healthmyths

Diamond Member

- Sep 19, 2011

- 30,006

- 11,477

- 1,400

...the EVIL filthy wealthy?

First of all here is what the poor get from the wealthy tax dollars..

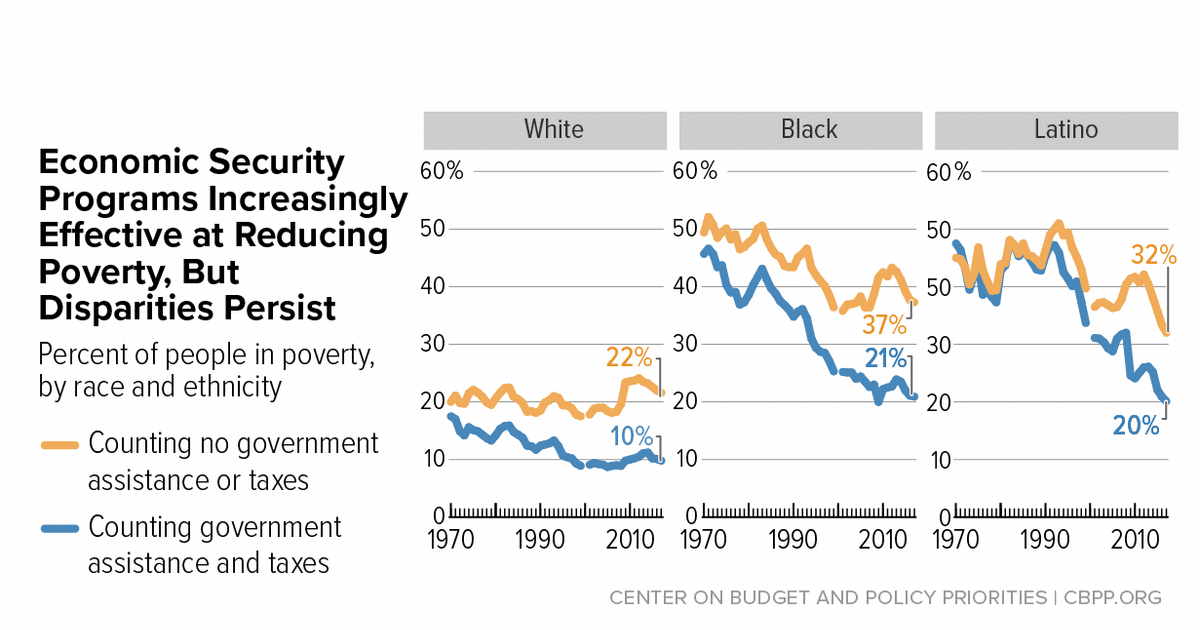

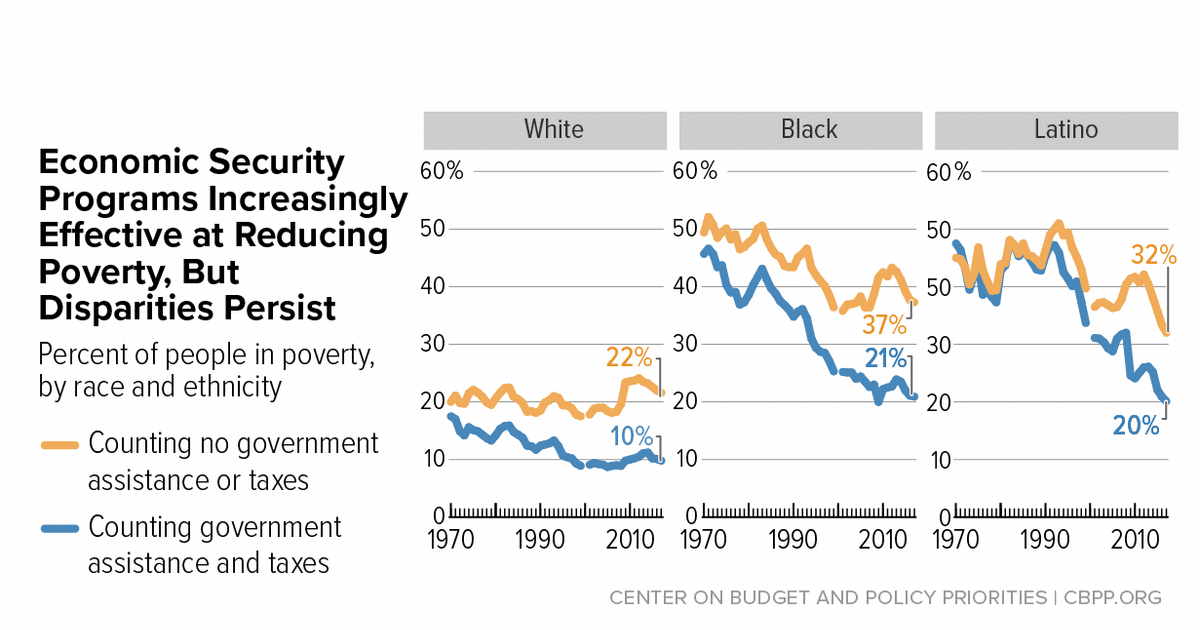

Economic Security Programs Reduce Overall Poverty, Racial and Ethnic Inequities

Free Government Cell Phones: Plans, Devices, How to Apply

Free Government Cell Phones: Plans, Devices, How to Apply

Thanks to the government’s Lifeline Assistance Program, you can qualify for free cell phones and inexpensive cell phone plans.

For those of you who struggle making your cell phone payment every month, this government program was made for you.

www.whistleout.com

Free Internet Access

www.whistleout.com

Free Internet Access

$65 billion to expand broadband access for nearly 50 million elderly and children that couldn't use the internet!

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MUOYZ3UJRNICRMF3EBMVKNQSEA.jpg)

www.reuters.com

Free housing

www.reuters.com

Free housing

Over 5 million low-income households receive federal rental assistance."

Federal Rental Assistance Fact Sheets | Center on Budget and Policy Priorities

Free food

There are over 59 million Americans that receive welfare during an average month. SNAP is the biggest welfare program in the US. Children, the disabled and elderly constitute the majority of public benefit recipients. More women than men are dependent on food stamps. Straight Talk on Welfare Statistics (20+ Stats & Facts) | Fortunly

Because.. here is who pay the Federal government taxes...

In 2019, the top 1 percent of taxpayers accounted for more income taxes paid than the bottom 90 percent combined.

The top 1 percent of taxpayers paid $612 billion in income taxes while the bottom 90 percent paid $461 billion in income taxes.

taxfoundation.org

taxfoundation.org

First of all here is what the poor get from the wealthy tax dollars..

Economic Security Programs Reduce Overall Poverty, Racial and Ethnic Inequities

Economic Security Programs Reduce Overall Poverty, Racial and Ethnic Inequities | Center on Budget and Policy Priorities

While government programs have done much to narrow these disparities in poverty, further progress will require stronger government efforts to reduce poverty and discrimination and build opportunity for all.

www.cbpp.org

Thanks to the government’s Lifeline Assistance Program, you can qualify for free cell phones and inexpensive cell phone plans.

For those of you who struggle making your cell phone payment every month, this government program was made for you.

Free Government Phones: Plans, devices, how to apply

In this guide we'll explain the government's Lifeline Assistance program, which gives low income Americans access to free cell phones and $9.25/month cell phone plans. A number of carriers participate in the program, like Lifeline, including QLink and Safelink Wireless.

$65 billion to expand broadband access for nearly 50 million elderly and children that couldn't use the internet!

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MUOYZ3UJRNICRMF3EBMVKNQSEA.jpg)

U.S. Senate advances roughly $1 trillion bipartisan infrastructure bill

A roughly $1 trillion bipartisan infrastructure investment bill advanced in the U.S. Senate on Wednesday, passing a key milestone that moves the emerging legislation toward formal debate and possible passage.

Over 5 million low-income households receive federal rental assistance."

Federal Rental Assistance Fact Sheets | Center on Budget and Policy Priorities

Free food

There are over 59 million Americans that receive welfare during an average month. SNAP is the biggest welfare program in the US. Children, the disabled and elderly constitute the majority of public benefit recipients. More women than men are dependent on food stamps. Straight Talk on Welfare Statistics (20+ Stats & Facts) | Fortunly

Because.. here is who pay the Federal government taxes...

In 2019, the top 1 percent of taxpayers accounted for more income taxes paid than the bottom 90 percent combined.

The top 1 percent of taxpayers paid $612 billion in income taxes while the bottom 90 percent paid $461 billion in income taxes.

Summary of the Latest Federal Income Tax Data, 2025 Update

New IRS data shows the US federal income tax system continues to be progressive as high-income taxpayers pay the highest average income tax rates. Average tax rates for all income groups remain lower after the Tax Cuts and Jobs Act (TCJA).