fncceo

Diamond Member

- Nov 29, 2016

- 42,818

- 35,442

- 3,615

Let’s Roll Back The Tax Cuts Instead

Or significantly expand them.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

Let’s Roll Back The Tax Cuts Instead

Just in case you want my take on the tax issue:

Increase the marginal tax rate on personal income to 1960 levels; that way you get rid of a good portion of financial asset speculation.

Reduce the loopholes in corporate taxes so that actual taxes are closer to the 4% of the 60's.

They might find ways around it... that's the main task of lobbies. The above is the "nice" approach. I've heard more radical options: tax all the wealth above a threshold (e.g all wealth above 10 million with a 2% tax rate).

You don't need to run a balanced budget, you just have to pull out the money that goes into the FIRE sector because it is non-productive; in the best case scenario it causes a financial bubble , in the worse case it inflates land and housing prices.

By the by , you don't sound like a left-winger.

A confiscation? The Wealth was taxed when it was accumulated. Is this un-constitutional?tax all the wealth

I am not. I want balanced budgets, prosperity, jobs for all of America.you don't sound like a left-winger.

No.

It is not the regular tax rate, it is the marginal tax rate: the rate for all income above a threshold ( e.g the tax on all income above 10,000,000).

It didn't cause a problem then and it will not cause a problem in the future, most of that money goes into non-productive investments: stock options, crypto, derivatives, money markets.

Because, poor people are consumers (20% of the population). If you tax them, consumption goes down.

That doesn't happen with the top 1% because most of the extra money goes into financial assets which contribute 0% to production and consumption.

Some macroeconomics comes handy when making those harsh decisions.

Well, I told you the first alternative was the "nice" one.A confiscation? The Wealth was taxed when it was accumulated. Is this un-constitutional?

I am not. I want balanced budgets, prosperity, jobs for all of America.

I recently signed up as "the opposite" of an anti-american, anarchist, commee puke poster on here who posts as rightwinger.

Because the government will re-circulate it into the economy through spending.It is not the regular tax rate, it is the marginal tax rate: the rate for all income above a threshold ( e.g the tax on all income above 10,000,000).

Would a 90% rate on all income over $1 million cause a problem?

It didn't cause a problem then and it will not cause a problem in the future, most of that money goes into non-productive investments: stock options, crypto, derivatives, money markets.

Why is putting money into those things less productive than giving it to idiots in D.C.?

No, not really ,

The amount of money circulating in an economy is given by the following formula

Money created in a period = ( government spending - taxes ) + interests on bonds + ( loans - loan payments ) )

So , if you cut spending you must also cut taxes in the same proportion and hope the private sector is able to cope with the layoffs.

Alas, many corporations are probably more interested in financial assets than increasing output.

If you cut spending before cutting taxes you end up in a recession.

Well, I told you the first alternative was the "nice" one.

You can't have a balanced budget, the only sector that can be in negative financial equity is the government.

Since the economy is a set of interleaved balance sheets government liabilities are the assets of the other sectors ( households, firms and banks ) .

You need to tax wealth or income because taxes and public services are what give value to fiat currency ( taxes create demand for currency ).

Then we are done here. Income is taxed already.You need to tax wealth or income

Because the government will re-circulate it into the economy through spending.

Just in case you want my take on the tax issue:

Increase the marginal tax rate on personal income to 1960 levels; that way you get rid of a good portion of financial asset speculation.

Reduce the loopholes in corporate taxes so that actual taxes are closer to the 4% of the 60's.

They might find ways around it... that's the main task of lobbies. The above is the "nice" approach. I've heard more radical options: tax all the wealth above a threshold (e.g all wealth above 10 million with a 2% tax rate).

You don't need to run a balanced budget, you just have to pull out the money that goes into the FIRE sector because it is non-productive; in the best case scenario it causes a financial bubble , in the worse case it inflates land and housing prices.

By the by , you don't sound like a left-winger.

Because the government will re-circulate it into the economy through spending.

There is a chance that, may happen, but, judging by historical figures... no. When the effective corporate taxes and marginal income taxes were higher gdp growth was higher.So , if you cut spending you must also cut taxes in the same proportion and hope the private sector is able to cope with the layoffs.

If you cut spending, can't other borrowers use that money to do something more productive than the idiots in D.C.?

When sold, the money is income. It would (I hope) be taxed at the same flat rate. I’d eliminate the distinction between long term capital gains and short term gains. Income is income. Period.what about the high earners with $1mil income....but given $25mil annual stock packages? I hate to label them grants? It is very confusing? Gates? COOK? do you tax them on todays value? Cannot. they have not sold it yet? Unrealized gain until they sell shares. Then only 12% Capital gains? perhaps? I don't know. I am asking.

There is a chance that, may happen, but, judging by historical figures... no. When the effective corporate taxes and marginal income taxes were higher gdp growth was higher.

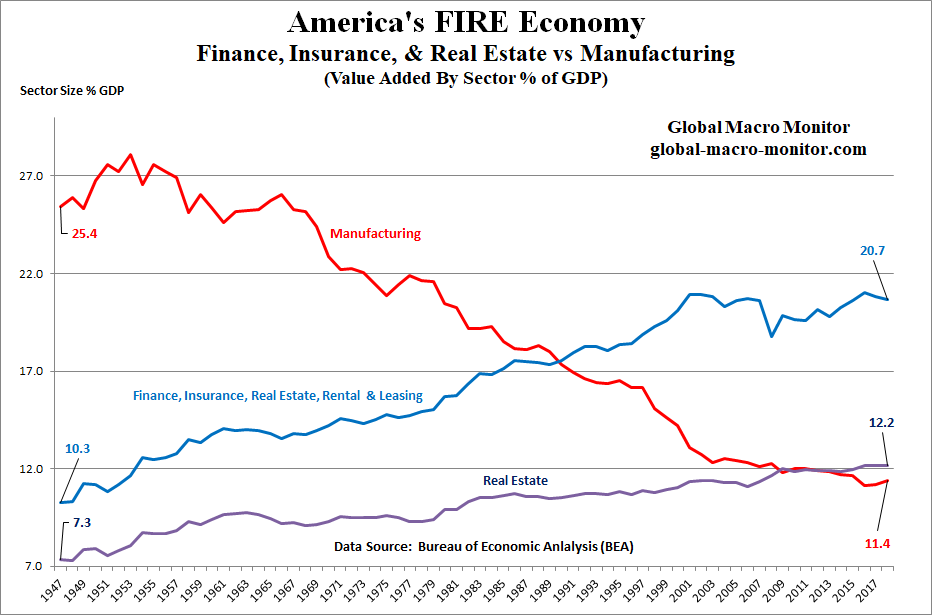

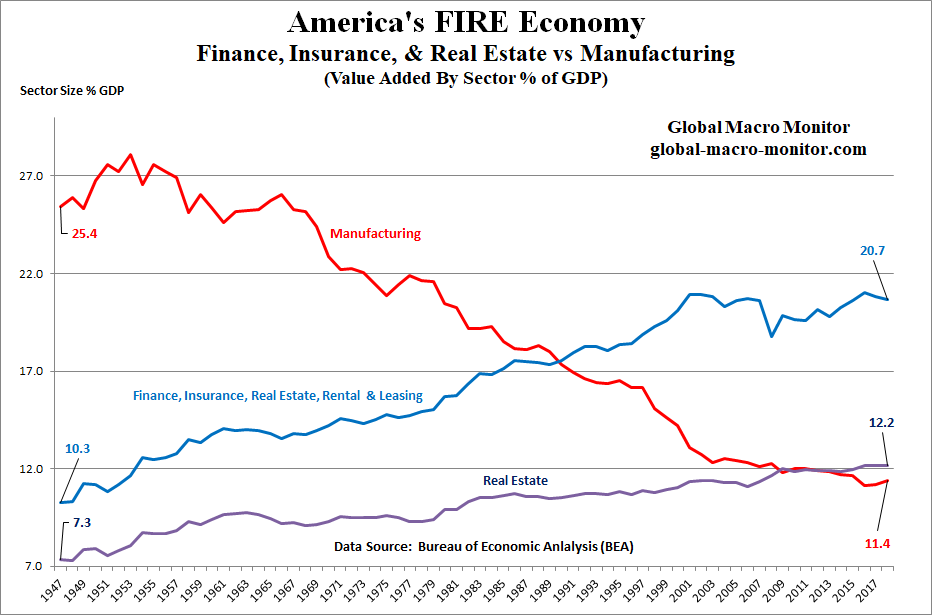

View attachment 779331

I mean the historical data shows the average GDP growth was higher in the 50's and 60's than in the past two decades.There is a chance that, may happen, but, judging by historical figures... no.

What do you mean, no?

Government borrowing never crowds out private borrowing?

You need to take an econ class. Start out slow, I can tell you're going to have a hard time.

When the effective corporate taxes and marginal income taxes were higher gdp growth was higher.

You mean when the rest of the world had been bombed into rubble?

I mean the historical data shows the average GDP growth was higher in the 50's and 60's than in the past two decades.

In that time marginal taxes were higher and effective corporate taxes were higher.

... and no , at that time the world wasn't being bombed into rubble?

Why cant you have a balanced budget. I told you before that when ever there is a government shutdown, the "NON ESSENTIAL" personnel get let off, but then after the government opens up again, these lazy fucks get back pay. If they arent essential, then we dont need them. Lay everyone of them off and we would be on a surplus of taxes.Well, I told you the first alternative was the "nice" one.

You can't have a balanced budget, the only sector that can be in negative financial equity is the government.

Since the economy is a set of interleaved balance sheets government liabilities are the assets of the other sectors ( households, firms and banks ) .

You need to tax wealth or income because taxes and public services are what give value to fiat currency ( taxes create demand for currency ).

Also the GDP was higher because we had just come out of a war and every male was back making stuff that people wanted. But those damn Marxists, they had to start taxing everyone making life harder so not just one family member had to work, but both. And giving lazy fucks money to sit home without putting any effort into that money, just shrank it to what it is today. In the 1950s an ounce of gold was 40 dollars. Today it is over 2000 dollars. The dollar has shrunk over 50 times.I mean the historical data shows the average GDP growth was higher in the 50's and 60's than in the past two decades.

Maybe growth was higher because government spending was lower?

and no , at that time the world wasn't being bombed into rubble?

Europe and Asia hadn't fully recovered from WWII yet.

It was in all the papers.

Well, that's unlikely, as I said the economy is a set of interleaved balance sheets: the negative equity of the government is part of the positive equity of the other sectors.I mean the historical data shows the average GDP growth was higher in the 50's and 60's than in the past two decades.

Maybe growth was higher because government spending was lower?

and no , at that time the world wasn't being bombed into rubble?

Europe and Asia hadn't fully recovered from WWII yet.

It was in all the papers.

Well, that's unlikely, as I said the economy is a set of interleaved balance sheets: the negative equity of the government is part of the positive equity of the other sectors.

Two things have changed

1) The size of the FIRE sector

2) The US had a positive trade balance.

The FIRE sector doesn't produce anything, it just inflates prices and reduces the amount of money available for real production.

America’s Path To A FIRE Economy

We originally posted this chart in February 2011, which we just updated also breaking out the real estate industry from FIRE (finance, insurance, and real estate). It is still is just as shocking…global-macro-monitor.com