[W]hat if we compare U.S. taxes today to those in the past? Are Americans more heavily taxed than those in earlier years, and do polls show greater dissatisfaction with taxes today?

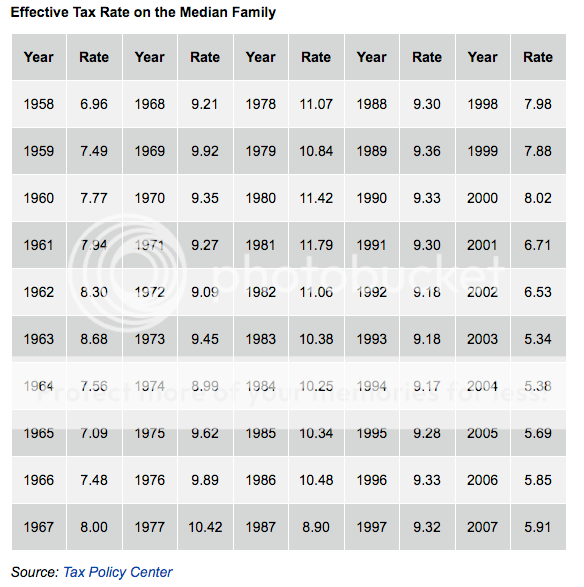

To answer these questions, I looked at the effective federal income tax rate--taxes paid as a share of income--for a family with the median income. The median is the exact middle of the income distribution--half of families are above and half are below. It's as close as we can get, statistically, to the typical American family.

As the table shows, in 2007, the most recent year available, the median family paid 5.91% of its income to the federal government in the form of income taxes. This is half the tax rate paid in 1981 before the Reagan tax cut took effect. Although the 2007 rate is up very slightly from its 2003 low point, it is still well below the rate that prevailed from the 1950s through the 1990s.

I don't have data for 2009, but it's a certainty that the median family tax rate is well below that which prevailed in 2007 if only because in February, Congress enacted a new tax credit that will reduce the median family's tax bill by $800 over last year.

Some may wonder about marginal rates--the tax on each additional dollar earned. This year, the median family will face exactly the same marginal tax rate it has faced since 1987: 15%. This is down substantially from the 1970s, when the median family paid as much as 25% on the marginal dollar of income.

Thus, it is hard to find evidence that taxes are rising or unusually high. This is confirmed by poll data. According to Gallup, only 46% of Americans think their federal income taxes are too high--the lowest percentage recorded since 1961. In 2000, 65% of people thought their taxes were too high; last year the figure was 52%.

It is even more revealing to compare the percentage of Americans who think their taxes are too high to those who think they are about right. Ten years ago, there was a wide gap--65% thought their taxes were too high and only 29% thought they were about right. This year, 48% of people think their federal income taxes are about right. In only one other year since 1956 have more Americans said their taxes were about right than said they were too high. ...

I have problems with ... the sudden appearance of tea parties to protest taxes. First, many protesters implicitly assume that that the deficit has increased solely as a result of Barack Obama's policies. But in fact, the Congressional Budget Office was projecting a deficit of more than $1 trillion this year back in January, before any of Obama's policies had been enacted, and a cumulative deficit of $4.3 trillion through 2019. (CBO made no assumptions about what his policies might be in making its projection.)

It's true that projected deficits have gotten larger since January. But much of this resulted from deteriorating economic conditions that would have occurred even if John McCain were president. Moreover, it is absurd to assume that McCain would not have enacted any stimulus programs had he been elected.

More than likely, McCain would have proposed a stimulus plan of roughly the same size as that proposed by Obama. No doubt, it would have had a different composition--heavier on tax cuts, different kinds of tax cuts, less spending, different spending--but it wouldn't have been all that different from Obama's package given large Democratic majorities in the House and Senate and the pressure to act quickly. ...

[T]here were no tea parties during the years when George W. Bush was turning the surpluses of the Clinton years into massive deficits. Indeed, if concerns about deficits are the primary motivation for this week's tax protests, then these same people should have been holding demonstrations of support for Bill Clinton in 2000 when the federal government ran a budget surplus of 2.4% of the gross domestic product--equivalent to a surplus of $336 billion this year.

The truth is that the greatest addition to national indebtedness occurred in 2003 when Bush rammed through the Republican Congress a massive expansion of Medicare to provide drug benefits even though the system was already broke. According to the latest report from Medicare's trustees, the drug benefit added $7.9 trillion to the nation's indebtedness. This should have led to massive tax protests on April 15, 2004. But, of course, there weren't any. Those protesting this week were only protesting because it is a Democrat who has increased the deficit. When a Republican did worse, it's like Emily Litella used to say, "Never mind." ...

Bruce Bartlett is a former Treasury Department economist and the author of Reaganomics: Supply-Side Economics in Action and Impostor: How George W. Bush Bankrupted America and Betrayed the Reagan Legacy. He writes a weekly column for Forbes.

Tax Tea Party Time, Part Two - Forbes.com