mskafka

Silver Member

America is in decline because our government for decades has refused to make the responsible choices they need to make. Of course, they've dodged this responsibility because the American people themselves have refused to adapt to a changing world. Our energy policies, labor policies, education system, environmental policies, regulatory environment, welfare policies, and tax policies have all contributed to this.

1. An interesting historical anomaly is the period 1945 through 1965, a golden age in many ways. This was the period after the war, when any of our potential competitors were rebuilding from the devastation, making it impossible for the United States economy not to thrive. Beneficiaries included the unions and blue collar high school graduates who were assured of high paying jobs. That is no longer true, and probably wont be again, short of a third World War.

H.W. Brands ,American Colossus: The Triumph of American Capitalism, 1865-1900.

2. That being said, standard of living is a function of two factors: amount of education one has, and the amount of work one is willing to do.

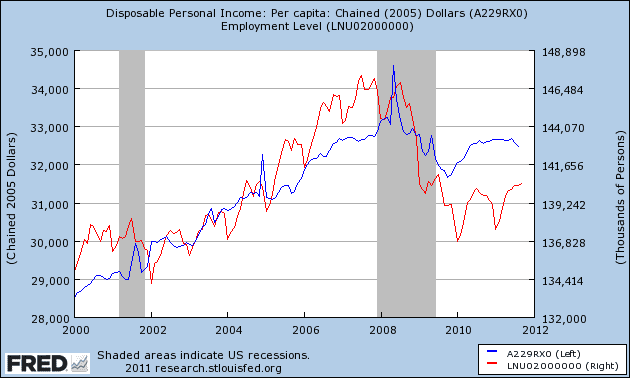

Do you know the the unemployment rate for college educated?

"However, if one examines the August BLS jobs report closely, one finds something interesting -- the unemployment rate for college graduates (that is, those holding at least a Bachelors degree) is only 4.3 percent. Moreover, this figure has slowly declined from 5.0 percent in August 2010.

Or, to put it another way, more than 95 percent of college graduates in the Unites States are working in the aftermath of one of the worst recessions in living memory."

Institute for Economic Competitiveness | Despite Unemployment Worries, 95% of U.S. College Grads Have Jobs

For September, 2011, it is down to 4.2.

So, in the words of that great intellectual, Flavor Flav, 'Don't Believe the Hype."

I'm pretty sure that you have the data for the unemployed college educated from somewhere. I'm curious. What is it? And does it take into account what the individuals majored in?