320 Years of History

Gold Member

This is all spending:

This is discretionary spending for the same period:

What's the biggest difference? Discretionary spending is funded by income taxes, tolls, excise taxes/tariffs, fees, and just about anything else except self-employment insurance tax, Social Security tax and Medicare tax. As you can see a small portion of Social Security, unemployment and Medicare are funded by income and other taxes.

Roughly the "pie sections" in the charts above align with the several executive branch departments of government.

There is also a spending category to which is rarely discussed: the legislative appropriation. That's the money Congress decides it needs for itself. Last I checked it was something between $4B and $5B per year, or about half the cost to run the Department of Commerce and about three times the sums Congress makes available to Commerce to help small business owners open or grow their businesses (page 16 here).

Because the graphic depicts all government spending not government spending by revenue source. A high level depiction of government spending such as the one provided in this post logically groups together very closely related types of spending.

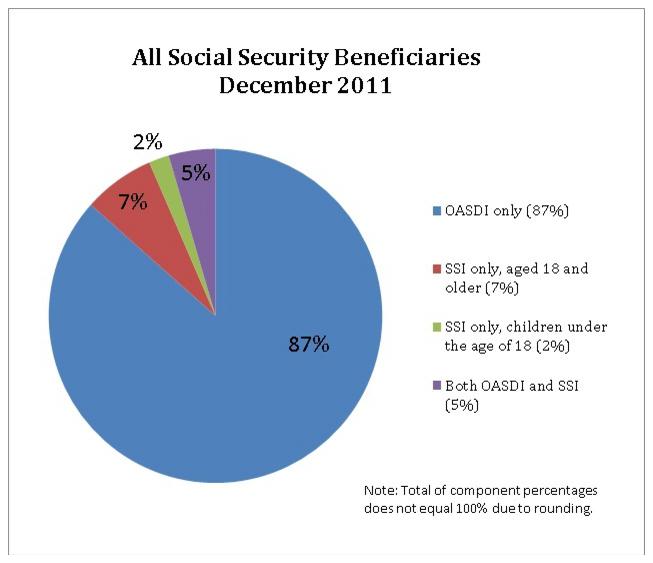

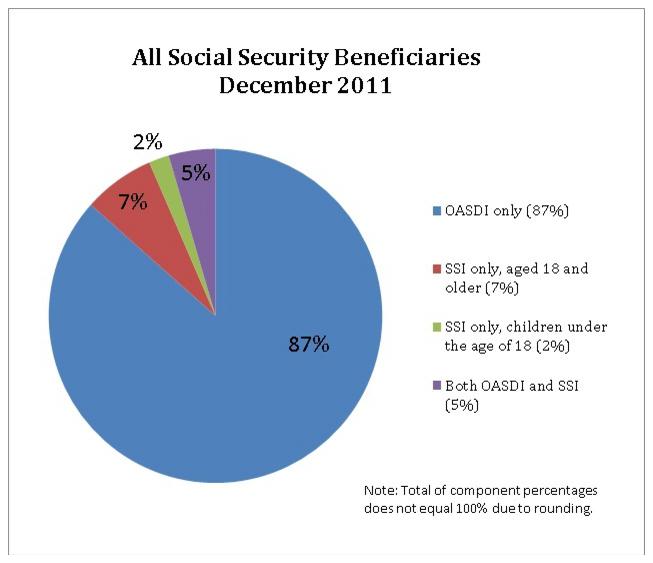

For example, Social Security, Unemployment and Labor is all spending that is directly attributable to individuals' labor. be it paying workers now for labor performed in the past (Social Security) (yes, Social Security is paid to some people who didn't or don't work, but mostly Social Security benefits are paid to people who did work -- see chart below), paying them now for labor they are unable to perform now (unemployment), or spending on programs to enable citizens to perform one or several forms of labor (Dept of Labor). Medicare and health are grouped because that is spending related to providing for citizens' health.

FWIW, the spending of Social Security, Medicare, and Medicaid is spending that overwhelmingly uses funds other than income taxes.

Because military spending means DOD spending not Dept. of Veterans Affairs spending. What's the difference? Veterans Affairs deals overwhelmingly with citizens who are no longer serving as military personnel and who are not eligible/subject in general (under anything but the most extreme of circumstances -- like the country is in "to the last man" situation or some other such "Independence Day" scenario that we see in movies and therefore willingly suspend disbelief about the likelihood of such a thing actually occurring) to serve as active military personnel in an branch of the DoD.

This is discretionary spending for the same period:

What's the biggest difference? Discretionary spending is funded by income taxes, tolls, excise taxes/tariffs, fees, and just about anything else except self-employment insurance tax, Social Security tax and Medicare tax. As you can see a small portion of Social Security, unemployment and Medicare are funded by income and other taxes.

Roughly the "pie sections" in the charts above align with the several executive branch departments of government.

- United States Department of Agriculture

- United States Department of Commerce

- United States Department of Defense

- United States Department of Education

- United States Department of Energy

- United States Department of Health and Human Services

- United States Department of Homeland Security

- United States Department of Housing and Urban Development

- United States Department of the Interior

- United States Department of Justice

- United States Department of Labor

- United States Department of State

- United States Department of Transportation

- United States Department of the Treasury

- United States Department of Veterans Affair

There is also a spending category to which is rarely discussed: the legislative appropriation. That's the money Congress decides it needs for itself. Last I checked it was something between $4B and $5B per year, or about half the cost to run the Department of Commerce and about three times the sums Congress makes available to Commerce to help small business owners open or grow their businesses (page 16 here).

Why does it combine ss , unemployment , and "labor" , into one expense ?

Because the graphic depicts all government spending not government spending by revenue source. A high level depiction of government spending such as the one provided in this post logically groups together very closely related types of spending.

For example, Social Security, Unemployment and Labor is all spending that is directly attributable to individuals' labor. be it paying workers now for labor performed in the past (Social Security) (yes, Social Security is paid to some people who didn't or don't work, but mostly Social Security benefits are paid to people who did work -- see chart below), paying them now for labor they are unable to perform now (unemployment), or spending on programs to enable citizens to perform one or several forms of labor (Dept of Labor). Medicare and health are grouped because that is spending related to providing for citizens' health.

FWIW, the spending of Social Security, Medicare, and Medicaid is spending that overwhelmingly uses funds other than income taxes.

Why are military and vet budgets separate ?

Because military spending means DOD spending not Dept. of Veterans Affairs spending. What's the difference? Veterans Affairs deals overwhelmingly with citizens who are no longer serving as military personnel and who are not eligible/subject in general (under anything but the most extreme of circumstances -- like the country is in "to the last man" situation or some other such "Independence Day" scenario that we see in movies and therefore willingly suspend disbelief about the likelihood of such a thing actually occurring) to serve as active military personnel in an branch of the DoD.