I wasn’t prepared when my retirement plans went awry. Are you?

The often-overlooked expense

Know your Social Security strategy

Evaluate income and tax strategies

Check risk in your retirement accounts

Have a cushion

Prepare emotionally

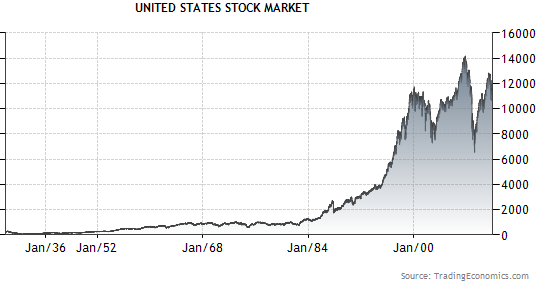

“One of the hardest things that retirees face is the notion that their retirement account, which has been growing while they worked, will be going down in value over the course of retirement as they make withdrawals,” Herr said. “People can get really uncomfortable with that.”

More details @ Getting close to retirement? Here are 6 key considerations

The often-overlooked expense

Know your Social Security strategy

Evaluate income and tax strategies

Check risk in your retirement accounts

Have a cushion

Prepare emotionally

“One of the hardest things that retirees face is the notion that their retirement account, which has been growing while they worked, will be going down in value over the course of retirement as they make withdrawals,” Herr said. “People can get really uncomfortable with that.”

More details @ Getting close to retirement? Here are 6 key considerations