You saying the 'markets' don't work?

Markets work most of the time. Sometimes they don't work all the time. I've spent nearly 20 years in capital markets and have seen first hand how markets break down.

Did the Fed Cause the housing Bubble?

According to research by Ambrogio Cesa-Bianchi and Alessandro Rebucci, the housing bubble was caused by "regulatory rather than monetary-policy failures"

Economist's View: Did the Fed Cause the housing Bubble?

Regulators and policymakers enabled this process at virtually every turn.

Part of the reason they failed to understand the housing bubble was willful ignorance: they bought into the argument that the market would equilibrate itself. In particular, financial actors and regulatory officials both believed that secondary and tertiary markets could effectively control risk through pricing.

http://www.tobinproject.org/sites/tobinproject.org/files/assets/Fligstein_Catalyst of Disaster_0.pdf

Banks used cheap capital to create a bubble. Their lending strategies fueled and fed off the housing bubble, and they did so using mortgage products whose performance was premised on continued growth of that bubble.

In that paper, there is a an "if-then" argument. "If" the Federal Reserve had to lower interest rates, "then" the government should have increased regulation.

First, in theory, that's absolutely correct. Take an extreme example. Had the government changed the law to require a 50% or higher loan to value, there would have been no housing bubble. The housing market would have collapsed, but there would have been no bubble.

Second, the authors didn't argue that there shouldn't have been deregulation. They were arguing that there should have been

more regulation to offset the abnormally low interest rate. I don't know of any economist who was arguing that we should increase taxes in 2003 or 04 as the authors suggested. Paul Krugman went on 60 Minutes to argue that the government should inflate the housing market as stimulus.

But the first order was that the Fed kept interest rates too low for too long. The second order required increased regulation. Had the first order not existed, i.e. interest rates not been kept too low, there would have been no argument for the second order, that there should not have been a need for regulation.

Also, the authors seem to mis-understand how asset markets work. That housing prices were rising when the Fed was increasing rates is what we'd expect in a normal market, and it's not a priori evidence that the Fed was not being too loose. Markets tip over usually when credit is tight, not when the short end of the curve begins to rise.

Yes, underwriting standards declined substantially. That was a reason why the bubble happened.

However, the reason there was a decline in underwriting standards was because interest rates were lowered to levels that hadn't been seen in 60 years, which created a mismatch between assets and liabilities of financial entities. Those entities needed yield, and structured products gave them that return. So there was a huge demand for structured products. To fill the structured products, they turned to mortgages. Underwriting standards were lowered to fill the structures which were sold to investors demanding the products because bonds didn't yield enough. And bonds didn't yield enough because the price of fixed income was set too low.

after the Fed started to tighten its monetary-policy stance and the prime segment of the mortgage market promptly turned around,

the subprime segment of the mortgage market continued to boom, with increased perceived risk of loans portfolios and declining lending standards. Despite this evidence, the first regulatory action to rein in those financial excesses was undertaken only in late 2006, after almost two years of steady increases in the federal funds rate.

When regulators finally decided to act, it was too late

Was it easy money or easy regulation that caused the housing bubble? | AEIdeas

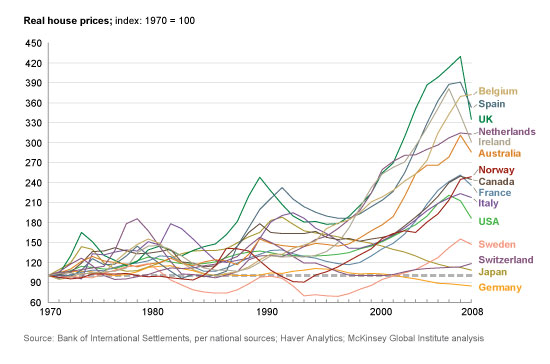

Bubbles happen for many reasons. For the Housing Bubble, I blame the following in this order

1. The Fed

Then way down

2. Wall Street

3. Deregulation

Deregulation in financial services is usually a good thing in the long-term, but in the short-term, it can create bubbles, asset mispricing and economic collapse. There is significant empirical evidence from around the world that both are the case.

The actions of the Fed and the mispricing of credit spurred the second two causes of the collapse.