- Thread starter

- #121

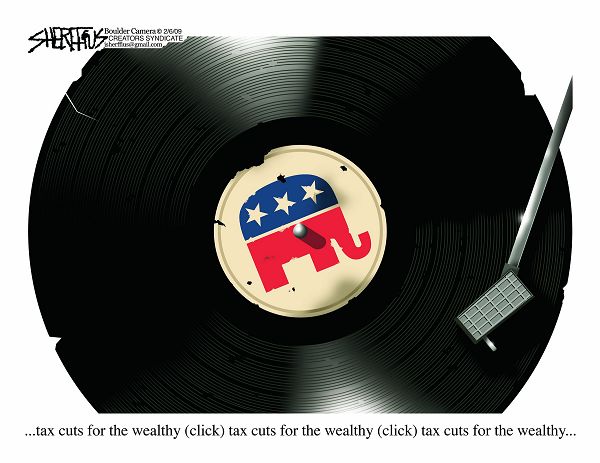

none of that is indicated by moderate increases in taxes, fox. 100% unsubstantiated policy positions.across the board, tax revenues need to go up for the solvency pf government. unlike our states, our federal solvency effects the dollar directly, and we cant play the games we have been the last 30 years. wouldn't raise taxes if we didn't need to reclaim the dough.

But what does it accomplish if increased tax revenues result in decreased economic activitiy and prosperity? It sounds great that yeah, raise all the taxes to balance the budget.

But if those tax increase result in lost jobs, more folks on unemployment, more folks on food stamps, more folks on welfare, more folks not paying into the system because they have little or no income, those tax increases would be pretty stupid wouldn't you say?

for businesses, as i had espoused to GA earlier, taxes invite investment as they promote the activity of businesses to shelter themselves through deductibility. how does your analysis fit with the clinton tax increase?

do you acknowledge that there needs to be more government revenue at all, in addition to major restructuring of the costs of government? a line is drawn for me on that basic recognition between folks who have a clue about what the dollar faces, and those who have fallen victim to the political budgeteering.

the myths you've laid out above are symptoms of this modern voter dystrophy. also indicated is an impression that the government has the will or wherewithal to affect debt reduction through constraining costs of government alone, or that there isn't commensurate impact on the wider economy from such adjustments alone.

taxes effect the whole economy. price increases aimed at accounting for taxes tend to be across the board, not offering preferential competitive advantage between domestic businesses. personally, i have never adjusted pricing for any products or services i've ever offered to account for tax. how real is that?Every businessman knows that just raising prices does not necessarily increase the bottom line and can actually hurt it if the tax increase results in his customers going elsewhere or not buying at all.

I asked some very specific questions and I believe all are pertinent given the economic history in past century alone. I did not lay out any myths or examples of any kind. You chose not to answer the questions asked but rather deflected from the questions with a series of red herrings and straw men. Once you answer my questions, then we can proceed with answers to your questions.