Soggy in NOLA

Diamond Member

- Jul 31, 2009

- 40,565

- 5,358

- 1,830

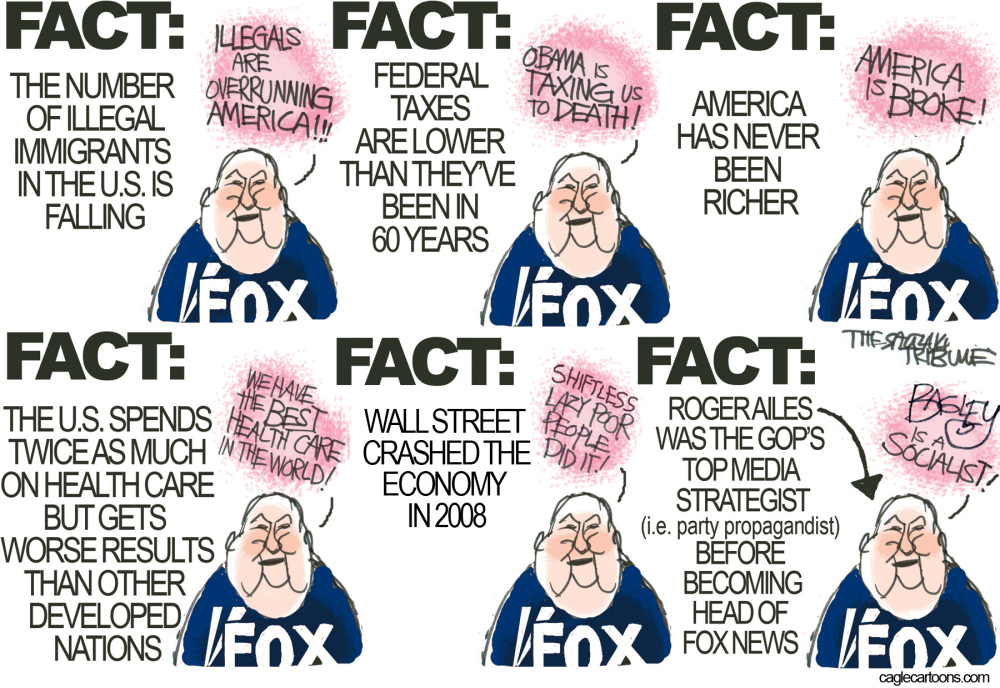

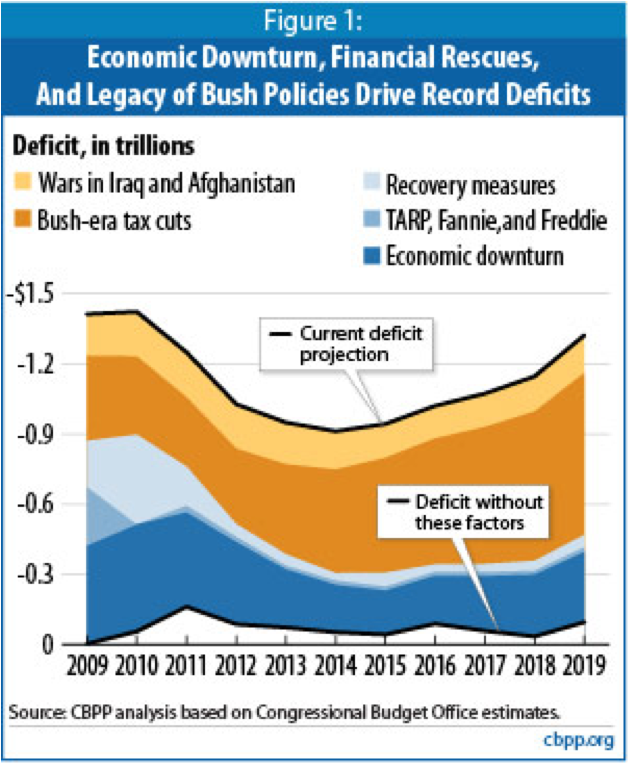

We need Government to undo the damage they did in embracing supply side economics. The idea that concentrating money at the top would result in a rising economic tide that would bring prosperity and jobs to everyone was a major failure

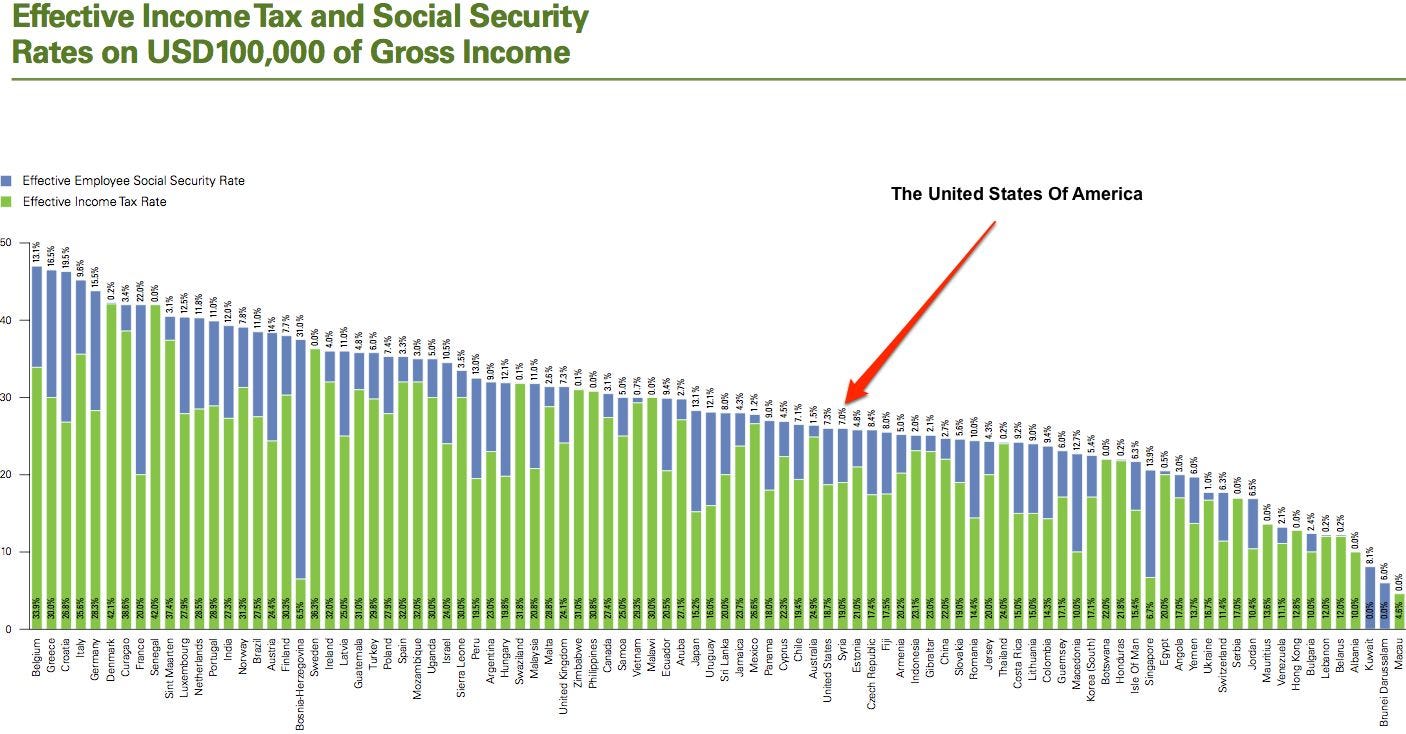

We need to revert to previous tax rates in excess of 50% for the wealthy. Revoke tax shelters and deductions. Tax capital gains the same as earned income. Tax stock transactions

For working Americans we need to reduce the economic risk of serious health problems, provide affordable education for their children, increase wages for unskilled workers

No, we don't any of that failed shit... you people never learn.