Lookout

VIP Member

- Oct 5, 2007

- 922

- 77

- 63

Who's your daddy? The Fed expands its role in your personal life - 09 Jul 2009

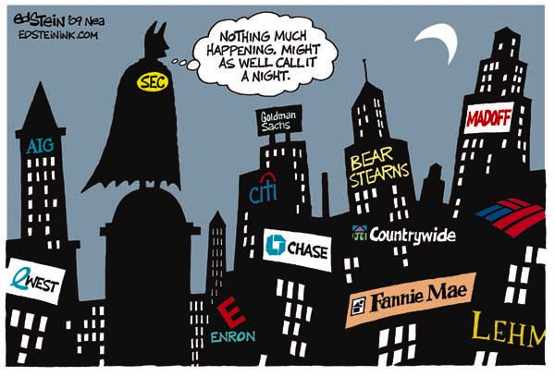

Some call it consumer protection. Some say it's necessary because government regulation has broken down and failed us, even though some who are expressing that opinion were heavily involved in the breakdown. Others see it as an ever-growing insult by the federal government, telling us that we are not smart enough to make good decisions, therefore we must leave it up to them. What's the target this time? The Fed is upset because you are not saving enough of your paycheck for a rainy day, and they intend to do something about that by taking your money before you get a chance to spend it. Very few details have been released, but here is the basic plan as reported by The Wall Street Journal.

If currently proposed legislation creating the new Consumer Finance Protection Agency (CFPA) is made into law, the federal government will create a savings account for you, and instead of sending you your tax refund, your overpayment of taxes will automatically be deposited into this account. Any pay raises you earn on your job will not show up in your paycheck, but will also be siphoned off into the new savings account. Out of sight, out of mind, might be the philosophy. You will have the ability to opt out of the new forced savings plan. But supporters of this program say by opting out, you are making a conscious choice not to save... and the federal government is counting on you to not make that decision.

Some call it consumer protection. Some say it's necessary because government regulation has broken down and failed us, even though some who are expressing that opinion were heavily involved in the breakdown. Others see it as an ever-growing insult by the federal government, telling us that we are not smart enough to make good decisions, therefore we must leave it up to them. What's the target this time? The Fed is upset because you are not saving enough of your paycheck for a rainy day, and they intend to do something about that by taking your money before you get a chance to spend it. Very few details have been released, but here is the basic plan as reported by The Wall Street Journal.

If currently proposed legislation creating the new Consumer Finance Protection Agency (CFPA) is made into law, the federal government will create a savings account for you, and instead of sending you your tax refund, your overpayment of taxes will automatically be deposited into this account. Any pay raises you earn on your job will not show up in your paycheck, but will also be siphoned off into the new savings account. Out of sight, out of mind, might be the philosophy. You will have the ability to opt out of the new forced savings plan. But supporters of this program say by opting out, you are making a conscious choice not to save... and the federal government is counting on you to not make that decision.