Star

Gold Member

- Apr 5, 2009

- 2,532

- 614

- 190

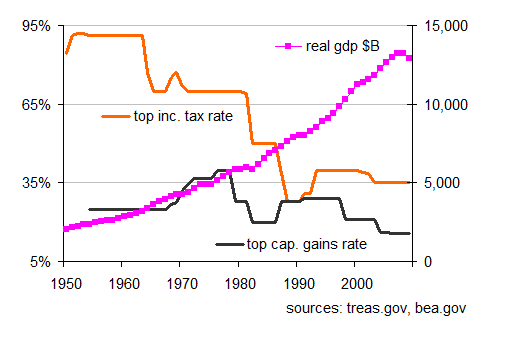

The chart below puts the lie to the Republican mantra that high marginal tax rates on the wealthiest among us kill economic growth. In fact-----in fact the empirical evidence shows; just the opposite is true, high marginal tax rates on the wealthiest among us equals economic growth.

Back in the 1950s, when the top marginal tax rate was more than 90 percent, real annual growth averaged more than 4 percent. During the last eight years, when the top marginal rate was just 35 percent, real growth was less than half that. Altogether, in years when the top marginal rate was lower than 39.6 percent the top rate during the 1990s annual real growth averaged 2.1 percent. In years when the rate was 39.6 percent or higher, real growth averaged 3.8 percent. The pattern is the same regardless of threshold. Take 50 percent, for example. Growth in years when the tax rate was less than 50 percent averaged 2.7 percent. In years with tax rates at or more than 50 percent, growth was 3.7 percent.

As Linden put it, these numbers do not mean that higher rates necessarily lead to higher growth. But the central tenet of modern conservative economics is that a lower top marginal tax rate will result in more growth, and these numbers do show conclusively that history has not been kind to that theory. Indeed, these numbers put the lie to the common Republican refrain that Obama and Democrats in Congress are trying to implement a job-killing tax hike by putting the top tax rate back to where it was under President Clinton.

Back in the 1950s, when the top marginal tax rate was more than 90 percent, real annual growth averaged more than 4 percent. During the last eight years, when the top marginal rate was just 35 percent, real growth was less than half that. Altogether, in years when the top marginal rate was lower than 39.6 percent the top rate during the 1990s annual real growth averaged 2.1 percent. In years when the rate was 39.6 percent or higher, real growth averaged 3.8 percent. The pattern is the same regardless of threshold. Take 50 percent, for example. Growth in years when the tax rate was less than 50 percent averaged 2.7 percent. In years with tax rates at or more than 50 percent, growth was 3.7 percent.

As Linden put it, these numbers do not mean that higher rates necessarily lead to higher growth. But the central tenet of modern conservative economics is that a lower top marginal tax rate will result in more growth, and these numbers do show conclusively that history has not been kind to that theory. Indeed, these numbers put the lie to the common Republican refrain that Obama and Democrats in Congress are trying to implement a job-killing tax hike by putting the top tax rate back to where it was under President Clinton.