Yarddog

Diamond Member

- Jun 13, 2014

- 19,074

- 13,564

- 2,405

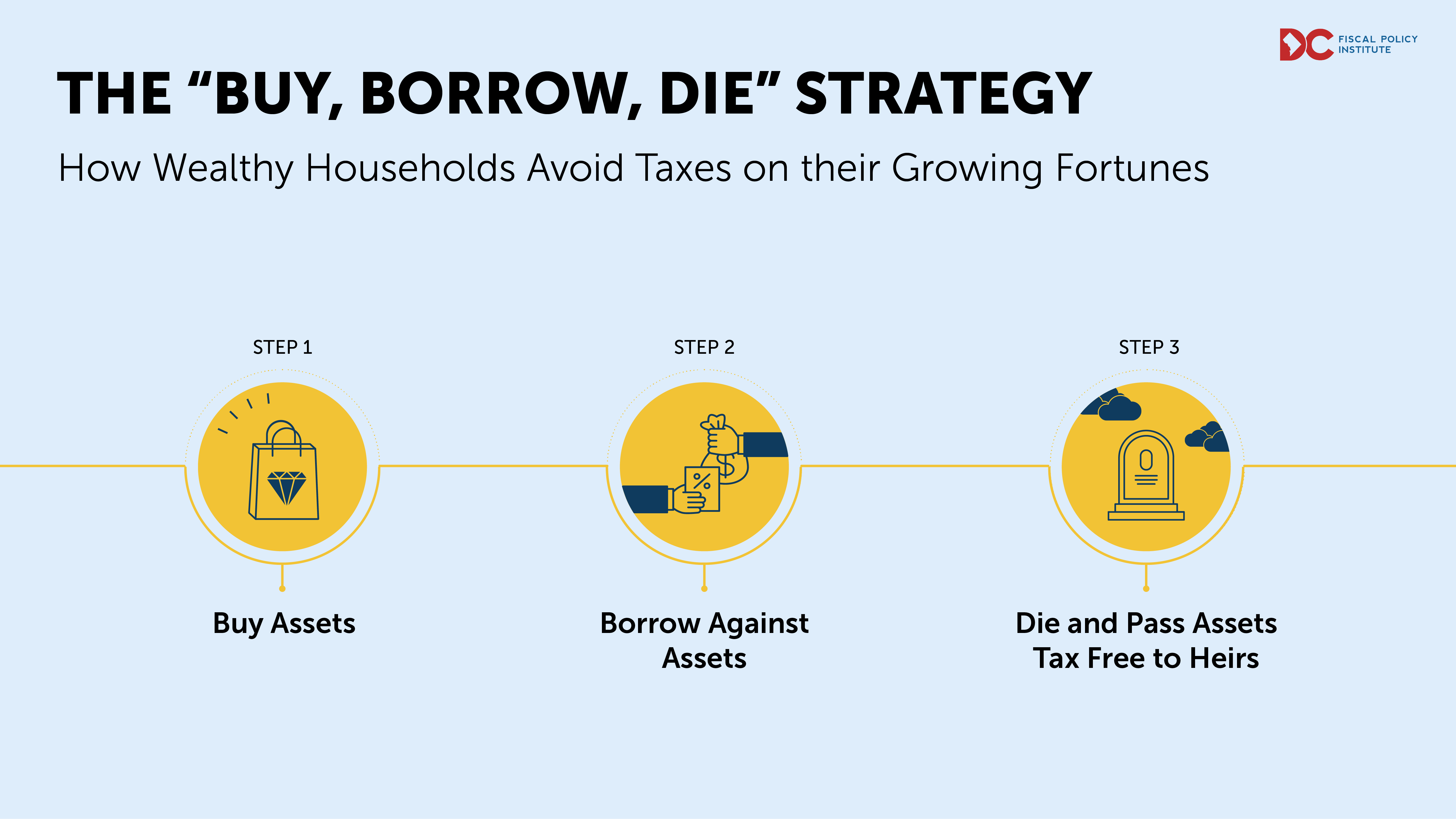

You only pay capital gains after you sell your assets. What wealthy people do to avoid paying taxes at all is borrow against their assets. You don't pay taxes on borrowed money.

They then invest the borrowed money into new assets like rental property. They live on that income while their assets grow indefinitely. Meanwhile, their original assets grow indefinitely, making it possible to borrow more money and invest in more property.

Then they die without their original assets ever being taxed.

How Wealthy Households Use a “Buy, Borrow, Die” Strategy to Avoid Taxes on Their Growing Fortunes

Capital gains are the profits generated from wealth such as stocks and real estate. Wealthy households can use the three-step “buy, borrow, die” strategy to get massive capital gains tax advantages.www.dcfpi.org

Yeah, your describing the 1031 exchange process, which is great. You dont have to be one of the top 5% to do this. Its also a way middle class people can move up in wealth. It's a good thing, not bad.