Good luck finding one...Duh.......lets see which party is trying to elect budget balancers...classs ....anyoneThat is the House of Representatives job also...get back to us when Obama starts paying down all he has run up

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Donald Trump Would Push Debt To Highest Level In U.S. History, Report Says

- Thread starter Lakhota

- Start date

Manonthestreet

Diamond Member

- May 20, 2014

- 34,726

- 22,999

- 1,945

That would be us.......repubs have tossed out more tax and spenders............dont see any dems even trying to peddle "fiscal conservative" lie since Obamas first termGood luck finding one...Duh.......lets see which party is trying to elect budget balancers...classs ....anyoneThat is the House of Representatives job also...get back to us when Obama starts paying down all he has run up

DarkFury

Platinum Member

- Banned

- #23

Except the OP is not yours. Its cut and paste.I repeat from the OP:

“The difference between [Clinton and Trump] is indeed stark,” Henry Aaron, a widely respected Brookings economist who did not work on the committee’s analysis, told The Huffington Post Sunday. “One candidate shows determination to, at least, keep debt under control. The other is utterly indifferent to it.”

Rexx Taylor

Platinum Member

- Banned

- #24

only good thing about the Obama recession, I just may be able to buy a very nice home in Sarasota for 50,000 cash !!!....{I am gonna put my place here in Naples on the market soon,,,,,i am so sick of living here !!!!}At this point in time, we are passed the point already.....One major recession will doom us all because of no reserves...Hillary says Trump will bankrupt the USA? didnt Bambi already do that?The game they are playing with low interest rates on bonds, allows our government to think that borrowing is a low cost advantage..yet they need to be paying down the debt..Once controls are lifted, inflation will follow...

We have Roy Blunt....Oh boy, and even worse McCaskill...That would be us.......repubs have tossed out more tax and spenders............dont see any dems even trying to peddle "fiscal conservative" lie since Obamas first termGood luck finding one...Duh.......lets see which party is trying to elect budget balancers...classs ....anyoneThat is the House of Representatives job also...get back to us when Obama starts paying down all he has run up

Shit man, you could get a fixer upper in Joplin, Mo for 5-10 grand...till the tornado wiped out half the city....Bentonville, Ark, to get a lot close to the downtown area is around 500k, The recession didn't seem to hurt Wal Mart land....only good thing about the Obama recession, I just may be able to buy a very nice home in Sarasota for 50,000 cash !!!....{I am gonna put my place here in Naples on the market soon,,,,,i am so sick of living here !!!!}At this point in time, we are passed the point already.....One major recession will doom us all because of no reserves...Hillary says Trump will bankrupt the USA? didnt Bambi already do that?The game they are playing with low interest rates on bonds, allows our government to think that borrowing is a low cost advantage..yet they need to be paying down the debt..Once controls are lifted, inflation will follow...

"Committee for a responsible federal budget"? Where the hell have they been for the last 7 1/2 years?

Little-Acorn

Gold Member

Donald Trump Would Push Debt To Highest Level In U.S. History, Report Says

Oh my, that's shocking! Horrifying! I never would have guessed! Thank Gawd we have these media outlets to point out these unexpected things!

Except... wait a minute. Isn't the Debt at higher levels than it has ever been, right now? And doesn't it go to an even higher level, every day?

In fact, isn't it true that ANY president will push the Debt to an even "Highest Level in U.S. History", the minute he takes the oath on Jan. 20, 2017?

Unless he instantly puts legislation in place to totally balance the budget - something that hasn't been done since the 1950s.

And keep in mind that the President can't balance ANY budget by himself. He must have the cooperation of Congress to pass a balanced budget for him to sign, or else he can do nothing.

How likely is it that Congress will pass a perfectly balanced budget just before noon on Jan. 20, 2017, ready for the President's signature as soon as he takes his hand off the Bible?

The OP is simply a senseless smear presented in the hopes that people won't stop and think for a minute. Fortunately, only Democrats fall into that category.

Oh my, that's shocking! Horrifying! I never would have guessed! Thank Gawd we have these media outlets to point out these unexpected things!

Except... wait a minute. Isn't the Debt at higher levels than it has ever been, right now? And doesn't it go to an even higher level, every day?

In fact, isn't it true that ANY president will push the Debt to an even "Highest Level in U.S. History", the minute he takes the oath on Jan. 20, 2017?

Unless he instantly puts legislation in place to totally balance the budget - something that hasn't been done since the 1950s.

And keep in mind that the President can't balance ANY budget by himself. He must have the cooperation of Congress to pass a balanced budget for him to sign, or else he can do nothing.

How likely is it that Congress will pass a perfectly balanced budget just before noon on Jan. 20, 2017, ready for the President's signature as soon as he takes his hand off the Bible?

The OP is simply a senseless smear presented in the hopes that people won't stop and think for a minute. Fortunately, only Democrats fall into that category.

"Committee for a responsible federal budget"? Where the hell have they been for the last 7 1/2 years?

Little-Acorn

Gold Member

The usual falsehoods from the usual leftist liar.

Clinton did not "hand Bush a $127.3 billion surplus".

Clinton never balanced a single budget during his eight years (nor did any other president in living memory). He produced only deficits, for ever one of them. Each one of them added to the National Debt - it never stayed constant or went down, for any fiscal year.

ScienceRocks

Democrat all the way!

- Banned

- #31

Me, Clinton and Obama are all more fiscally conservative then Reagan or Trump. That is a fact. Blowing money on iraq was a really stupid thing to do and we need to stop giving out so many tax breaks.

- Moderator

- #32

Amusing to hear Obama voters suddenly concerned about the debt

The country’s annual deficit is the difference between what the government collects in revenues and spends in one year. The national debt, which exceeds $18 trillion, is the net of annual deficits minus any annual surpluses.The usual falsehoods from the usual leftist liar.

Clinton did not "hand Bush a $127.3 billion surplus".

Clinton never balanced a single budget during his eight years (nor did any other president in living memory). He produced only deficits, for ever one of them. Each one of them added to the National Debt - it never stayed constant or went down, for any fiscal year.

- Thread starter

- #34

Except the OP is not yours. Its cut and paste.I repeat from the OP:

“The difference between [Clinton and Trump] is indeed stark,” Henry Aaron, a widely respected Brookings economist who did not work on the committee’s analysis, told The Huffington Post Sunday. “One candidate shows determination to, at least, keep debt under control. The other is utterly indifferent to it.”

Did I claim it was? Actually, it's "copy" and paste. They get pissed when it's just ripped off their websites.

It did not seem to budge the new GOP led House either....Amusing to hear Obama voters suddenly concerned about the debt

Little-Acorn

Gold Member

The usual falsehoods from the usual leftist liar.

Clinton did not "hand Bush a $127.3 billion surplus".

Clinton never balanced a single budget during his eight years (nor did any other president in living memory). He produced only deficits, for ever one of them. Each one of them added to the National Debt - it never stayed constant or went down, for any fiscal year.

Very good! You're actually learning something! I guess even a blind squirrel finds an occasional walnut.The country’s annual deficit is the difference between what the government collects in revenues and spends in one year. The national debt, which exceeds $18 trillion, is the net of annual deficits minus any annual surpluses.

Back to the subject:

When the government spends exactly the same amount that it took in during the fiscal year, the budget is "balanced", and the National Debt remains at the same lever as it was the previous year.

When the govt spends less than it took in, this is also called "balanced". In this case, the National Debt is LOWER at the end of the fiscal year, than it was at the beginning.

But when they spend more than they take in, the budget is not balanced, and the National Debt is higher at the end of the year than at the beginning.

The last time the budget was balanced, was in the 1950s.

Clinton never produced a surplus. Ever.

Debt to the Penny (Daily History Search Application)

Best way to get the left to vote for ya is push up the debt.Trump is really pushing for the left to vote form then.

These hypocritical lefties are all of the sudden concerned about fiscal responsibility. Hilarious

Making America great again — by running up huge IOUs.

Donald Trump’s policy agenda would quickly push the national debt to its highest level in history, according to a new report.

The analysis, which the nonpartisan Committee for a Responsible Federal Budgetpublished Sunday evening, represents one of the first serious efforts to assess how electing Trump or his chief rival for the presidency, former Secretary of State Hillary Clinton, might affect federal finances over time.

Rather than focusing on individual policy initiatives — like Trump’s call to abolish theestate tax, or Clinton’s pledge to help working parents pay for child care — this new analysis takes into account all of the candidates’ proposals to date, in order to assess how they would alter the federal budget and, ultimately, the amount of debt that the public holds.

It was not an easy task for the committee’s researchers, because Trump, the presumptive Republican nominee, barely talks about policy. When he does, he’s frequently vague or inconsistent. But the few proposals that Trump has actually described publicly made it possible to construct a rough analysis and compare his agenda with the more detailed proposals from Clinton, the presumptive Democratic nominee.

The resulting contrast was stark. As the report demonstrates, the election doesn’t simply present Americans with a choice between a politician who disparages entire ethnic and religious groups and a politician who preaches the virtues of diversity. It also offers a choice between a candidate who’d create vast new deficits for the sake of some highly questionable tax cuts — and one proposing a more modest agenda of expanded government programs, with added revenue that would cover nearly all of their cost.

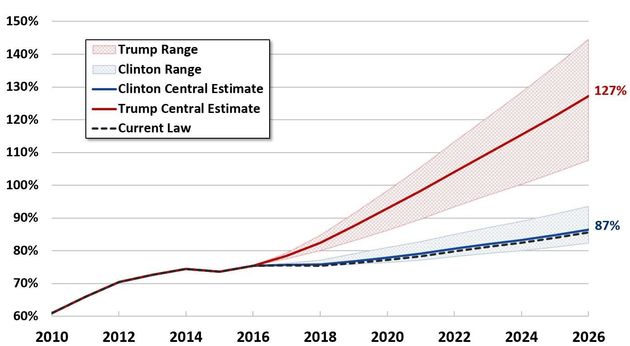

COMMITTEE FOR A RESPONSIBLE FEDERAL BUDGET

Debt as a percentage of GDP, for the two major presidential candidates and under current law.

The centerpiece of Trump’s agenda is a series of proposed tax cuts, including new breaks for businesses and reductions in individual rates, that past studies have shown would disproportionately benefit wealthy Americans. The committee’s researchers, working from estimates by the (also nonpartisan) Urban-Brookings Tax Policy Center, determined that, taken together, the tax cuts would add something like $9.25 trillion in new debt over the next 10 years. (For these and other projections, committee researchers produced three separate estimates to generate a range of possibilities and then used the one in the middle for their main analysis.)

Other items on Trump’s agenda, including his promises to overhaul veteran services and repeal the Affordable Care Act, would add a few hundred billion dollars to that total. With no significant new revenues or spending cuts to offset these costs, and with the higher interest payments that so much new borrowing would require, the cumulative impact of Trump’s agenda would probably be around $11.5 trillion in additional federal debt over 10 years, the committee’s researchers found.

The number itself doesn’t mean a whole lot. The U.S. has carried significant debt going all the way back to the 1790s — when, at the urging of Alexander Hamilton, the fledgling federal government assumed liabilities that the states had incurred during the American Revolution and its aftermath.

What matters, instead, is the size of the debt relative to the rest of the economy, measured as Gross Domestic Product. That figure indicates how many resources society must divert from current priorities, like education or defense or retirement programs, in order to pay for past borrowing.

And it’s debt-to-GDP ratio where the impact of Trump’s agenda may be most arresting. According to the committee’s researchers, Trump’s agenda, if enacted, would push the ratio of federal debt to GDP from its current level of 75 percent all the way up to 127 percent.

The previous peak was around 110 percent, and that was during the 1940s — when the necessities of fighting a world war called for unusually large borrowing. Trump has yet to explain why his agenda would justify so much additional debt.

Of course, Clinton would also add liabilities to the federal ledger. Specifically, she has proposed an array of new programs, including tax credits to offset out-of-pocket medical costs and new federal assistance with college tuition, that would significantly expand the size and scope of the federal government. All told, according to the committee’s analysis, Clinton’s agenda would have the federal government laying out an additional $1.4 trillion in new spending over the next decade.

But the amount of federal money Clinton would commit to these new programs is just a fraction of the amount of federal money that Trump would dump into his tax cuts. Many of Clinton’s proposals, including the ones that focus on early childhood, hold out the promise of much greater economic returns in the future. Last but not least, Clinton has actually called for raising taxes on the wealthy — and has identified enough specific increases to raise $1.25 trillion in revenue and offset most of her new spending initiatives.

As a result, the committee’s analysis finds, Clinton’s agenda would place the ratio of debt-to-GDP at around 87 percent by 2026. This is more or less where that ratio is headed anyway: If current policy stays exactly the same, the debt-to-GDP ratio would reach about 86 percent by 2026, projections suggest.

The committee’s report was careful to point out that at 87 percent, the debt-to-GDP ratio after 10 years would still be higher than its present level of 75 percent. That’s a big problem, the committee says, given that an aging population is likely to push the cost of government services, particularly health care programs, much higher in the future.

Current projections suggest that if the government’s fiscal trajectory does not change, debt-to-GDP ratio could exceed 130 percent by 2040 — a level that would also be well above the previous historic peak.

“To date,” the report says, “neither former Secretary of State Hillary Clinton nor businessman Donald Trump has put forward a plan to address the national debt.”

But fiscal projections beyond the immediate future are notoriously unreliable, and mainstream economists disagree over precisely what constitutes an ideal debt-to-GDP ratio, or whether an ideal ratio even exists. A lot depends on how much of the debt is financing current needs, rather than investments that will (hopefully) yield a more productive economy in the future.

Meanwhile, the report makes clear which of the two major candidates would require vast new borrowing and which one wouldn’t. “Mr. Trump’s proposals would massively increase the debt,” the report says.

On that, there isn’t much debate among mainstream experts.

“The difference between [Clinton and Trump] is indeed stark,” Henry Aaron, a widely respected Brookings economist who did not work on the committee’s analysis, told The Huffington Post Sunday. “One candidate shows determination to, at least, keep debt under control. The other is utterly indifferent to it.”

Donald Trump Would Push Debt To Highest Level In U.S. History, Report Says

Trump even brags about being the king of debt. Just imagine what he would do to the U.S. economy and world standing. How could any foreign country ever trust us - on anything.

Trump: 'I'm the king of debt' - POLITICO

Seems their chart is full of shit, the debt is already more than 100% of GDP. What does that say about you dumb link?

- Thread starter

- #39

Making America great again — by running up huge IOUs.

Donald Trump’s policy agenda would quickly push the national debt to its highest level in history, according to a new report.

The analysis, which the nonpartisan Committee for a Responsible Federal Budgetpublished Sunday evening, represents one of the first serious efforts to assess how electing Trump or his chief rival for the presidency, former Secretary of State Hillary Clinton, might affect federal finances over time.

Rather than focusing on individual policy initiatives — like Trump’s call to abolish theestate tax, or Clinton’s pledge to help working parents pay for child care — this new analysis takes into account all of the candidates’ proposals to date, in order to assess how they would alter the federal budget and, ultimately, the amount of debt that the public holds.

It was not an easy task for the committee’s researchers, because Trump, the presumptive Republican nominee, barely talks about policy. When he does, he’s frequently vague or inconsistent. But the few proposals that Trump has actually described publicly made it possible to construct a rough analysis and compare his agenda with the more detailed proposals from Clinton, the presumptive Democratic nominee.

The resulting contrast was stark. As the report demonstrates, the election doesn’t simply present Americans with a choice between a politician who disparages entire ethnic and religious groups and a politician who preaches the virtues of diversity. It also offers a choice between a candidate who’d create vast new deficits for the sake of some highly questionable tax cuts — and one proposing a more modest agenda of expanded government programs, with added revenue that would cover nearly all of their cost.

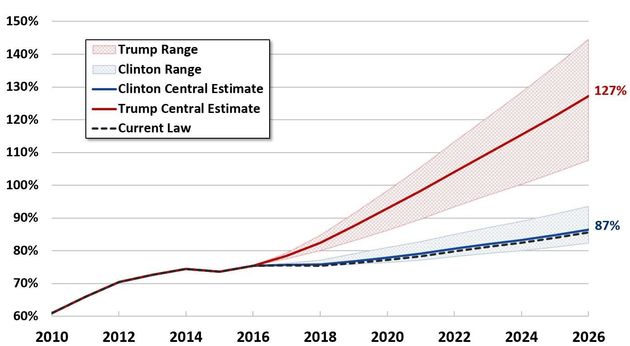

COMMITTEE FOR A RESPONSIBLE FEDERAL BUDGET

Debt as a percentage of GDP, for the two major presidential candidates and under current law.

The centerpiece of Trump’s agenda is a series of proposed tax cuts, including new breaks for businesses and reductions in individual rates, that past studies have shown would disproportionately benefit wealthy Americans. The committee’s researchers, working from estimates by the (also nonpartisan) Urban-Brookings Tax Policy Center, determined that, taken together, the tax cuts would add something like $9.25 trillion in new debt over the next 10 years. (For these and other projections, committee researchers produced three separate estimates to generate a range of possibilities and then used the one in the middle for their main analysis.)

Other items on Trump’s agenda, including his promises to overhaul veteran services and repeal the Affordable Care Act, would add a few hundred billion dollars to that total. With no significant new revenues or spending cuts to offset these costs, and with the higher interest payments that so much new borrowing would require, the cumulative impact of Trump’s agenda would probably be around $11.5 trillion in additional federal debt over 10 years, the committee’s researchers found.

The number itself doesn’t mean a whole lot. The U.S. has carried significant debt going all the way back to the 1790s — when, at the urging of Alexander Hamilton, the fledgling federal government assumed liabilities that the states had incurred during the American Revolution and its aftermath.

What matters, instead, is the size of the debt relative to the rest of the economy, measured as Gross Domestic Product. That figure indicates how many resources society must divert from current priorities, like education or defense or retirement programs, in order to pay for past borrowing.

And it’s debt-to-GDP ratio where the impact of Trump’s agenda may be most arresting. According to the committee’s researchers, Trump’s agenda, if enacted, would push the ratio of federal debt to GDP from its current level of 75 percent all the way up to 127 percent.

The previous peak was around 110 percent, and that was during the 1940s — when the necessities of fighting a world war called for unusually large borrowing. Trump has yet to explain why his agenda would justify so much additional debt.

Of course, Clinton would also add liabilities to the federal ledger. Specifically, she has proposed an array of new programs, including tax credits to offset out-of-pocket medical costs and new federal assistance with college tuition, that would significantly expand the size and scope of the federal government. All told, according to the committee’s analysis, Clinton’s agenda would have the federal government laying out an additional $1.4 trillion in new spending over the next decade.

But the amount of federal money Clinton would commit to these new programs is just a fraction of the amount of federal money that Trump would dump into his tax cuts. Many of Clinton’s proposals, including the ones that focus on early childhood, hold out the promise of much greater economic returns in the future. Last but not least, Clinton has actually called for raising taxes on the wealthy — and has identified enough specific increases to raise $1.25 trillion in revenue and offset most of her new spending initiatives.

As a result, the committee’s analysis finds, Clinton’s agenda would place the ratio of debt-to-GDP at around 87 percent by 2026. This is more or less where that ratio is headed anyway: If current policy stays exactly the same, the debt-to-GDP ratio would reach about 86 percent by 2026, projections suggest.

The committee’s report was careful to point out that at 87 percent, the debt-to-GDP ratio after 10 years would still be higher than its present level of 75 percent. That’s a big problem, the committee says, given that an aging population is likely to push the cost of government services, particularly health care programs, much higher in the future.

Current projections suggest that if the government’s fiscal trajectory does not change, debt-to-GDP ratio could exceed 130 percent by 2040 — a level that would also be well above the previous historic peak.

“To date,” the report says, “neither former Secretary of State Hillary Clinton nor businessman Donald Trump has put forward a plan to address the national debt.”

But fiscal projections beyond the immediate future are notoriously unreliable, and mainstream economists disagree over precisely what constitutes an ideal debt-to-GDP ratio, or whether an ideal ratio even exists. A lot depends on how much of the debt is financing current needs, rather than investments that will (hopefully) yield a more productive economy in the future.

Meanwhile, the report makes clear which of the two major candidates would require vast new borrowing and which one wouldn’t. “Mr. Trump’s proposals would massively increase the debt,” the report says.

On that, there isn’t much debate among mainstream experts.

“The difference between [Clinton and Trump] is indeed stark,” Henry Aaron, a widely respected Brookings economist who did not work on the committee’s analysis, told The Huffington Post Sunday. “One candidate shows determination to, at least, keep debt under control. The other is utterly indifferent to it.”

Donald Trump Would Push Debt To Highest Level In U.S. History, Report Says

Trump even brags about being the king of debt. Just imagine what he would do to the U.S. economy and world standing. How could any foreign country ever trust us - on anything.

Trump: 'I'm the king of debt' - POLITICO

Seems their chart is full of shit, the debt is already more than 100% of GDP. What does that say about you dumb link?

Really? Are you sure of that...?

Making America great again — by running up huge IOUs.

Donald Trump’s policy agenda would quickly push the national debt to its highest level in history, according to a new report.

The analysis, which the nonpartisan Committee for a Responsible Federal Budgetpublished Sunday evening, represents one of the first serious efforts to assess how electing Trump or his chief rival for the presidency, former Secretary of State Hillary Clinton, might affect federal finances over time.

Rather than focusing on individual policy initiatives — like Trump’s call to abolish theestate tax, or Clinton’s pledge to help working parents pay for child care — this new analysis takes into account all of the candidates’ proposals to date, in order to assess how they would alter the federal budget and, ultimately, the amount of debt that the public holds.

It was not an easy task for the committee’s researchers, because Trump, the presumptive Republican nominee, barely talks about policy. When he does, he’s frequently vague or inconsistent. But the few proposals that Trump has actually described publicly made it possible to construct a rough analysis and compare his agenda with the more detailed proposals from Clinton, the presumptive Democratic nominee.

The resulting contrast was stark. As the report demonstrates, the election doesn’t simply present Americans with a choice between a politician who disparages entire ethnic and religious groups and a politician who preaches the virtues of diversity. It also offers a choice between a candidate who’d create vast new deficits for the sake of some highly questionable tax cuts — and one proposing a more modest agenda of expanded government programs, with added revenue that would cover nearly all of their cost.

COMMITTEE FOR A RESPONSIBLE FEDERAL BUDGET

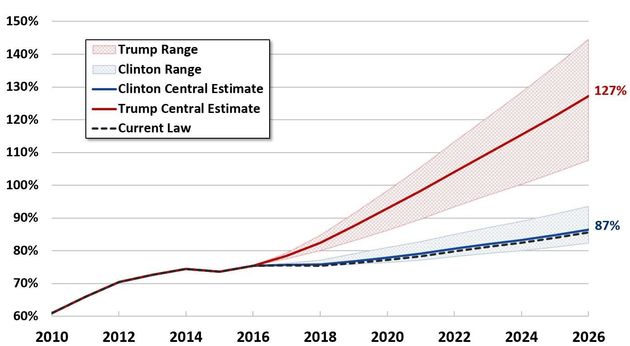

Debt as a percentage of GDP, for the two major presidential candidates and under current law.

The centerpiece of Trump’s agenda is a series of proposed tax cuts, including new breaks for businesses and reductions in individual rates, that past studies have shown would disproportionately benefit wealthy Americans. The committee’s researchers, working from estimates by the (also nonpartisan) Urban-Brookings Tax Policy Center, determined that, taken together, the tax cuts would add something like $9.25 trillion in new debt over the next 10 years. (For these and other projections, committee researchers produced three separate estimates to generate a range of possibilities and then used the one in the middle for their main analysis.)

Other items on Trump’s agenda, including his promises to overhaul veteran services and repeal the Affordable Care Act, would add a few hundred billion dollars to that total. With no significant new revenues or spending cuts to offset these costs, and with the higher interest payments that so much new borrowing would require, the cumulative impact of Trump’s agenda would probably be around $11.5 trillion in additional federal debt over 10 years, the committee’s researchers found.

The number itself doesn’t mean a whole lot. The U.S. has carried significant debt going all the way back to the 1790s — when, at the urging of Alexander Hamilton, the fledgling federal government assumed liabilities that the states had incurred during the American Revolution and its aftermath.

What matters, instead, is the size of the debt relative to the rest of the economy, measured as Gross Domestic Product. That figure indicates how many resources society must divert from current priorities, like education or defense or retirement programs, in order to pay for past borrowing.

And it’s debt-to-GDP ratio where the impact of Trump’s agenda may be most arresting. According to the committee’s researchers, Trump’s agenda, if enacted, would push the ratio of federal debt to GDP from its current level of 75 percent all the way up to 127 percent.

The previous peak was around 110 percent, and that was during the 1940s — when the necessities of fighting a world war called for unusually large borrowing. Trump has yet to explain why his agenda would justify so much additional debt.

Of course, Clinton would also add liabilities to the federal ledger. Specifically, she has proposed an array of new programs, including tax credits to offset out-of-pocket medical costs and new federal assistance with college tuition, that would significantly expand the size and scope of the federal government. All told, according to the committee’s analysis, Clinton’s agenda would have the federal government laying out an additional $1.4 trillion in new spending over the next decade.

But the amount of federal money Clinton would commit to these new programs is just a fraction of the amount of federal money that Trump would dump into his tax cuts. Many of Clinton’s proposals, including the ones that focus on early childhood, hold out the promise of much greater economic returns in the future. Last but not least, Clinton has actually called for raising taxes on the wealthy — and has identified enough specific increases to raise $1.25 trillion in revenue and offset most of her new spending initiatives.

As a result, the committee’s analysis finds, Clinton’s agenda would place the ratio of debt-to-GDP at around 87 percent by 2026. This is more or less where that ratio is headed anyway: If current policy stays exactly the same, the debt-to-GDP ratio would reach about 86 percent by 2026, projections suggest.

The committee’s report was careful to point out that at 87 percent, the debt-to-GDP ratio after 10 years would still be higher than its present level of 75 percent. That’s a big problem, the committee says, given that an aging population is likely to push the cost of government services, particularly health care programs, much higher in the future.

Current projections suggest that if the government’s fiscal trajectory does not change, debt-to-GDP ratio could exceed 130 percent by 2040 — a level that would also be well above the previous historic peak.

“To date,” the report says, “neither former Secretary of State Hillary Clinton nor businessman Donald Trump has put forward a plan to address the national debt.”

But fiscal projections beyond the immediate future are notoriously unreliable, and mainstream economists disagree over precisely what constitutes an ideal debt-to-GDP ratio, or whether an ideal ratio even exists. A lot depends on how much of the debt is financing current needs, rather than investments that will (hopefully) yield a more productive economy in the future.

Meanwhile, the report makes clear which of the two major candidates would require vast new borrowing and which one wouldn’t. “Mr. Trump’s proposals would massively increase the debt,” the report says.

On that, there isn’t much debate among mainstream experts.

“The difference between [Clinton and Trump] is indeed stark,” Henry Aaron, a widely respected Brookings economist who did not work on the committee’s analysis, told The Huffington Post Sunday. “One candidate shows determination to, at least, keep debt under control. The other is utterly indifferent to it.”

Donald Trump Would Push Debt To Highest Level In U.S. History, Report Says

Trump even brags about being the king of debt. Just imagine what he would do to the U.S. economy and world standing. How could any foreign country ever trust us - on anything.

Trump: 'I'm the king of debt' - POLITICO

Seems their chart is full of shit, the debt is already more than 100% of GDP. What does that say about you dumb link?

Really? Are you sure of that...?

Yep!

Current GDP 18.230 trillion

Current Debt 19.390 trillion and counting fast

GDP | Gross Domestic Product | Gross National Product US

U.S. National Debt Clock : Real Time

BTW I used the highest GDP I could find.

Similar threads

- Replies

- 5

- Views

- 201

- Replies

- 49

- Views

- 519

- Replies

- 0

- Views

- 65

Latest Discussions

- Replies

- 27

- Views

- 432

- Replies

- 0

- Views

- 1

- Replies

- 58

- Views

- 286

Forum List

-

-

-

-

-

Political Satire 8071

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 471

-

-

-

-

-

-

-

-

-

-