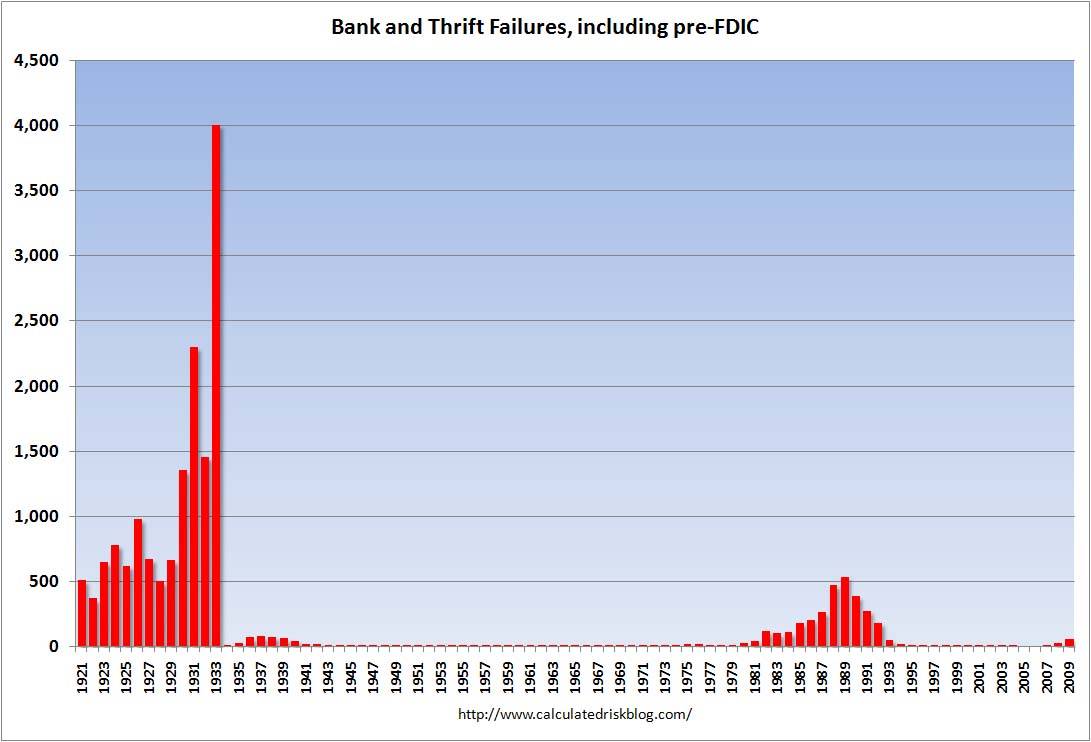

Never thought I'd hear someone argue we should bring back bank runs.

There are still runs on banks, and banks fail all the time. Probably even more now that there is Federal Insurance on Deposits.

You may not know or understand, but the moment you put your money in the bank, you become a creditor of the bank. Being a creditor of any business does not obligate or entitle one to have their losses covered. Before deposit insurance, banks competed on soundness. They competed on interest rates. They competed on capitalisation.

Banks no longer have to compete on these standards. Not because the public is ignorant, but because the public doesn't care. The public doesn't care because they believe their money is covered. They will put their money into any bank. The bank will do foolish things with it, and the people will be none the wiser.

What is even sadder is the fact that these people believe their deposits are actually safe. Poor saps.