And what happens when they retire? Will we need even more immigrants?What does that mean? That the fund is still running out of money even though we've left IOU's?

We have a worker shortage and a baby shortage. Trump wants to pass a baby tax break to fix that problem. I don't think we have 18 years to wait for them to grow up and start working. We need more immigrants. We need more people paying into social security.

Anyways, I don't want to vote for the party who is up for making cuts to these programs. We know Republican want to cut these programs if not eliminate them altogether.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Fun facts about Social Security and how the Democrat party has attacked it repeatedly.

- Thread starter Nostra

- Start date

Hopefully the middle class is doing better then and they start having more kids.And what happens when they retire? Will we need even more immigrants?

And if we need more immigrants, sure.

But I suspect the immigrants we take in now will have a lot of kids.

So basically for social security to work, we need an ever expanding population. How many people should we have in America? A billion? 3 billion? And then what?Hopefully the middle class is doing better then and they start having more kids.

And if we need more immigrants, sure.

But I suspect the immigrants we take in now will have a lot of kids.

And what happens when they retire? Will we need even more immigrants?

I think we had/have way too many baby boomers and not enough workers.

Millennials were the largest generation group in the U.S. in 2021, with an estimated population of 72.19 million. Born between 1981 and 1996, Millennials recently surpassed Baby Boomers as the biggest group, and they will continue to be a major part of the population for many years.

So I think we have enough Millennials.

Gen Z is small

Members of Gen Z age 18 or older only make up 10.3% of the total U.S. population, compared to the largest generation, millennials, who make up nearly 22%. Even once all of Gen Z are grown, they'll still be a smaller generation than millennials.

I'm generation x

Generation X is the smallest of the three groups, representing roughly 16 percent of the workforce population. These people were born between 1965 and 1980. The smallness of this group magnifies the Baby Boomers' impact as they march toward retirement.

So basically for social security to work, we need an ever expanding population. How many people should we have in America? A billion? 3 billion? And then what?

Or at least a steady workforce. If the employee puts in and the employer puts in there should be plenty of money.

And doesn't our money make interest?

And what about all the people who die at 61 before they ever collect a dime?

And what about all the people who die at 61 before they ever collect a dime?

That's part of how you save money by raising the retirement age (again). More people will die before getting any benefit and those that get benefits have fewer years of drawing the benefits (based on Full Retirement Age).

WW

Last edited:

I'm 52. I will freak out if they tell me I have to work one month longer than I have to now.That's part of how you save money by raising the retirement age (again). More people will die before getting any benefit and those that get benefits have fewer years of drawing the benefits (based on Full Retirement Age).

WW

Or if they cut my benefits 20%.

Cut future generations. Raise the retirement age for people who are under 52. Just don't fuck with my shit.

Do you know who I sound like? Baby Boomers. LOL

Nostra

Diamond Member

- Oct 7, 2019

- 62,562

- 53,696

- 3,615

- Thread starter

- Banned

- #28

Let’s see some links.Wow, that’s rich coming from a Republican. Do you know that your party has been trying to cut Social Security and Medicare for decades? Do you know that Trump himself proposed slashing these programs in his budget plans? Do you know that he is now attacking his own GOP rivals on Truth Social for supposedly wanting to do the same thing? Talk about hypocrisy and inconsistency. Maybe you should do some research before making such baseless claims about Democrats.

Oh, and here is one for you, Simp…

pyetro

Diamond Member

- Jul 21, 2019

- 5,538

- 5,751

- 1,940

how many democrats in that particular year (so long ago Joe Biden looks young, lol) wanted to freeze social security spending? And when you tell me the year, I will tell you what Republicans wanted to do to social security the same year.

Nostra

Diamond Member

- Oct 7, 2019

- 62,562

- 53,696

- 3,615

- Thread starter

- Banned

- #31

I have no idea how many of your fellow travelers were on board with your Vegetable Messiah’s attempt to gut SS, Medicaid, and Veteran’s benefits.how many democrats in that particular year (so long ago Joe Biden looks young, lol) wanted to freeze social security spending? And when you tell me the year, I will tell you what Republicans wanted to do to social security the same year.

Why don’t you look it up, Simp.

pyetro

Diamond Member

- Jul 21, 2019

- 5,538

- 5,751

- 1,940

Wait. Are you saying that you were just guessing when you said "Democrats"..."attacked" social security?I have no idea how many of your fellow travelers were on board with your Vegetable Messiah’s attempt to gut SS, Medicaid, and Veteran’s benefits.

Why don’t you look it up, Simp.

Are you hiding the names of Democrats who disagreed with Biden that year?

Are you so embarrassed of the old video that you won't even say what year it was because it was so long ago and Republicans have been attacking SS for decades?

Yes. You're saying that.

Nostra

Diamond Member

- Oct 7, 2019

- 62,562

- 53,696

- 3,615

- Thread starter

- Banned

- #33

Quote me saying “Democrats attacked SS”, Simp.Wait. Are you saying that you were just guessing when you said "Democrats"..."attacked" social security?

Are you hiding the names of Democrats who disagreed with Biden that year?

Are you so embarrassed of the old video that you won't even say what year it was because it was so long ago and Republicans have been attacking SS for decades?

Yes. You're saying that.

Grow a brain, then learn to read.

And after that new brain of yours kicks in, go read the OP, Dumbass.

What happens when you get to 100% tax on the “rich”?Bottom line is this. You Republicans say the fund is running out of money. We all agree both sides have borrowed from the fund. So, I believe Democrats will find a way to keep funding seniors. Republicans when the fund runs out of money in 2035 will say it means we have to cut everyone's payments 20% in order to "save" the program.

You Republicans certainly won't raise taxes on the rich and corporations to fund social security and medicare. Biden will.

DudleySmith

Diamond Member

- Dec 21, 2020

- 20,455

- 14,546

- 2,288

Bush wanted to 'privatize' SS, which is just a scheme to allow Wall Street to embezze it and lose it all in the next big crash they generate. All it needs is for wages to be adjusted for real inflation, taxes on off-shoring to make up for the wages and salaries lost to that scam, and robot productivity taxed as if they were employed humans. Then they could lower the rates back down to 3% or less. They can also pay back all the money the govt. used SS revenues for, assorted corporate welfare scams, the interstate highways Eisenhower used them for, off-budget military spending, foreign aid, etc., etc. And, stop dumping the revenues into the General Fund.

It's Time for a 74% Top Tax Bracket to Save America From Our Billionaire ProblemWhat happens when you get to 100% tax on the “rich”?

100%? That's too much.

It's Time for a 74% Top Tax Bracket to Save America From Our Billionaire Problem

(Thom plus logo) The secret billionaires don't want you to know is that your pay won't change whether taxes go up or downIt's time to bring back the top 74% tax bracket that Ronald Reagan blew up, so average working people's wages can rise again and we can get our billionaire problem under control.

So, what you’re saying is you want them to move their money offshore….It's Time for a 74% Top Tax Bracket to Save America From Our Billionaire Problem

100%? That's too much.

It's Time for a 74% Top Tax Bracket to Save America From Our Billionaire Problem

(Thom plus logo) The secret billionaires don't want you to know is that your pay won't change whether taxes go up or downIt's time to bring back the top 74% tax bracket that Ronald Reagan blew up, so average working people's wages can rise again and we can get our billionaire problem under control.www.thomhartmann.com

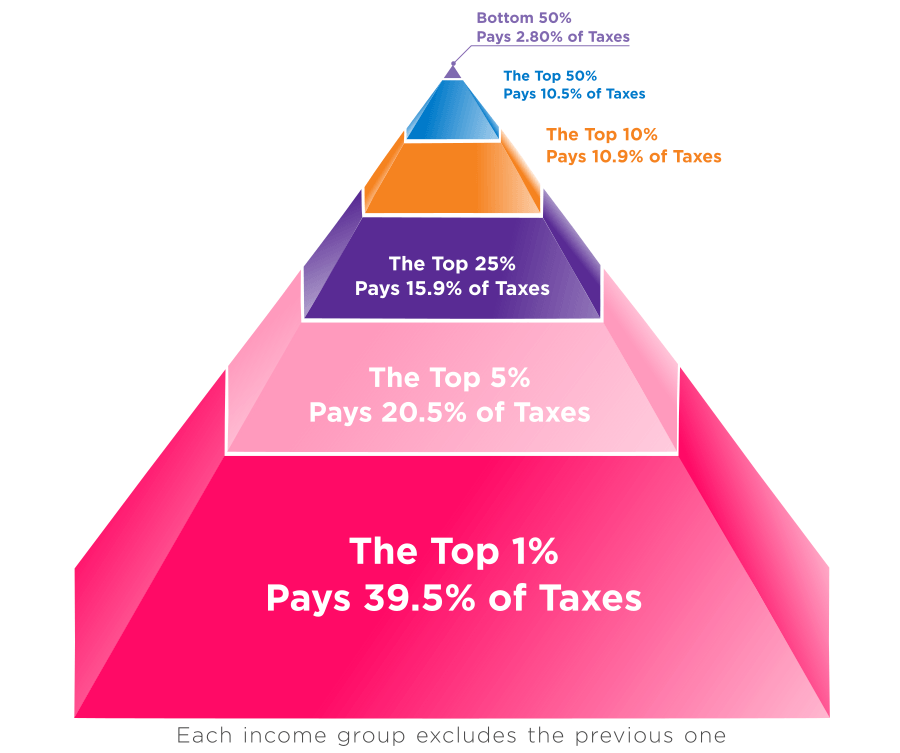

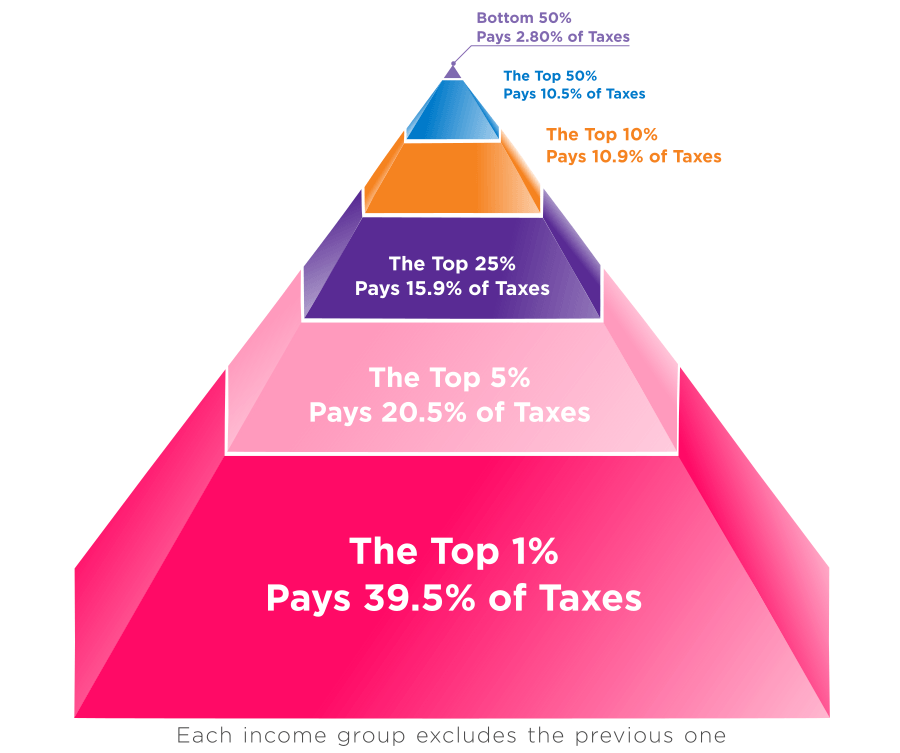

”Thank God for the 1%. That much-maligned minority, the richest percent of Americans, pay 39.5% of all Federal Income Tax. That is one of the most eye-catching figures in a study released by the Tax Foundation earlier this month. To put that percentage in absolute figures: the richest percent of American taxpayers pay in $542.64 billion of a total take of Federal Income Tax of $1.37 trillion.”

Thank God for the 1%

Believe It or Not - the Richest Americans DO Pay Most of the Federal Income Tax

howmuch.net

“More than a decade ago, President George W. Bush set out to fix what he called a broken Social Security system. In 2001, intermediate projections had shown the retirement trust fund would be exhausted in 2040. By 2005, finances had improved and the projected exhaustion date was 2043. But today, exhaustion looms closer, only two decades away in 2035.Bush wanted to 'privatize' SS, which is just a scheme to allow Wall Street to embezze it and lose it all in the next big crash they generate. All it needs is for wages to be adjusted for real inflation, taxes on off-shoring to make up for the wages and salaries lost to that scam, and robot productivity taxed as if they were employed humans. Then they could lower the rates back down to 3% or less. They can also pay back all the money the govt. used SS revenues for, assorted corporate welfare scams, the interstate highways Eisenhower used them for, off-budget military spending, foreign aid, etc., etc. And, stop dumping the revenues into the General Fund.

Bush wanted to modernize Social Security and ensure its fiscal integrity, but without raising taxes cutting benefits for current or near-retirees, or investing Social Security funds directly in the stock market. To achieve this goal, Bush convened a bipartisan Commission to Strengthen Social Security.

The commission recommended three different reform plans, each of which established a system of voluntary personal accounts. "Personal accounts improve retirement security by facilitating wealth creation and providing participants with assets that they own and that can be inherited, rather than providing only claims to benefits that remain subject to political negotiation," the commission's final report said. "By allowing investment choice, individuals would be free to pursue higher expected rates of return on their Social Security contributions."

None of the reform plans went anywhere in Congress.

What if George W. Bush’s Social Security reforms had passed? - Washington Examiner

More than a decade ago, President George W. Bush set out to fix what he called a broken Social Security system. In 2001, intermediate projections had shown the retirement trust fund would be exhausted in 2040. By 2005, finances had improved and the projected exhaustion date was 2043. But today...

And you lick their boots house slave.So, what you’re saying is you want them to move their money offshore….

”Thank God for the 1%. That much-maligned minority, the richest percent of Americans, pay 39.5% of all Federal Income Tax. That is one of the most eye-catching figures in a study released by the Tax Foundation earlier this month. To put that percentage in absolute figures: the richest percent of American taxpayers pay in $542.64 billion of a total take of Federal Income Tax of $1.37 trillion.”

Thank God for the 1%

Believe It or Not - the Richest Americans DO Pay Most of the Federal Income Taxhowmuch.net

Hey, give me all the money and I'll gladly pay most of the taxes.

Or give us all some of that money and that poor 1%er won't have to pay so much in taxes. Problem solved.

DudleySmith

Diamond Member

- Dec 21, 2020

- 20,455

- 14,546

- 2,288

”Thank God for the 1%. That much-maligned minority, the richest percent of Americans, pay 39.5% of all Federal Income Tax.

It's a great deal for them, since they have over 80% of all income.

Similar threads

- Replies

- 128

- Views

- 1K

- Replies

- 407

- Views

- 5K

- Replies

- 77

- Views

- 1K

Latest Discussions

- Replies

- 8

- Views

- 16

- Replies

- 232

- Views

- 1K

- Replies

- 33

- Views

- 198

- Replies

- 5K

- Views

- 66K

Forum List

-

-

-

-

-

Political Satire 8059

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-