berg80

Diamond Member

- Oct 28, 2017

- 33,368

- 27,217

- 2,820

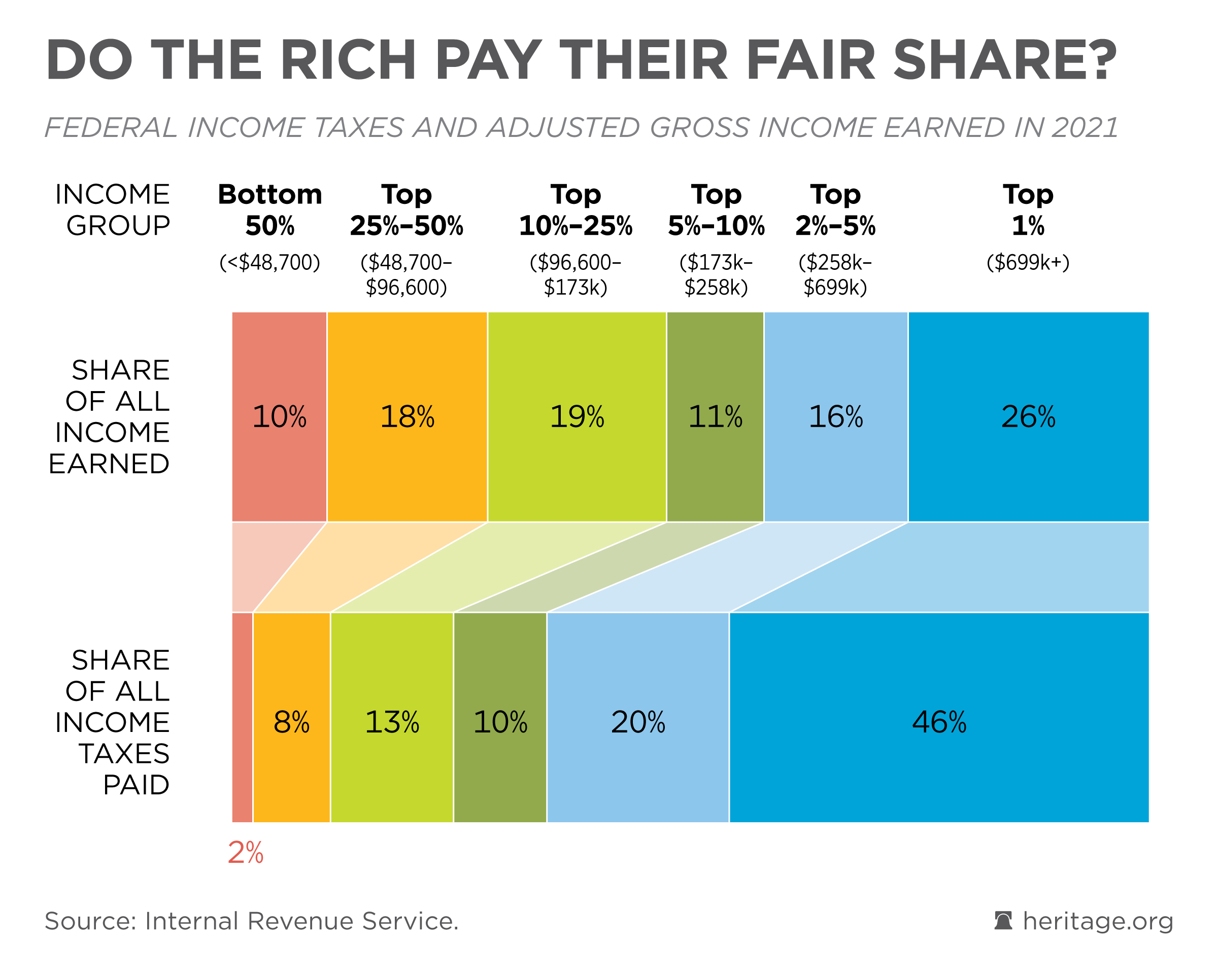

Trump tax plans could exempt 93 million Americans from income taxes

Former President Donald Trump’s tax reform ideas could offer total or partial income tax exemptions to roughly 93.2 million Americans, a meaningful chunk of the U.S. electorate, according to CNBC’s analysis of several estimates.

As part of his economic pitch to voters, Trump has floated a sweeping tax overhaul, including a slate of income tax breaks.

So far, the Republican presidential nominee has officially proposed eliminating income tax on tips and Social Security benefits, along with overtime pay. And last week, in an interview on the sports media site OutKick, Trump said he would consider tax exemptions for firefighters, police officers, military personnel and veterans.

Trump has said he would replace the lost tax revenue with revenue from tariffs, but tax experts say tariffs would not offset the tax losses.

Meanwhile.........

Trump plan would make Social Security insolvent in just 6 years, budget group says

Former President Donald Trump’s campaign plans would significantly accelerate the already-fast-approaching date when Social Security is projected to run out of money, a nonpartisan budget group said Monday.

Trump’s agenda would make the popular government program, relied upon by millions of American seniors, insolvent in six years — shrinking the current timeline by a third, the group found.

The Republican nominee’s proposals would also expand Social Security’s cash shortfall by trillions of dollars and lead to even steeper benefit cuts in the coming years, said US Budget Watch 2024, a project of the Committee for a Responsible Federal Budget.

Massive deficits and SS insolvency. Sounds awesome. Start stockpiling beef jerky, water, and gold.