- Aug 8, 2016

- 26,073

- 25,129

- 2,445

Rather concise explanation; kept country simple...

Futures oil contract trading is generally done by two different groups, speculators and commercial hedgers.

Speculators are essentially taking a position on where oil will be at a future time. If they think it will go higher, they will buy an oil contract(s) to profit from what they expect, a higher price. If they believe oil will be lower, they will sell (short) oil contract(s) to profit from the decline they expect.

Commercial hedgers are a different breed. They are hedging positions they have as part of their business. For example, an oil producer knows that he is going to produce X barrels of oil in a given future month. He likes the current price of that future month's contract and so sells some oil contracts to hedge his production, essentially locking in the money he will receive for that oil.

Continued...

www.economicpolicyjournal.com

www.economicpolicyjournal.com

Futures oil contract trading is generally done by two different groups, speculators and commercial hedgers.

Speculators are essentially taking a position on where oil will be at a future time. If they think it will go higher, they will buy an oil contract(s) to profit from what they expect, a higher price. If they believe oil will be lower, they will sell (short) oil contract(s) to profit from the decline they expect.

Commercial hedgers are a different breed. They are hedging positions they have as part of their business. For example, an oil producer knows that he is going to produce X barrels of oil in a given future month. He likes the current price of that future month's contract and so sells some oil contracts to hedge his production, essentially locking in the money he will receive for that oil.

Continued...

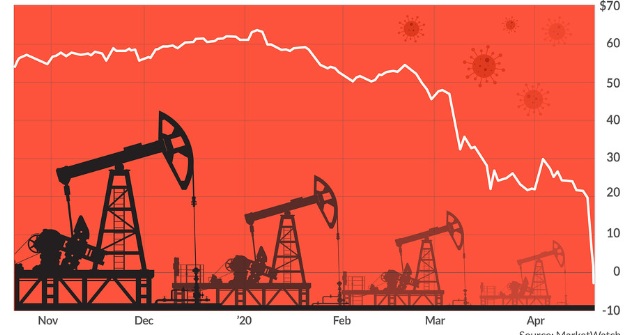

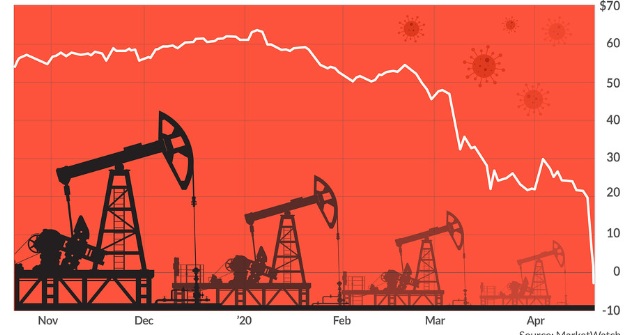

This is Why the May Oil Contract Price Went Negative on Monday

Robert Wenzel

Last edited: