Seems like what's really happening is that most Americans measure price trends with tools like the PCE deflator, the CPI-U, etc., and then regulate the dollar's value at a couple percent above last year's prices.

Tell me why you're saying this is suicidal.

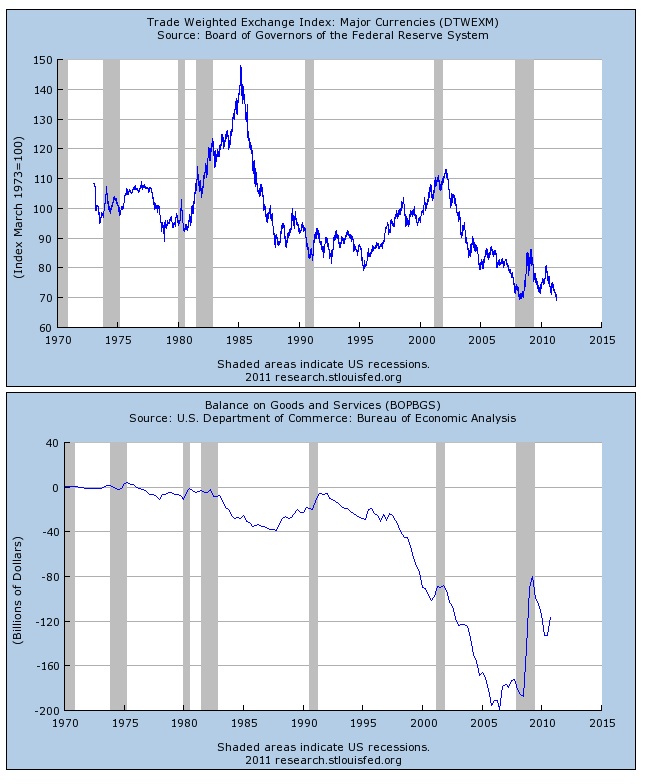

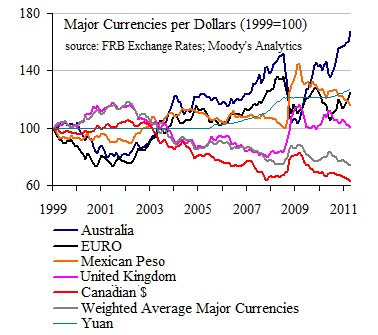

Simple....As the Dollar free falls vs major currencies,

OK, if we're talking politics and what everyone says then we're agreed that the buzz is that dollars are worthless. In real life we keep our dollars locked up safe becuase we know they're worth well, money. When we personally go to exchange our dollars for foreign money we know it's stable:

Real life/politics. I've never been comfortalble with double think.

--you mean, the People's Republic is selling $10k T-bills for fifty cents each first come first serve while they last? In real life I'd buy all I could as would a world of bond traders. I'd make a fortune and China would loose trillions.

Additionally, a call could be made to suspend the Dollar as the basis currency for oil and other futures. Does this not trigger a red flag for you?

China loosing trillions would hurt the Yaun not the dollar.

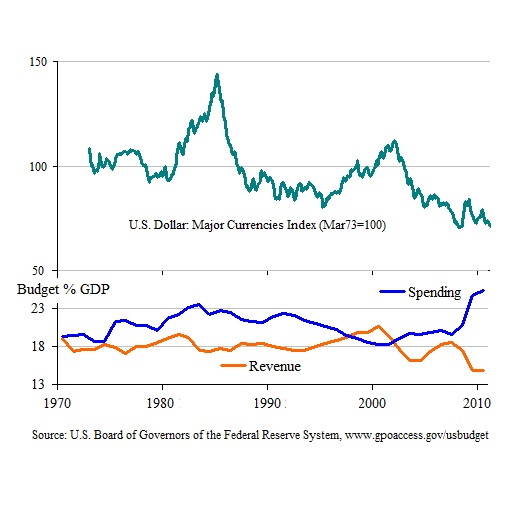

How much longer and how much more are you willing to see the US go into debt and how much larger can you stand to see deficit spending go on?

The national debt's important, and treasury notes are traded in dollars, not foreign money.

You had lots of other good stuff there but like I said we're talking in different worlds, political banter vs. real life.