Rshermr

VIP Member

Well, ed, slow to me is someone who can not understand a simple two part argument, like you, apparently. As I said, it is not the tax increase, ed. Try to understand that. It is how the revenue is spent to create demand.Well, Wiseacre, I can either believe you or the most renounced economists. And you can't even find evidence to refute what I have said.

Saying that high taxes make an economy grow is like saying that pricking a hole in a balloon will make the balloon grow or expand.

If it was true the idea would not seem stupid and absurd and there would be an explanation of how or why it happened.

See why we are 100% positive a liberal will be slow?

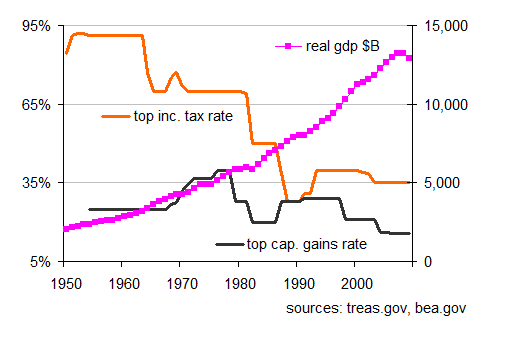

And ed, you are still unable to show me where a bad economy has suffered as a result of a tax increase. The tax increase done in the Clinton provided for a great economy. Reagan increased taxes 11 times to help overcome his original tax decrease, which tubed the economy.

So, tell me again why you think liberals are slow. You really impress me with that. Or lets see you find some proof of your statements. Tool.