there4eyeM

unlicensed metaphysician

- Jul 5, 2012

- 20,975

- 5,512

- 280

See post 27; yes, checks, letters of credit and lines of credit are creation of money.So, from your perspective, credit does not create new money?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

See post 27; yes, checks, letters of credit and lines of credit are creation of money.So, from your perspective, credit does not create new money?

But, that's not the creation of money. It's the creation of debt.See post 27; yes, checks, letters of credit and lines of credit are creation of money.

It is the creation of wealth, and usually results in goods and services.But, that's not the creation of money. It's the creation of debt.

I would argue that it is the mere circulation of wealth. All new wealth comes from the land/earth.It is the creation of wealth, and usually results in goods and services.

Credit does not create new money, but creates a need for more money to pay the debt.

I put 100k in the bank...Liberals often talk about wealth disparity and wages as something akin to a zero sum game. CEOs make too much money, not leaving enough for others, that kind of stuff. Conservatives usually say that wealth has no limits and can be created if people just find a way. Credit is supposed to be one of the ways wealth is created, and government influence over credit allegedly affects creation of new wealth. When the fed cuts interests rates low, or even down to zero, it's allegedly no different than printing money out of thin air. But is it?

Does credit equate to creating new money? Why? How?

See post 27; yes, checks, letters of credit and lines of credit are creation of money.

Here ya go...No:

- you buy something

- the credit card company pays the seller

- you pay the credit card company back.

How is that "new money"?

:max_bytes(150000):strip_icc()/save-money-concept-with-hand-man-putting-coin-on-stack-set--803561926-960a10cd6ff74045ac12aeeaeedb1288.jpg)

Good.That's not quite how it works. But I understand your position, now.

It is not "liberals" that treat the income disparities as "zero sum" it is people like you.

Liberals understand the multiplier effect

People like you only understand greed.

Thus explaining your limited understanding of the topics you're posting.

Your understanding of economics is exceeded by anything larger than a gnat's eyelashAt one time, no the dollar was bound by the amount of gold in the reserve so the FED couldnt print any money other than with backing. It is the progressives who took the US off the gold standard allowing the debt and printing of oodles of money by the FED. Quantitative Easing, first by the brown turd Obammy was supposed to bring the US out of Progressive Andrew Cuomo's housing debacle, but all it did was delay the recovery while people like Steve Jobs , Elon Musk and Warren Buffet all took out loans at almost zero percent interest while investing in their company making 3 to 5 percent income per year. Now with the threat of higher interest rates, those debts are soon going to be higher than the income thus there will be a mad selloff of stock to cover, bringing a depression on the US. Who is the president again?

Try again...When a loan is made the Federal reserve prints it up or uses money already printed to loan out again. It is allowed to be laned out I believe 9 times each time worth 10% less from the previous loan. The fiat currency relies on constant credit expansion as it will implode with out it. However, in recent years it seems more likely and there can be just printing up money 24 hours a day to keep the system from collapsing from all the debt and promised payouts.

:max_bytes(150000):strip_icc()/save-money-concept-with-hand-man-putting-coin-on-stack-set--803561926-960a10cd6ff74045ac12aeeaeedb1288.jpg)

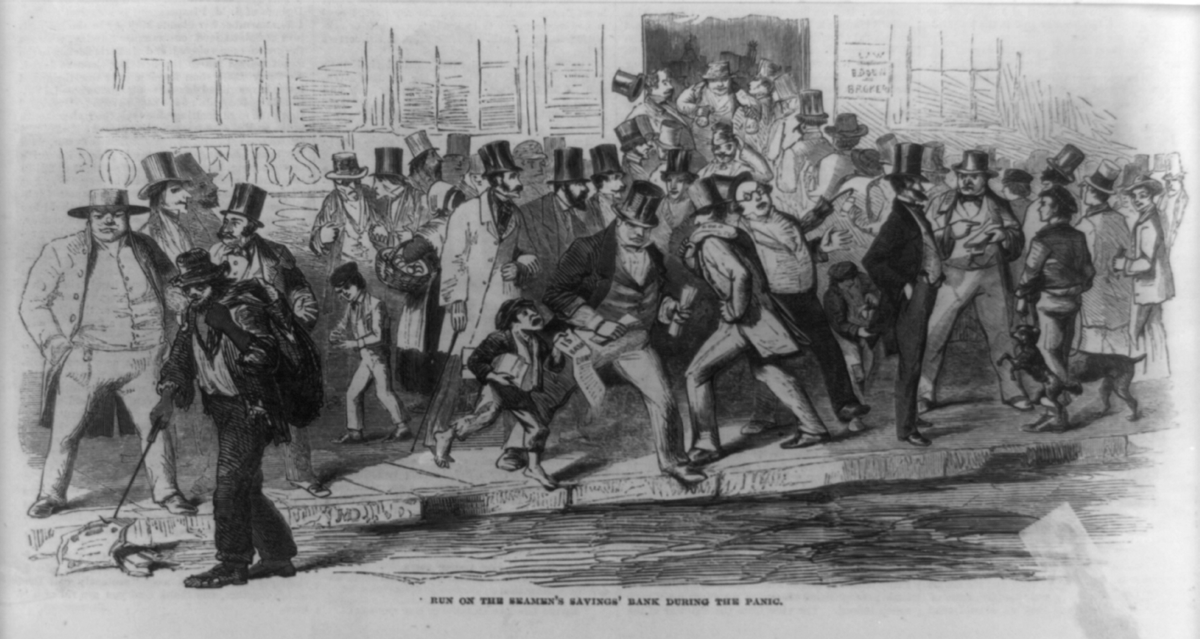

There were massive regional and nationalI'm curious. Back in the days of the gold standard, was new money not ever created? If it was, how was it created? Was there no inflation? If there was, what caused it?

Yep. My favorite illustration is the whiskey and water scenario.Most people don't know what money actually is, Bootney.

All of the currency that is piling up is nothing more than a receipt for a claim check on an IOU bond.

Actual 'money' has to be a store of value and maintain its purchasing power over long periods of time, have a well defined unit of account to serve as a standard of value, and a medium of exchange.

Challenge any single one of our resident so-called 'experts' in the field to define the unit of account for one Federal Reserve Note and see what they tell you. Ask them to define their yardstick for measuring economic value. Heh heh. That'll be a hoot. They'll either look like a deer in headlights or pawn of some sensless troll remark or try to flip the script with some stupid, irrelevant counter-question to weasel away from it and re-steer the discussion. History is rife with example.

As you know, creating currency and credit out of thin air devalues the currency and inevitably leads to inflation.

Education is also 'wealth'. Good will is wealth. There are indeed intangibles involved.I would argue that it is the mere circulation of wealth. All new wealth comes from the land/earth.

Are you kidding or being obtuse?You're sending off mixed signals here. First you say that loaning 1 kilo of rice does not create new money in the island's economy, but now you say lines of credit are a creation of money.

Are you kidding or being obtuse?

You understand, we assume, that in the first, isolated case, all the parameters are fixed, known and limited.

In the second case, things are happening in a diverse and wide-spread world. When the merchant leaves Florence with his letter of credit to go to the fabric fair in Troyes, France, the gold stays in Florence, thus sparing the poor fellow the weight and danger of carrying it. The letter is accepted at the fair as exchange, money. Thus the value of the gold is in at least two places at once (and may have further been 'loaned' against in the meantime). This way, the same quantity of valued metal serves to create wealth in various places. It builds factories here, buys land there, purchases goods for transformation wherever. These things create jobs and the wealth continues to develop. The gold stays put.

ROFL! If given a choice between pieces of paper and a gold brick, which would you take?People speak of some metal "backing" a currency as if that metal had absolute value. Humans determine all value. Gold has as much value as people give to it. Paper money is no different.

On a desert island with two people on it, one has a hundred kilos of gold and one has a hundred kilos of rice. Who is rich?

"Liberals often talk about wealth disparity and wages as something akin to a zero sum game. "Whoa now! I'm asking an honest, good faith question to stimulate discussion and gain better insight into other people's economic views. There is absolutely no reason to get a bad attitude. This has been a largely friendly conversation so far. If that's too much for you to handle...well that would say an awful lot about you.