Wry Catcher

Diamond Member

- Thread starter

- Banned

- #21

Fuel taxes have nothing to do with the price of oil you idiot.

They are per gallon taxes and not based on the price.

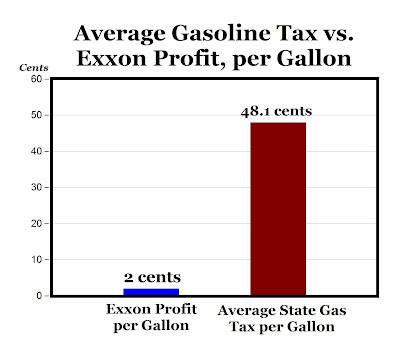

Gasoline Taxes Vs. Exxon Profit, Per Gallon

You'll see that Exxon makes less per gallon of gas sold than the fucking goverment takes in taxes.

I'm not an idiot, I was misinformed (that is ignorant). Idiots are those who continue to hold beliefs even when evidence is provided proving them wrong. And willful idiots won't read anything which challenges their assumptions.

[Is Exxon, in your example, the only 'person' to profit from a gallon of gasoline?]

Gasoline taxes remain at 18.4 cents per gallon, unchanged since 1993. Which I learned from the following link - which may inform others about Obama's Energy Policy and that of his Energy Sect.

FactCheck.org : Obama Wanted Higher Gasoline Prices?

Had to pos rep you for that.

I wrote about the difference between the ignorant and the stupid and you quoted it almost verbatim.

Good grief. I'm speechless.