- Thread starter

- #81

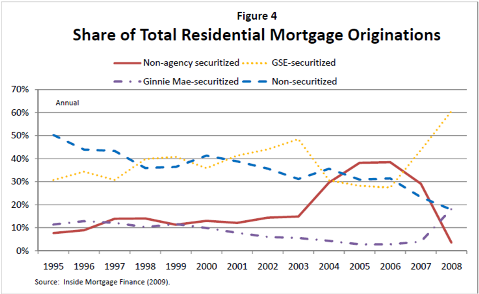

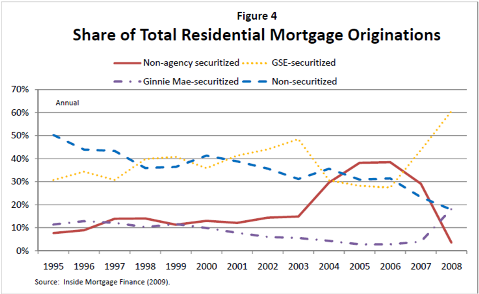

The biggest contributor to the Financial Crisis outside of the Fed was Wall Street, who securitized enormous amounts of crappy loans and packaged them to investors as "AAA" investments. As you can see here, Wall Street, i.e. "non-agency securitized" mortgages, dramatically gained market share at the expense of the GSEs, whose market share fell.

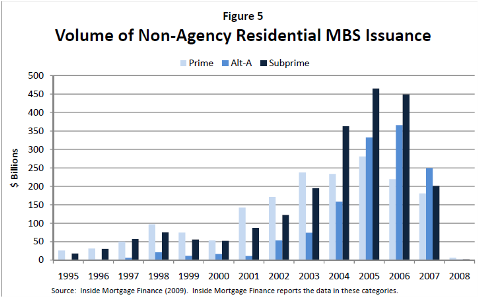

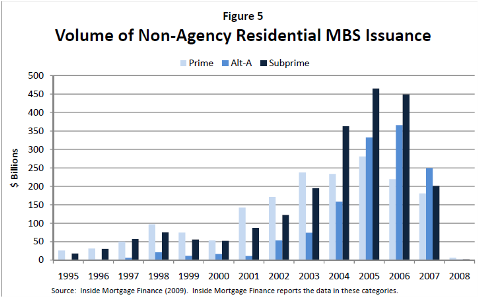

The volume of non-agency securitized loans went up by ~10x during the decade.

Economist's View: "Bankers Have Been Sold Short"

If, in fact, Fannie and Freddie were the primary causes of this mess, then their market share would not have fallen as dramatically as it did.

The volume of non-agency securitized loans went up by ~10x during the decade.

Economist's View: "Bankers Have Been Sold Short"

If, in fact, Fannie and Freddie were the primary causes of this mess, then their market share would not have fallen as dramatically as it did.

The San Francisco Fed was all it took for me to call it bullshit.

The San Francisco Fed was all it took for me to call it bullshit.