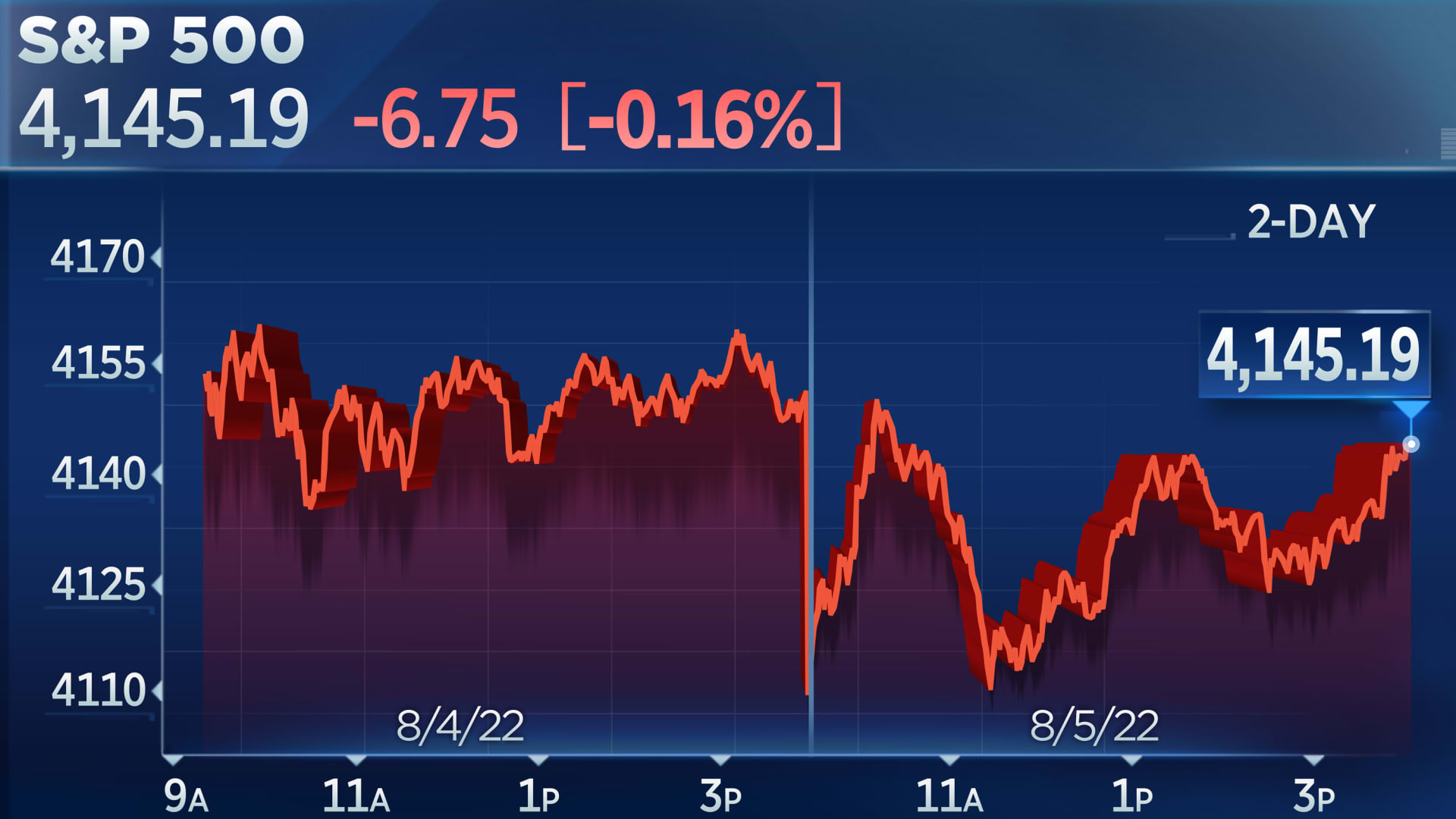

Our economy is doing so well, the stock market is worried the Fed will increase interest rates even more.

Investors looked to Friday's jobs report for further clues about the Federal Reserve's path of rate hikes.

www.cnbc.com

The labor market added 528,000 jobs in July, easily beating a Dow Jones estimate of a 258,000 increase. The unemployment rate ticked down to 3.5%, below the 3.6% estimate. Wage growth also ticked up more than estimated, up 0.5% for the month and 5.2% higher than a year ago, signaling that high inflation is likely still a problem.

Rapid growth contributes to inflation.

3.5% unemployment. That ties Trump's lowest unemployment rate.

Inflation in the UK is expected to hit 13 percent, which is Biden's fault, amiright?

The Bank of England raises rates as it warns inflation will rise over 13% and the UK faces a long recession.

www.bbc.com