Dr.House

Lives on in syndication!

Give me gridlock!

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Somehow there is a group of people who think Wall Street makes something. They trade paper which represents REAL labor and production. Wall Street is much like the government in my mind. They produce nothing, but take a cut, which does not help the economy.

Wall Street and the government are doing well right now, yet unemployment grew last month. Deregulation of REAL businesses and investment in REAL businesses will move the economy forward.

The reactionary voting back and forth is what is going to destroy us.

Give me gridlock!

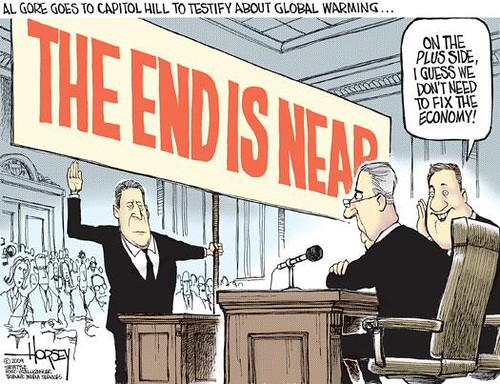

Faith based politics just plain sucks big time.

Either these Doomers have been lying, science has it wrong or God has been providing us all the oil we need for the past 100 years!!! So tell us again how faith based politics just plain sucks big time.

Either these Doomers have been lying, science has it wrong or God has been providing us all the oil we need for the past 100 years!!! So tell us again how faith based politics just plain sucks big time.

Love how people can only scream "less taxes" or "more regulations". Check the Federal Register, there were 64,438 in 2001 when Bush took office and in 2007, there were 78,090, there were more regulations that at anytime in the history of our Republic when Bush was President.

There is more to economics than fiscal or regulatory, too many ignore monetary policy and how it affects the economy.

Love how people can only scream "less taxes" or "more regulations". Check the Federal Register, there were 64,438 in 2001 when Bush took office and in 2007, there were 78,090, there were more regulations that at anytime in the history of our Republic when Bush was President.

There is more to economics than fiscal or regulatory, too many ignore monetary policy and how it affects the economy.

It's the keyboard warriors.... they think very simplistic thoughts. Hence the conviction that it was all the 'fault' of the other guy. It's sad but many are incapable of facing reality - they prefer to stick to 'blame'.

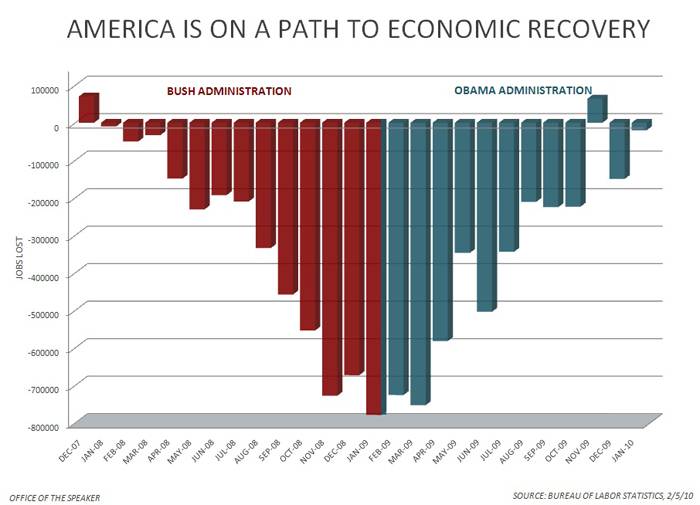

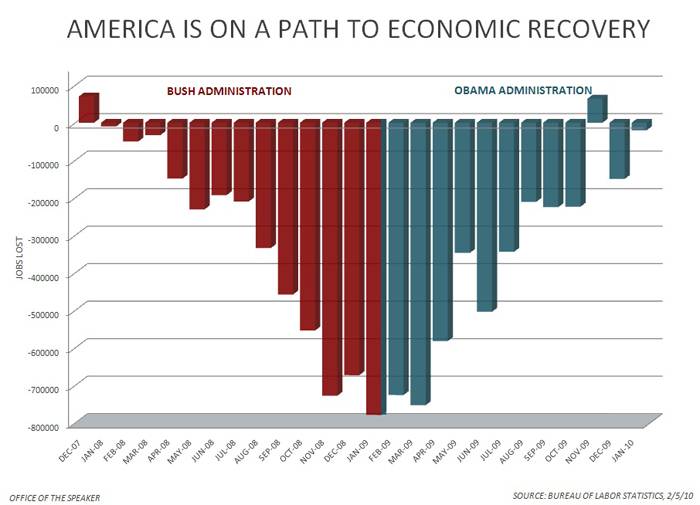

The economy started to tank the day Democrats took control of Congress

and began to recover as soon as Obama took office.

Thanks, Frank!

what are you? a cockroach?

what are you? a cockroach?And here we go again.

"The democrats wrecked it"

"No, the republicans did it"

"No we didn't"

"Yea you did"

Both parties ..... and you fucking partisans.... you are all responsible.

Let's get back to the original premise which is that tired old "1% got a big break". Sounds like somebody's attempting to make the argument that 1% of the population is footing the bill.

It's worn out Marxist class envy bullshit. We have a tax system that is out of whack with 40+% paying no income taxes combined with politicians (pick a side, I don't care) spending money we don't have. The notion that we are going to tax our way out of this is retarded.

And here we go again.

"The democrats wrecked it"

"No, the republicans did it"

"No we didn't"

"Yea you did"

Both parties ..... and you fucking partisans.... you are all responsible.

yet the

continues while it all crumbles(due to government intervention).

And here we go again.

"The democrats wrecked it"

"No, the republicans did it"

"No we didn't"

"Yea you did"

Both parties ..... and you fucking partisans.... you are all responsible.

I'm not fucking responsible. I lived within my means. paid my way, what I couldn't afford I did without. The responsiblity lies with those individuals and that government that did not do that. So speak for thyself.

The notion that we are going to tax our way out of this is retarded.

And here we go again.

"The democrats wrecked it"

"No, the republicans did it"

"No we didn't"

"Yea you did"

Both parties ..... and you fucking partisans.... you are all responsible.

yet the

continues while it all crumbles(due to government intervention).

Some intervention is necessary. The GOP likes to paint regulation as the bad guy in all this, but some is necessary. The derivatives market was almost completely unregulated and helped set off this whole mess. Loosening regulations allowed Banks to play crazy games with investor's money. Fancy accounting tricks that should have been illegal allowed firms to outright lie and swindle investors left and right.

Folks want some level of regulation so that they can feel like they can safely invest without getting taken for a ride. I'm fine with losing money because I choose poorly as long as I had honest facts ahead of time. Its when I've been lied to that I'm going to take my money and leave the market.

You won't get people investing money until they're sure they're not getting ripped off. And until that happens, there just won't be a recovery.

I do agree that too much regulation is stifiling. The problem is finding balance. We seem to repeatedly go in cycles on this.

yet the

continues while it all crumbles(due to government intervention).

Some intervention is necessary. The GOP likes to paint regulation as the bad guy in all this, but some is necessary. The derivatives market was almost completely unregulated and helped set off this whole mess. Loosening regulations allowed Banks to play crazy games with investor's money. Fancy accounting tricks that should have been illegal allowed firms to outright lie and swindle investors left and right.

Folks want some level of regulation so that they can feel like they can safely invest without getting taken for a ride. I'm fine with losing money because I choose poorly as long as I had honest facts ahead of time. Its when I've been lied to that I'm going to take my money and leave the market.

You won't get people investing money until they're sure they're not getting ripped off. And until that happens, there just won't be a recovery.

I do agree that too much regulation is stifiling. The problem is finding balance. We seem to repeatedly go in cycles on this.

I look at derivatives as part of the symptoms; not the cause; of the entire economic crash, had the bubbles not happened, there never would have been such a huge derivatives market to begin with, derivatives aren't a bad thing in and by themselves, they are like any type "insurance" where one can protect or hedge their bets or risks, had the monetary part of the equation not been so lax to begin with, this market, the housing market,stock market, etc., never would have inflated into these massive bubbles to begin with.

And here we go again.

"The democrats wrecked it"

"No, the republicans did it"

"No we didn't"

"Yea you did"

Both parties ..... and you fucking partisans.... you are all responsible.

I'm not fucking responsible. I lived within my means. paid my way, what I couldn't afford I did without. The responsiblity lies with those individuals and that government that did not do that. So speak for thyself.

And folks like you and I that stayed in our means, saved money responsibly, didn't carry debt, etc, are the ones that will pay for it all. Sucks doesn't it?

That's why regulations exist and should exist. So folks like you and I don't end up paying for the mistakes and lies of others.

The economy started to tank the day Democrats took control of Congress

Love how people can only scream "less taxes" or "more regulations". Check the Federal Register, there were 64,438 in 2001 when Bush took office and in 2007, there were 78,090, there were more regulations that at anytime in the history of our Republic when Bush was President.

There is more to economics than fiscal or regulatory, too many ignore monetary policy and how it affects the economy.