JohnDB

Platinum Member

- Jun 16, 2021

- 7,594

- 4,523

- 938

It does when you are insider trading...as Nancy has been doing since last year.That has nothing to do with the point you were trying to make.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

It does when you are insider trading...as Nancy has been doing since last year.That has nothing to do with the point you were trying to make.

JohnDB, that means nothing other than you recognize stocks go up and down. I am glad you know that. It is far more likely that Johnson and Scalise have been insider trading.The "all time high" is coming from everyone "hunkering down" in the large cap 7. The other stocks are trending down as the Russell 2k shows.

My investments are at an all time high and I didn't do any insider trading.It does when you are insider trading...as Nancy has been doing since last year.

The person I quoted has an entire website devoted to obvious insider trading done by Congress, Government officials and others....JohnDB, that means nothing other than you recognize stocks go up and down. I am glad you know that. It is far more likely that Johnson and Scalise have been insider trading.

Look at the Russell 2,000....it is a much better indicator of the health and direction of the economy than the Dow or S&P....and the S&P is currently being dominated by the "Big 7"....the rest of the S&P is down or flat.My investments are at an all time high and I didn't do any insider trading.

The market is at an all time high.

You might have a better point if her investments were at an all time high when the market was down.

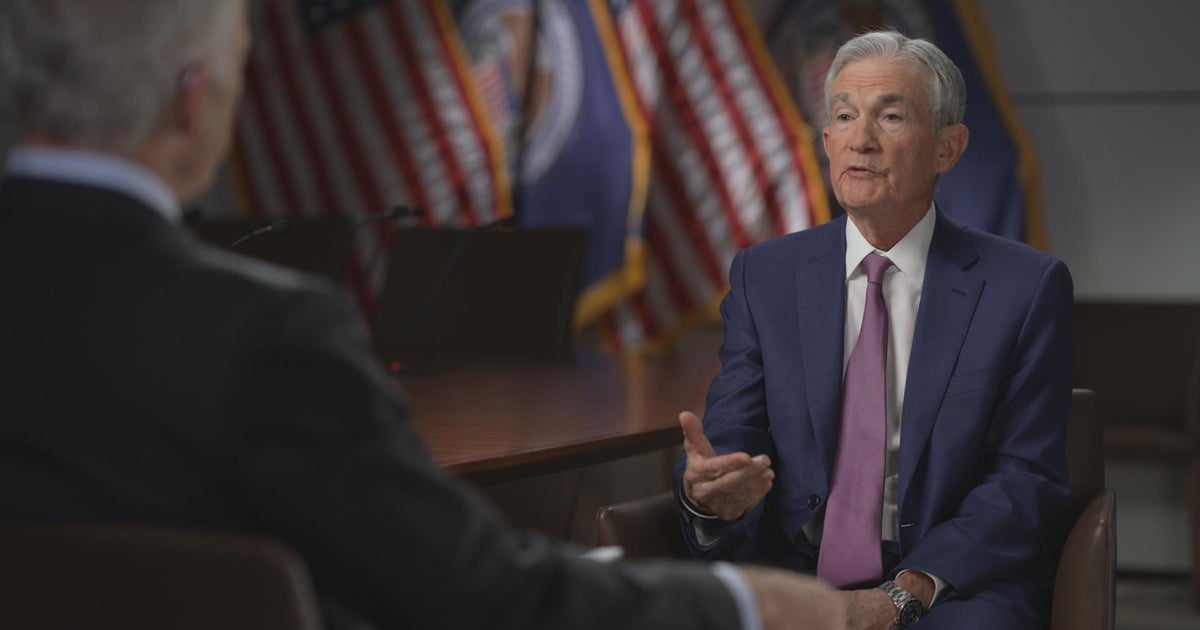

Transcript for those without videoLast night's CBS 60-Minutes program offered an interview with Chairman Powell of the Federal Reserve. It was a recent interview....done on Friday, February 2nd.

It is informative, understandable, credible. Powell is measured and careful.....but very insightful.

My avatar offers it here to add context to the frequent complaints voiced on this venue that the American economy is in free-fall, is terrible, is the worst in decades, yadda, yadda, yadda.

Powell offers to all Americans a brief synopsis of what the Federal Reserves thinks it sees in our current economy.

From my own perspective and current experience.......Powell's observations seemed to ring true.

It's just a short segment of their hour long show.....but it is meaty.

60 Minutes Chairman Powell; A Hole in the System; The Mismatch - Yahoo Video Search Results

The search engine that helps you find exactly what you're looking for. Find the most relevant information, video, images, and answers from all across the Web.video.search.yahoo.com

JP Morgan is predicting 2% growth and no recession.Look at the Russell 2,000....it is a much better indicator of the health and direction of the economy than the Dow or S&P....and the S&P is currently being dominated by the "Big 7"....the rest of the S&P is down or flat.

EVERY brokerage house out there is predicting a recession....from Principle to JP Morgan....none are not predicting a looming recession. EVERY indicator and prediction model is clearly showing we are in recession territory. From purchasing managers index, P/E ratios of the S&P, normalized employment data, inverted Yeild curves, and etc....all showing recession.

I'm not expecting my gains to remain.

When the Federal Reserve begins cutting rates because the tanking economy becomes more important than the inflationary pressures they caused...that's when the market itself will tank.

The Stock market itself is not a very accurate reflection of the economy. It is related but supply and demand as well as expectations have more of an effect than the economy on the Bipolar Traders ever did.

I have an entire website dedicated to something I know about and have fun with in memorabilia.The person I quoted has an entire website devoted to obvious insider trading done by Congress, Government officials and others....

Where people like Martha Stewart go to Jail for such things they tend to try and make others that make obvious short squeeze opportunities uncomfortable (GameStop) ....they themselves break the law with impunity.

The SEC, IRS, FBI,and Federal Reserve have been morally bankrupt for decades....only aggressively pursuing those who can't defend themselves or going after those they oppose politically.

It needs to stop. We either believe in the rule of law or we don't. The law either applies to everyone or to no one.

The "all time high" is coming from everyone "hunkering down" in the large cap 7. The other stocks are trending down as the Russell 2k shows.

Then you would sell. So it kind of sounds like maybe you're a bit full of itI'm not expecting my gains to remain.

Don't listen to me....I can't predict the future....by all means I do not give advice on the stock market.Then you would sell. So it kind of sounds like maybe you're a bit full of it

Just saying that some of the most active insider traders in congress are signaling something bad is coming.Then why ....