Wiseacre

Retired USAF Chief

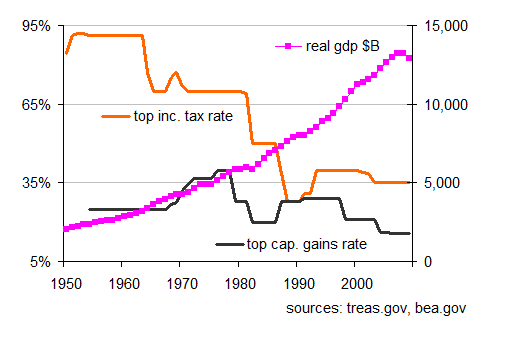

% of Incomewhat i see is rhetoric and theory. "lower taxes, the savings will be passed on creating demand then expansion and jobs!"

we've had trickle-down for 30yrs and unemployment is sky-high. job creators? ya there?

banks have essentially FREE money to lend, and theyre not lending, why not? job creators, hello?

republicans are right when they say lower taxes help facilitate the velocity of money, in which case EVERYONE should have low tax rates. but the lower classes pay more, why? shits gotta be paid for. exactly. SOMEBODY has to pay up to run a country. give the rich the breaks, theyll sit on it. give the middle class the breaks, we'll burn through it

republicans have theory, and it doesnt pan out, theyre just getting in the way

im a DEMAND CREATOR. WE are demand creators. cut OUR taxes, THEN youll see growth.

boom. done.

Almost half the country pays no federal income tax now, so where's the demand?

The top 10% of income earners now account for 50% of all income in the US.

The top 1% of income earners now account for 23.5% of all income in the efUS.

The top .1% (thats 1 in 1000) now account for 11% of all income in the US.

Not since the year before the great depression has the top 10% of income earners neared 50%of all income.

% Income Growth 1979 2007

The top 1% had growth in income of 281%

The Middle 5 % had growth in income of 25%

The bottom had income growth of 16%

All of the above are from:

The 30-Year Growth of Income Inequality |

Taxes Paid by Income Percentile

Top 1% 20.3%

Top 10% 48%

The lowest 40% of the income earners earn 10.6% of all income, and pay 7.2% of all taxes.

So here is the difference, Wiseacre. The numbers here reflect total taxes: federal, state, and local.

The above is from: http://www.ctj.org/pdf/taxday2011.pdf

And by the way, your statement that "Almost half the country pays no federal income tax now, so where's the demand?" is totally bogus. They pay about 9% of all federal income taxes on about 14% of the total income. You should be really pissed at whomever got you to believe that quote.

About 47 percent will pay no federal income taxes at all for 2009. Either their incomes were too low, or they qualified for enough credits, deductions and exemptions to eliminate their liability. That's according to projections by the Tax Policy Center, a Washington research organization.

Half of Americans pay no federal income tax - Business - Personal finance - Tax Tactics - msnbc.com

Some of us see the value of not charging income taxes on those poor enough to not be able to live.

Not able to live? Isn't that a bit over the top, even for you?

By the way, are you at all concerned that Exon and GE paid essentially no us federal income taxes???

Actually, yes I am. It's about freakin' time we reformed the tax code for both corps and individuals, if it was me I'd lower the rates and pay for it by capping the deductions at say 10% of taxable income. And I'd yank all the subsidies too, which mostly go to the big corps. You do know that every single democrat voted to continue those subsidies in the latest farm bill, right? Got just enough repubs to pass it through the Senate, not sure how it'll work out in committee with the House though. And BTW I'd also change the tax law that taxes income earned overseas, like every other developed country does. Wonder who opposes that, and why.