Arlette

Diamond Member

- Jul 6, 2023

- 15,623

- 10,552

- 2,138

So when Biden took office inflation was annualized 1.9 percent in January,2021..

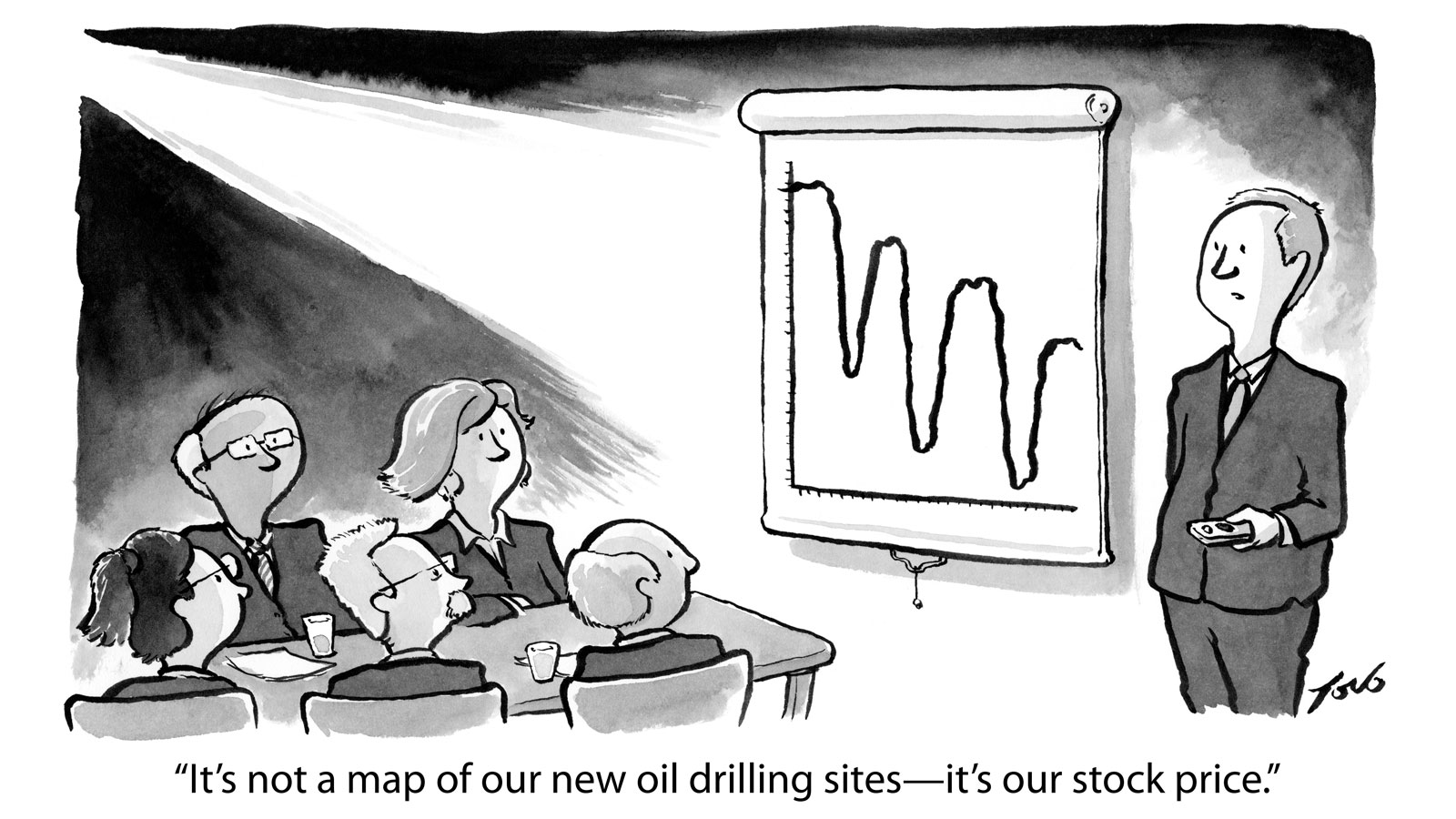

Within a year because Biden said this in 2019 and oil companies took him seriously...

Behind the Numbers: PCE Inflation Update, January 2021

The headline, or all-items, PCE price index rose an annualized 4.2 percent in January after rising an annualized 4.5 percent in December.www.dallasfed.org

I guarantee We Are Going To Get Rid of Fossil Fuels” September 06, 2019, 5:49 PM

Banks and investment firms took him seriously and this was the result..

Financial support for fossil fuel projects has waned for both environmental and financial reasons. The return on investment of carbon-intensive fuels is no longer the guarantee it once was.

Investors flee Big Oil as portfolios get drilled » Yale Climate Connections

Even as Earth's climate has warmed, years of lackluster profits have cooled the investment climate for oil and gas producers.yaleclimateconnections.org

Consequently this is what you and all Americans felt just 1 year later...

In 2022, the average rate of inflation was 8.0%.

In 2021, the average rate of inflation was 4.7%.

In 2020, the average rate of inflation was 1.2%.

AND you were paying a national average for a gallon of gas in 2022... because gasoline companies:max_bytes(150000):strip_icc()/GettyImages-2003724854-2aff2851bdba49d3aa4d53a8323cadf8.jpg)

Historical U.S. Inflation Rate by Year: 1929 to 2025

By looking at the inflation rate each year, you can gain insight into how prices changed and how events around the globe impacted the average U.S. consumer.www.investopedia.com

1) had trouble getting investments... thus their costs go up..

2) With your food/services and your transportation cost going up to :

View attachment 1033433

U.S. weekly average gas and diesel prices 2025 | Statista

In late-March 2025, average gas prices in the U.S. rose to 3.17 U.S. dollars per gallon, with diesel prices increasing to 3.6 USD.www.statista.com

Remember all that diesel fuel is most likely used to deliver food, etc. to supermarkets, etc. AND YOU PAY FOR IT!

I'm not gonna put up with a wannabe dictator over a few bucks. I'm not that hard up.