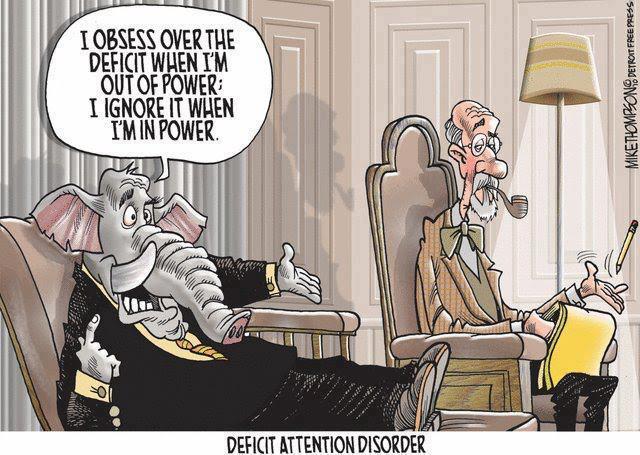

Someone has to pay the bills - and the national debt.

So why did Nancy Pelosi pay her property tax bills early to avoid paying more under the $10k cap for 2018?

Apples and onions. What's your point?

I'm thinking somebody who is so concerned about the debt and who trashed the president's tax plan would pay her fair share and not take advantages of loopholes she is always accusing other people of.

So, you're suggesting it's unpatriotic when someone takes advantage of such legal loopholes? BTW, she paid her "fair share" according to the law.