Toro

Diamond Member

Eventually the market's gonna crash. It's inevitable as the valueless currency we use can't be sustained forever. At some point, like other countries (most recently Argentina,) we too will default on our debt and the house of cards will come crashing down. I don't know what's gonna happen then, but as the line in "Ultraviolet" went, "What would have happened if I didn't pass one of these tests?" - "Nothing good."

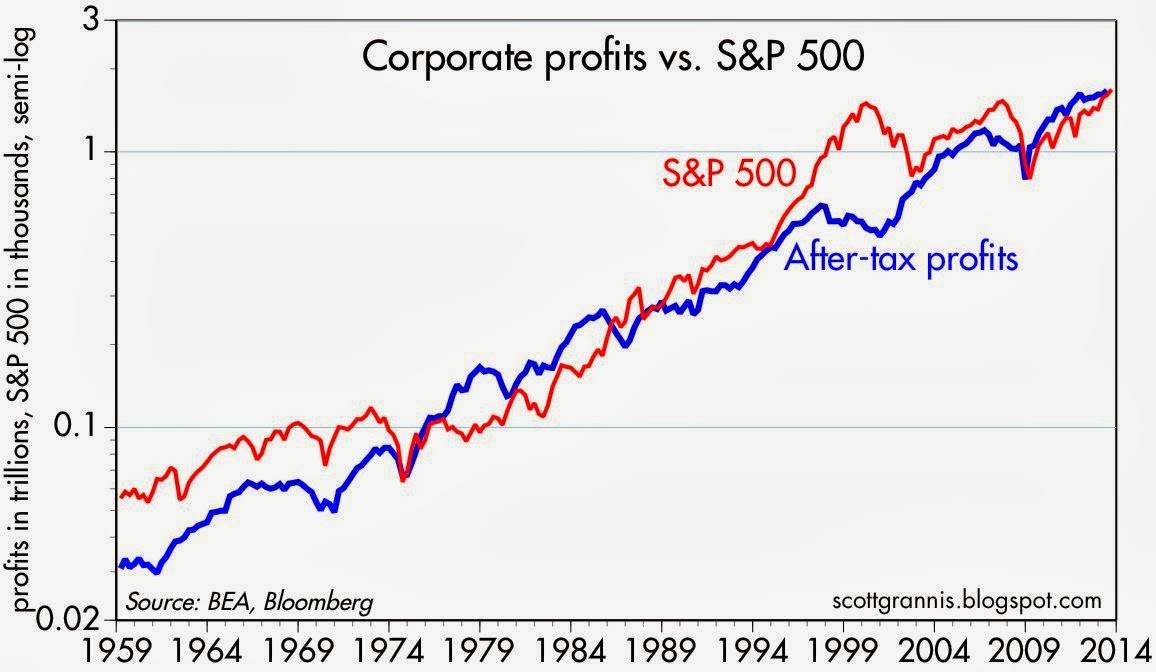

Those may all happen, but they may happen 100 years from now. In the meantime, people huddled in their bunkers waiting for such a crash will all be dead and have missed great investment opportunities.