Some, but not what they should pay.

US companies pay US taxes on US profits.

A con tool response. How surprising, coming from a con tool.

So, did you think that the money made by transfers and operations moved overseas are not US profits?

Not the percentage I pay, and others pay.

No kidding. They pay a higher percentage than you do.

A con tool response. How surprising, coming from a con tool.

They pay a lower percentage than I. A number paid None. The average for corporations was around 12%.

They pay a lower percentage than I.

What percentage do you pay?

Really, me boy, you did not really think I would tell you with no conditions. I would if you want to publish your taxes. Because as a con tool, I could not believe what you sy. Cons lie typically. OK? You publish, then I publish.

The average for corporations was around 12%.

Sounds like liberal math. IE wrong

A con tool response. How surprising, coming from a con tool.

But I did forget to include the word profitable.

What rate did you think profitable us companies paid, me boy?

Oh, and I know that you are just a con, and cons are often ignorant, but producing a tax rate is not Math, me boy. Just trying to help educate you.

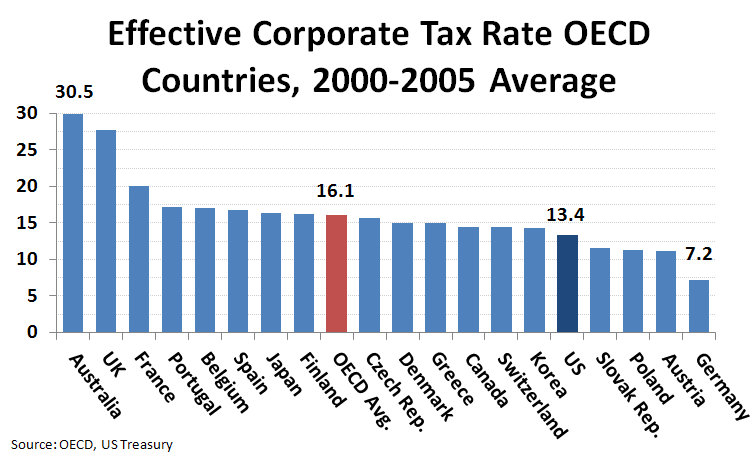

Profitable corporations paid U.S. income taxes amounting to just 12.6% of worldwide income in 2010.

Fact Sheet: Corporate Tax Rates

I know you're a moron, but consider this scenario.

You make a $1,000,000 profit in the U.K. and a $1,000,000 profit in the US.

You pay your 35% tax in the US and your 20% tax in the U.K.

Now a liberal moron, that'd be you, says "You made $2,000,000 in profit, but only paid $350,000 in US taxes, that's a 17.5% effective US tax on your worldwide income"

You'd say that because you're a liberal moron, but then I repeat myself.

The corporation paid an effective US tax on US profits of 35%.

Why, me boy, would you pay 35% on profits when the average profitable company pays 12.6% on worldwide profits, and under 20% on us profits. They must be the morons, like you, eh. According to the source you site above (same web page):

They'd be stupid, like you, if they brought home that U.K. profit and paid an additional

US tax on it of $150,000 (the difference between 35% and 20%, because you're a moron),

Depends, me poor ignorant con troll, where you report your profits. It becomes an accounting issue. You pay accountants to handle that. No company is stupid enough (like you) to pay taxes in two jurisdictions. And no company is stupid enough (like you) to pay the stated rate of 35% when they can and do in fact pay less. Dipshit.

but even if they did, their effective US tax rate on worldwide income would only be 25%.

That would be like you, living in California, near the Arizona border, working half the year in each state.

Arizona taxes you at a peak rate of 3.36% on $50,000, California, a peak rate of 8% on $50,000.

If California said, "If you bring any of that Arizona income here, we'll tax you another 4.64% on it".

Ah, tax amnesty. Pure bullshit, me boy:

Tax Holiday for Overseas Corporate Profits Would Increase Deficits, Fail to Boost the Economy, and Ultimately Shift More Investment and Jobs Overseas

| Center on Budget and Policy Priorities

Since you are a con troll, of course you would lie like a rug about the tax amnesty, or holiday, program.

Really, me boy, you are easy to predict. And for the good of our country it would be Todster stupid to impliment it again.

That'd be Rshermr level stupidity to bring that money home just to give Jerry Brown more money to

build choo-choos with. You'd leave it in Arizona and now you've only paid an effective California tax rate of ~4%

on your worldwide income.

Depends, me boy, on the laws. And laws are subject to change.

Feel better now? If any of that math was too tough for you, my 7th grader will be home this afternoon.

They'll be happy to explain further.

Wow. A baseless insult. Just like you were a con troll. Oh, forgot, you are indeed a con troll.

But as a con troll, you are simply making up scenarios and tax law on the fly. Issue is, and was, where should taxes be paid. That transfers are made and that they may be legal, or not, is a legal issue. What you are suggesting, however, is that businesses in this country are stupid like you, and therefor will pay 35% when in fact they almost NEVER do. And when in fact they generally pay lower taxes in the US than most advanced nations, they should be paying taxes in whatever country they do business in. Typical con look at things. Because, of course, those very companies pay big time to get politicians to change the laws to allow them to stiff the US. As a con troll, as long as the corporation pays less, it is good. The issue is, most people do not agree with you. You are, me boy, WRONG. Legal, probably. And as a con troll, you are pushing the con talking points. Always.

Thats pretty cool, though, isn't it. As a con troll, you just post con talking points and use con justification. You do not even have to read the articles you use as sources.