- Jun 18, 2009

- 34,470

- 18,765

- 1,915

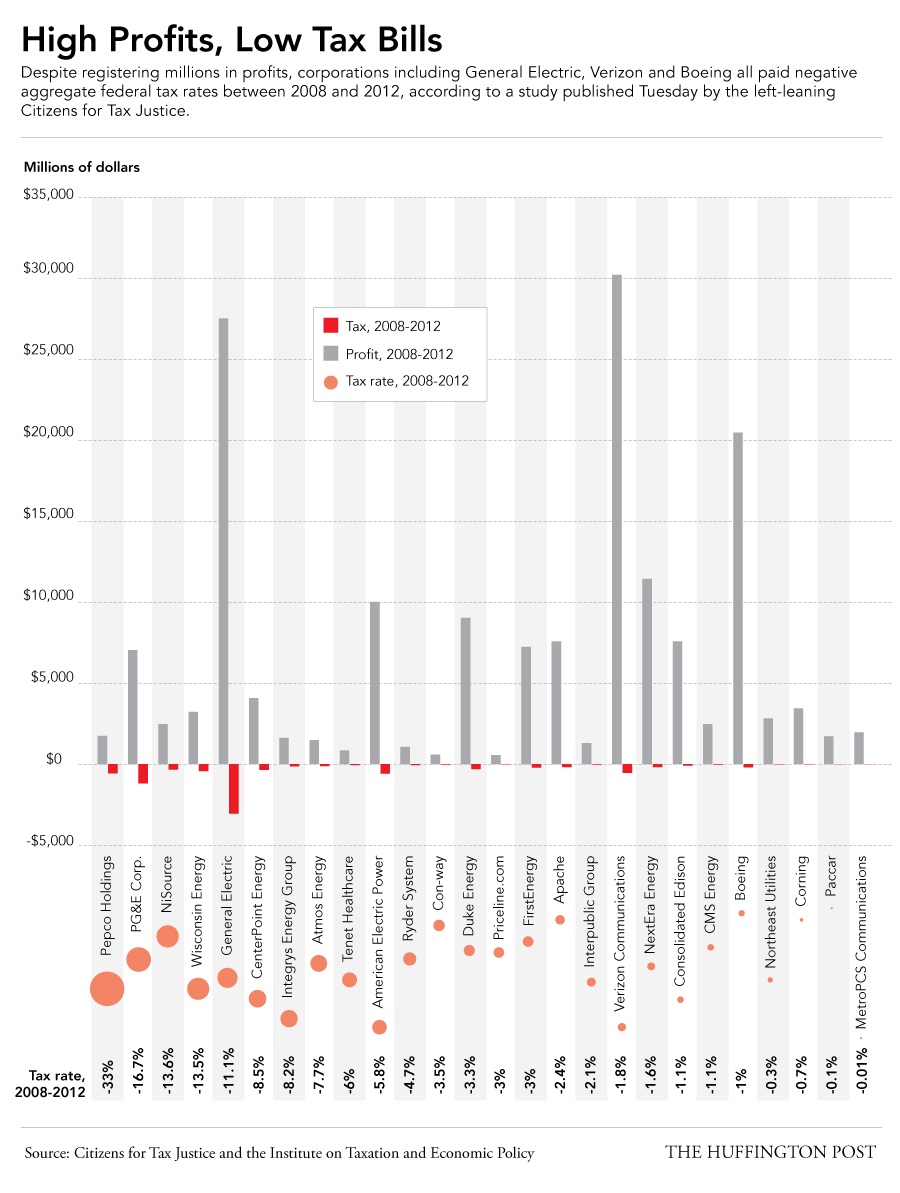

You want lower Corporate Taxes but you also want to raise Boeings' Taxes?That's 4 POINT 6 Percent not 46.

Boeing paid only 4.6 percent MAXIMUM since 2004.

Yes, I know. I read it. Something like a third of large corporations paid no taxes at all for much of the 00s.

What am I missing here?

Might want to try that again...Table 6. Additional Financial Information Fourth Quarter Full Year

(Dollars in Millions)

2013 2012 2013 2012

Revenues

Boeing Capital Corporation $105 $129 $408 $468

Other segment $22 $27 $102 $106

Unallocated items and eliminations $123 ($358) ($65) ($610)

Earnings from Operations

Boeing Capital Corporation $9 ($12) $107 $88

Other segment income/(expense) ($99) $31 ($156) ($186)

Unallocated items and eliminations excluding unallocated

pension/postretirement expense ($532) ($200) ($1,105) ($492)

Unallocated pension/postretirement expense ($323) ($212) ($1,314) ($899)

Other income, net $15 $23 $56 $62

Interest and debt expense ($96) ($112) ($386) ($442)

Effective tax rate 14.0% 36.3% 26.4% 34.0%

Source: http://www.google.com/url?sa=t&rct=...6Mc37de57MKVpfmlBlMmwpA&bvm=bv.71778758,d.aWw

Page 5