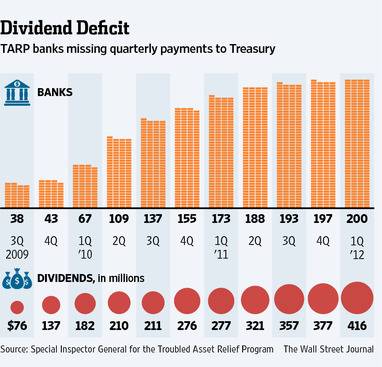

WSJ: TARP - Billions in Loans in Doubt - Christy Romero, special inspector general for the Troubled Asset Relief Program, said 351 small banks with some $15 billion in outstanding TARP loans face a "significant challenge" in raising new funds to repay the government.

Ms. Romero made the comments in her quarterly report to Congress, the first since the Senate approved her appointment in March as special inspector general for the program. She urged the government and regulators to find a way to help banks raise funds to repay the loans. "The status of those banks is one of the major issues facing TARP nearly four years after the financial crisis," the report says.

The report is the latest sign of a yearslong squeeze on smaller banks, those with less than $1 billion in assets. Their numbers and profitability have been declining due in part to regulatory and technological changes that made bigger institutions more profitable.

StoneCastle Partners LLC, a New York firm that has invested in about 800 community banks, estimates that community banks need $90 billion in fresh capital to clean up their balance sheets and acquire other institutions...

...Ms. Romero noted that taxpayers are still owed $118 billion, a figure she said included investments in AIG, GM, Allly Financial and other smaller programs under the TARP umbrella in addition to the outstanding loans to smaller banks. She also counted $4.2 billion Treasury had written off and realized losses of $9.8 billion "that taxpayers will never get back."

Granny says dem politicians an' bankers is in cahoots to kill off the middle class

Homeownership falls to lowest rate in 15 years

April 30, 2012: Homeownership in the U.S. fell to its lowest rate in 15 years during the first quarter as more delinquent borrowers lost their homes to foreclosure, forcing many to rent.

Homeownership falls to lowest rate in 15 years

April 30, 2012: Homeownership in the U.S. fell to its lowest rate in 15 years during the first quarter as more delinquent borrowers lost their homes to foreclosure, forcing many to rent.

The percentage of Americans who own their homes dropped a full percentage point over the past 12 months to 65.4% during the first three months of 2012, according to the latest Census Bureau data. That's the lowest rate since 1997 and down from the peak of 69.2% reached in 2004. "As foreclosures grew over the last six years, many homeowners became renters," said Alex Villacorte, director of analytics for Clear Capital, a real estate valuation company. The rental vacancy rate dropped to 8.8% during the first quarter, down from 9.7% a year earlier and from 9.4% in the last quarter of 2011, according to Census.

The growing demand has put pressure on the rental markets, said Villacorte. In many depressed housing markets, investors have been buying up distressed properties -- foreclosures and short sales -- fixing them up and renting them out. The median asking rent last quarter was $721, up 5.6% from 12 months ago, according to Census. Rents are highest in the Northeast, where the median is $932, followed by the West ($845), the South ($660) and the Midwest ($607).

Meanwhile, median home prices continue to fall. During the first quarter 2012, the median asking sales price for vacant units was $133,700. That's down from $143,700 during the first quarter of 2011, according to Census. Homeownership has fallen for all age groups, races and regions since the housing boom, Census reported. It is lowest in the West, where it has dropped one percentage point over the past 12 months to 59.9%. The Midwest has the highest homeownership rate at 69.5%, down 0.9 point year-over-year; the South is second at 67.5% (down 0.9 point) and the Northeast is third at 62.5 (down 1.4 point).

Source

The FDIC shut down another 5 banks this weekend. That makes 22 banks this quarter. Meanwhile the Big Banks just keep getting Bigger. In other news the government paid $30 million to Conoco to subsidize their oil refinery.

Last edited:

- Thread starter

- #14

PBS will be running this program again tonight at 9 eastern, if you're interested.

PBS Rocks!!

PBS Rocks!!

The cause the financial meltdown is not covered in Money Power & Wallstreet. They are only covering the bailout. It also was not just republicans. Bill Clinton and many prominent democrats pushed for the killing of "Glass Steagall". Bill Clinton personally signed all the laws that deregulated Wallstreet & turned it into a gambling casino that raises prices on citizens & steals their savings.

[ame="http://www.youtube.com/watch?v=x0k2PmF-o5Q"]Who repealed the Glass-Steagall Act?[/ame]

[ame="http://www.youtube.com/watch?v=cs3Z2Z2WMJk"]Bill Clinton Admits "I Was Wrong"[/ame]

Feb 27, 1995 TIME: CLINTON PROPOSES BANKING REFORMS - The Clinton Administration proposed sweeping changes in the nation's banking system that would permit commercial banks to sell insurance and underwrite securities. Treasury Secretary Robert Rubin outlined the new proposal, which would allow banks to "affiliate" with Wall Street firms, insurance companies and other financial service providers. It would repeal several federal restrictions, including the Depression-era Glass Steagall Act, which forbids banks from underwriting securities or selling insurance.

September 25, 1998 EIR-Economics: Clinton takes the lead on new financial architecture - Today, I have asked Secretary Robert Rubin and Federal Reserve Board Chairman Alan Greenspan to convene a major meeting of their counterparts within the next 30 days to recommend ways to adapt the international financial architecture to the 21st century, the President said. If you consider todays economic difficulties, disruptions, and plain old deep personal disappointments of now tens of millions of people around the world, it is clear to me that there is now a stark challenge not only to economic freedom but, if unaddressed, a challenge that could stem the rising tide of political liberty as well, the President warned. For most of the last 30 years, the United States and the rest of the world has been preoccupied by inflation, for reasons that all of you here know all too well, Clinton said. But clearly the balance of risks has now shifted, with a full quarter of the worlds population living in countries with declining economic growth or negative economic growth.

October 23, 1999 New York Times: Agreement Reached on Overhaul of U.S. Financial System - Dodd, whose state is home to the nation's largest insurance companies, and Schumer, with strong ties to Wall Street, have long sought legislation to repeal the Glass-Steagall Act. Both men said in interviews Friday that they moved to strike a compromise after it became apparent that the legislation might be killed, as it was last year by Gramm, over the debate about the Community Reinvestment Act.

Gramm had maintained that he did not want anything in the bill that would expand the application of the Community Reinvestment Act because it was, he said, unnecessarily burdensome to banks. He had sought a provision that would exempt thousands of smaller banks from the law. He also wanted a provision that would expose what he has described as the "extortion" committed by community groups against banks by requiring the groups to disclose any special financial deals the groups extract from the banks.

But the White House found that provision unacceptable and had its own ideas about community lending. It wanted the legislation to prevent any bank with an unsatisfactory record of making loans to the disadvantaged from expanding into new areas, like insurance or securities. The White House had insisted that the President would veto any legislation that would scale back minority-lending requirements.

October 24, 1999 New York Times: Deal on Bank Bill Was Helped Along By Midnight Talks - Mr. Dodd was not optimistic about the bill, which had reached the point of do or die. After four days of bitter polemic between Senator Phil Gramm, the Texas Republican who is chairman of the Senate Banking Committee, and Administration officials, the two sides were stuck over highly symbolic and racially tinged community lending rules that threatened to rip the legislation apart.

The discussions had become so poisoned by Thursday night that Mr. Gramm threatened both the top White House economic adviser, Gene Sperling, and the head of the nation's largest financial services company, Citigroup, that he would pull the plug on the bill, something neither the Administration nor Wall Street wanted.

But Mr. Dodd returned to the Capitol and, with a handful of other Democrats from the Banking Committee, slowly managed to turn Mr. Gramm around in an emotional confrontation in a tiny back office crammed with three dozen lawmakers and aides and Administration officials. There, they agreed to split a critical difference -- giving Mr. Gramm a provision he wanted that would make community lending advocates more accountable, and giving the White House what it wanted by making sure banks provided credit in poor communities before entering new lines of business.

At 2 o'clock on Friday morning, a few scant hours after his pessimistic report to the President, Mr. Dodd and other exhausted Democratic lawmakers placed a telephone call to a weary Treasury Secretary Lawrence H. Summers to report that they had clinched a deal with Mr. Gramm to repeal the Glass-Steagall Act of 1933. After eluding its advocates for decades, the agreement to deregulate Wall Street, favored by many of the nation's most powerful business interests, was struck.

[ame="http://www.youtube.com/watch?v=x0k2PmF-o5Q"]Who repealed the Glass-Steagall Act?[/ame]

October 27, 1999 New York Times: Former Treasury Secretary Joins Leadership Triangle at Citigroup - Robert E. Rubin, arguably the best-known financier of his generation and the recently retired Treasury Secretary, has taken a top position at Citigroup, the nation's largest financial services company...

The appointment came less than a week after the Clinton Administration and Congress agreed on a compromise bill that would overhaul the laws that regulate the financial industry, a measure that removes many of the restrictions preventing banks, securities firms and insurance companies from buying one another or engaging in one another's businesses. Both Mr. Rubin and Citigroup strongly supported the bill, which would greatly benefit the company. Mr. Rubin said he played a role in arranging the final compromise that will probably lead to the repeal of the so-called Glass-Steagall legislation.

Nov 13, 1999 New York Times: Clinton Signs Legislation Overhauling Banking Laws - President Clinton signed into law today a sweeping overhaul of Depression-era banking laws. The measure lifts barriers in the industry and allows banks, securities firms and insurance companies to merge and to sell each other's products.

''This legislation is truly historic,'' President Clinton told a packed audience of lawmakers and top financial regulators. ''We have done right by the American people.''

The bill repeals parts of the 1933 Glass-Steagall Act and the 1956 Bank Holding Company Act to level the domestic playing field for United States financial companies and allow them to compete better in the evolving global financial marketplace.

''With this bill,'' Treasury Secretary Lawrence H. Summers said, ''the American financial system takes a major step forward toward the 21st Century -- one that will benefit American consumers, business and the national economy.''

Time: 25 People to Blame for the Financial Crisis - President Clinton's tenure was characterized by economic prosperity and financial deregulation, which in many ways set the stage for the excesses of recent years. Among his biggest strokes of free-wheeling capitalism was the Gramm-Leach-Bliley Act, which repealed the Glass-Steagall Act, a cornerstone of Depression-era regulation. He also signed the Commodity Futures Modernization Act, which exempted credit-default swaps from regulation. In 1995 Clinton loosened housing rules by rewriting the Community Reinvestment Act, which put added pressure on banks to lend in low-income neighborhoods. It is the subject of heated political and scholarly debate whether any of these moves are to blame for our troubles, but they certainly played a role in creating a permissive lending environment.

[ame="http://www.youtube.com/watch?v=cs3Z2Z2WMJk"]Bill Clinton Admits "I Was Wrong"[/ame]

- Thread starter

- #16

It also was not just republicans.

Oh, no doubt!!

The current valve system which directs the rivers of cash-flow that is the American economy, just like the last one, was carefully crafted at the well paid behest of the reigning titans of American Industry by every president and congress elected since the last system collapsed back in the 30's. And the one that the wheels fell off of in the 1930's was built by every president and congress from the Civil War to The Great Depression.

The Late Great Albert Einstein said:The definition of insanity is repeating a process with the expectations of a different result.

Fair and simple taxes, public budgets that are balanced by law, transparency in all things politics and then build an economy that your kids can drive to the stars.

It ain't rocket science, y'all.

It ain't rocket science, y'all.Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

From Wall Street to 'K' Street in D.C. where the lobbyists live, the actual history of the problem is dumbfounding. This information is 'must have' for every voter.

As they said in the show: If you think this crisis is over,

"The quick version of this terrible story is that Norman and Oriane Rousseau of Newbury Park, California were scammed into a predatory mortgage. But they made their payments anyway, always paying with a cashiers check in person at the same branch. Then one day the bank misapplied their payment and said they still owed the money. This started a long, nasty process that led to the bank evicting the Rousseaus from their home.

Heres the shocker: right at the start the Rousseaus came up with proof that the bank had received the payment and had cashed the check. But the bank continued to claim it had missed the payment, gave the Rousseaus the runaround, started applying fees, and used it as an excuse to foreclose on the house anyway.

The Rousseaus fought back, the bank dragged it out for so long and pulled so many tricks, getting its way every step of the process, until this last Sunday Norman Rousseau finally gave up and shot himself in despair two days before the scheduled eviction, Tuesday, May 15."

I wish shows like this was on mainstream media.

The truth about the collapse is anti-political; meaning - both parties took active participation roles equally.

Right now Wall Street is even more risky than it was pre-2007. The $400 trillion derivative market is an absolute time-bomb that WILL go off. And when it does - there is not enough money in the world to save the banks. The top 4 American banks have $100 trillion in derivatives.

The truth about the collapse is anti-political; meaning - both parties took active participation roles equally.

Right now Wall Street is even more risky than it was pre-2007. The $400 trillion derivative market is an absolute time-bomb that WILL go off. And when it does - there is not enough money in the world to save the banks. The top 4 American banks have $100 trillion in derivatives.

More stunning hypocrisy from the rich powerful left.

Similar threads

- Replies

- 1

- Views

- 84

- Replies

- 38

- Views

- 344

- Replies

- 8

- Views

- 99

Latest Discussions

- Replies

- 189

- Views

- 1K

- Replies

- 2

- Views

- 74

Forum List

-

-

-

-

-

Political Satire 8040

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-

woah...

woah...