WillowTree

Diamond Member

- Sep 15, 2008

- 84,532

- 16,091

- 2,180

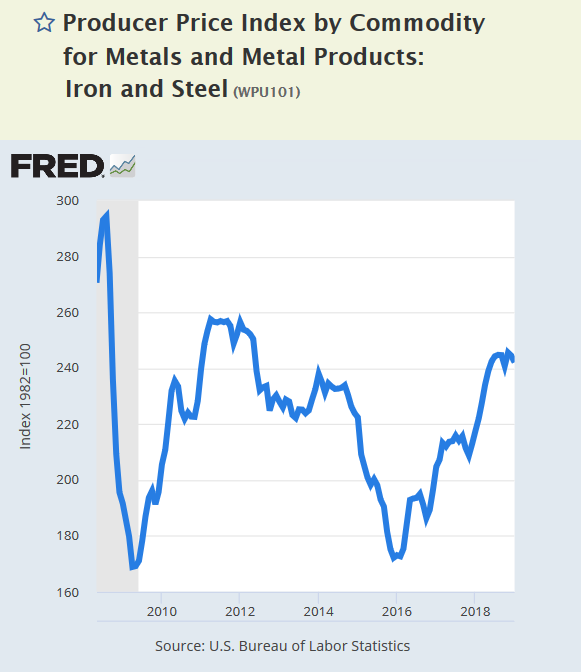

What about Canadian tariffs?who pays for them?Tariffs are taxes. When tariffs go up, prices go up as businesses pass on the increases to you. Trump’s trade taxes have cost the American consumer $69 billion thus far.

Businesses have captured most of that, but as any Economics 101 student knows, there is a deadweight loss to the economy. This is why 99.99999% of economists oppose tariffs.

That deadweight loss to the US economy has been about $7 billion.

U.S. Consumers Hit Hardest by Trade Tariffs, Studies Find

Good economics, half-witted geopolitics. China's wholesale, at least attempted, theft of intellectual property is an NPV loss of capital claimed to be in the trillions.

I can’t disagree, except perhaps the amount.

But this thread is about who is paying for the tariffs. It ain’t businesses or foreign firms. It’s US consumers.