- Apr 12, 2011

- 3,814

- 758

- 130

By JOHN MERLINE, INVESTOR'S BUSINESS DAILY

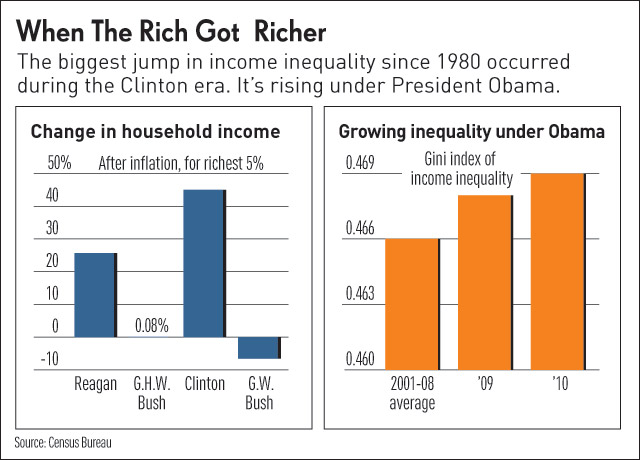

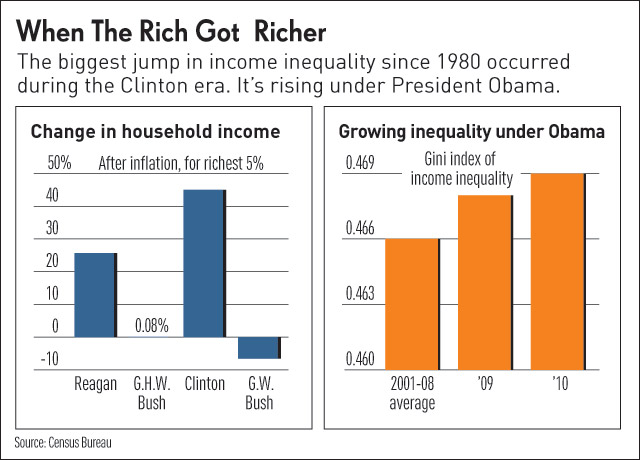

In his weekend radio address, President Obama decried that "over the past three decades, the middle class has lost ground while the wealthiest few have become even wealthier." Although he was trying to leverage the Occupy Wall Street movement, the income gap has been a longstanding concern of his.

During the 2008 campaign, Obama said, "The project of the next president is figuring out how do you create bottom-up economic growth, as opposed to the trickle-down economic growth that George Bush has been so enamored with."

But it turns out that the rich actually got poorer under President Bush, and the income gap has been climbing under Obama.

What's more, the biggest increase in income inequality over the past three decades took place when Democrat Bill Clinton was in the White House.

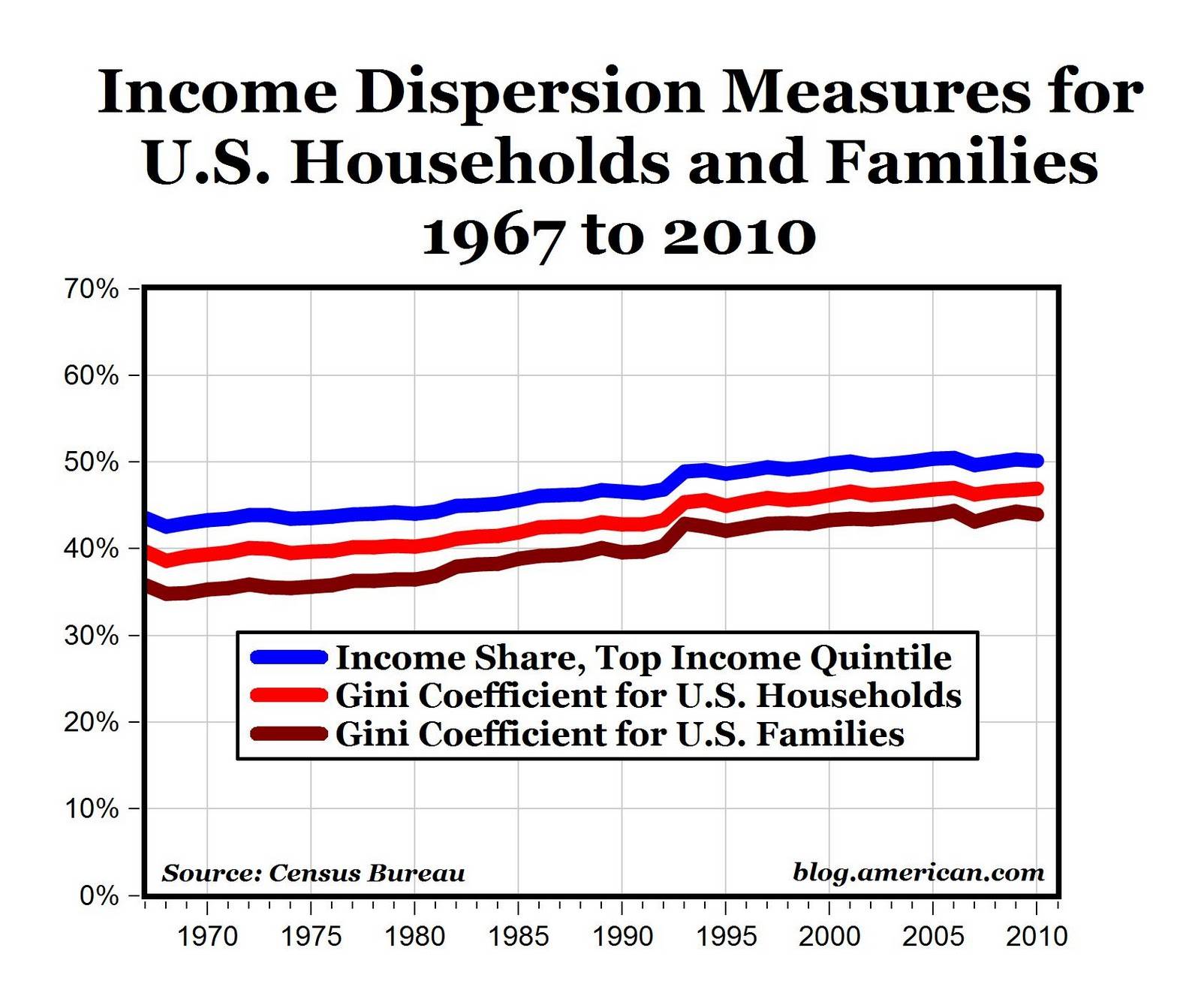

The wealthiest 5% of U.S. households saw incomes fall 7% after inflation in Bush's eight years in office, according to an IBD analysis of Census Bureau data. A widely used household income inequality measure, the Gini index, was essentially flat over that span. Another inequality gauge, the Theil index, showed a decline.

In contrast, the Gini index rose slightly in Obama's first two years. Another Census measure of inequality shows it's climbed 5.7% since he took office.

Meanwhile, during Clinton's eight years, the wealthiest 5% of American households saw their incomes jump 45% vs. 26% under Reagan. The Gini index shot up 6.7% under Clinton, more than any other president since 1980.

To the extent that income inequality is a problem, it's not clear what can be done to resolve it. Among the contributing factors:

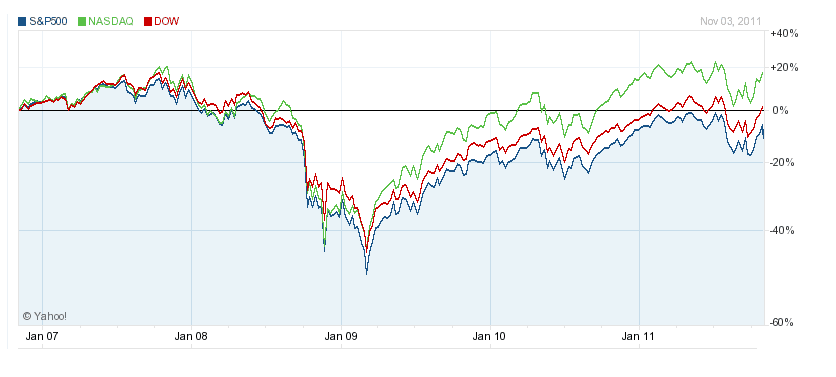

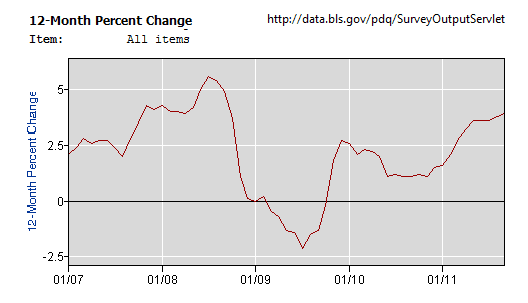

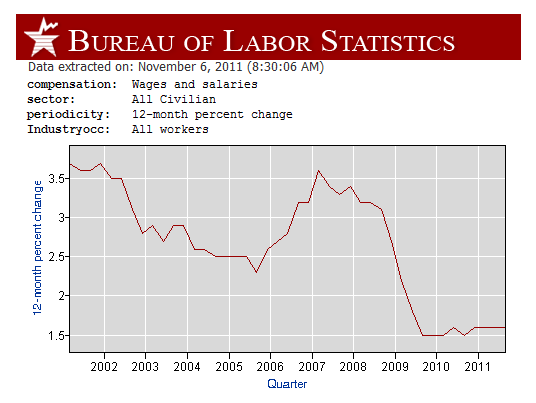

Economic growth. Strong economic growth, rising stock prices and household income inequality tend to go hand in hand.

Technology. Tech advances have put a premium on skilled labor, according to a Congressional Budget Office report . Because the pool of skilled workers hasn't grown as much as demand, their wages have climbed faster.

Free trade and immigration. Cheap labor abroad and an influx in low-skilled immigrants can depress wages at the bottom, according to the CBO.

Women in the workforce. As the CBO put it, "an increase in the earnings of women could boost inequality by raising the income of couples relative to that of households headed by single people."

Tax policy changes don't explain the widening income gap. The CBO found that, by one measure, "the federal tax system as a whole is about as progressive in 2007 as it was in 1979."

Read more at Business News - Financial News, Stock Market & Investing News - IBD - Investors.com .

In his weekend radio address, President Obama decried that "over the past three decades, the middle class has lost ground while the wealthiest few have become even wealthier." Although he was trying to leverage the Occupy Wall Street movement, the income gap has been a longstanding concern of his.

During the 2008 campaign, Obama said, "The project of the next president is figuring out how do you create bottom-up economic growth, as opposed to the trickle-down economic growth that George Bush has been so enamored with."

But it turns out that the rich actually got poorer under President Bush, and the income gap has been climbing under Obama.

What's more, the biggest increase in income inequality over the past three decades took place when Democrat Bill Clinton was in the White House.

The wealthiest 5% of U.S. households saw incomes fall 7% after inflation in Bush's eight years in office, according to an IBD analysis of Census Bureau data. A widely used household income inequality measure, the Gini index, was essentially flat over that span. Another inequality gauge, the Theil index, showed a decline.

In contrast, the Gini index rose slightly in Obama's first two years. Another Census measure of inequality shows it's climbed 5.7% since he took office.

Meanwhile, during Clinton's eight years, the wealthiest 5% of American households saw their incomes jump 45% vs. 26% under Reagan. The Gini index shot up 6.7% under Clinton, more than any other president since 1980.

To the extent that income inequality is a problem, it's not clear what can be done to resolve it. Among the contributing factors:

Economic growth. Strong economic growth, rising stock prices and household income inequality tend to go hand in hand.

Technology. Tech advances have put a premium on skilled labor, according to a Congressional Budget Office report . Because the pool of skilled workers hasn't grown as much as demand, their wages have climbed faster.

Free trade and immigration. Cheap labor abroad and an influx in low-skilled immigrants can depress wages at the bottom, according to the CBO.

Women in the workforce. As the CBO put it, "an increase in the earnings of women could boost inequality by raising the income of couples relative to that of households headed by single people."

Tax policy changes don't explain the widening income gap. The CBO found that, by one measure, "the federal tax system as a whole is about as progressive in 2007 as it was in 1979."

Read more at Business News - Financial News, Stock Market & Investing News - IBD - Investors.com .