it could well be argued both examples were their demise Liability.....~S~

England is not dead.

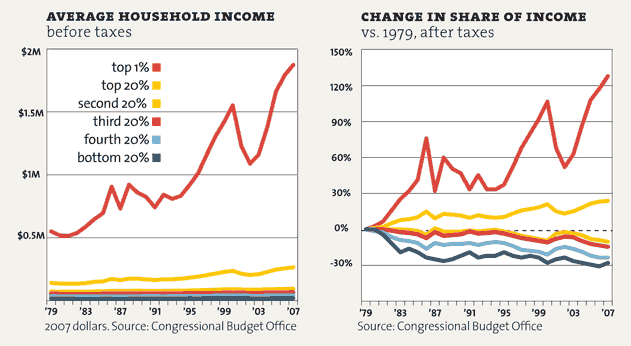

And Rome had TONS of problems. Was income disparity one of them? Yeah. Maybe. But that's not evidence that it was a significant problem or a contributing one to the collapse of that Empire.

England is presently a socialist quagmire

the pendelum swung a tad to far imho....

There are lots of factors that could be argued for/against any given country's upswing or downturn

disparity , imho, only helped the few, on the backs of the many

~S~

The relevant term in your foregoing "argument" is the phrase "imho."