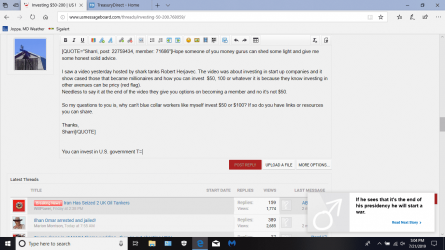

Hope someone of you money gurus can shed some light and give me some honest solid advice.

I saw a video yesterday hosted by shark tanks Robert Herjavec. The video was about investing in start up companies and it show cased those that became millionaires and how you can invest $50, 100 or whatever it is because they know investing in other avenues can be pricy (red flag).

Needless to say it at the end of the video they give you options on becoming a member and no it's not $50.

So my questions to you is, why can't blue collar workers like myself invest $50 or $100? If so do you have links or resources you can share.

Thanks,

Sharri

I saw a video yesterday hosted by shark tanks Robert Herjavec. The video was about investing in start up companies and it show cased those that became millionaires and how you can invest $50, 100 or whatever it is because they know investing in other avenues can be pricy (red flag).

Needless to say it at the end of the video they give you options on becoming a member and no it's not $50.

So my questions to you is, why can't blue collar workers like myself invest $50 or $100? If so do you have links or resources you can share.

Thanks,

Sharri