Euro

Senior Member

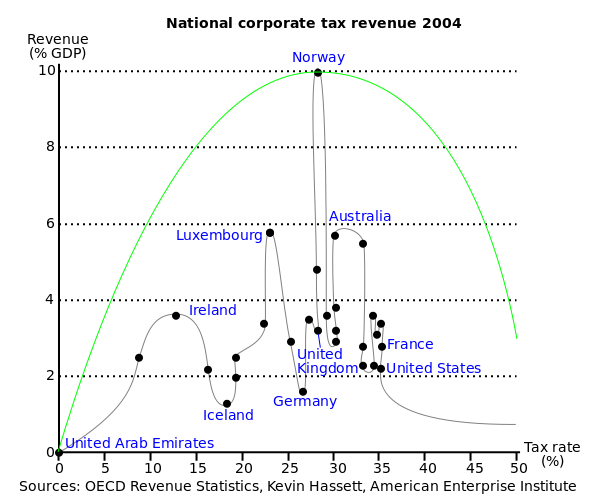

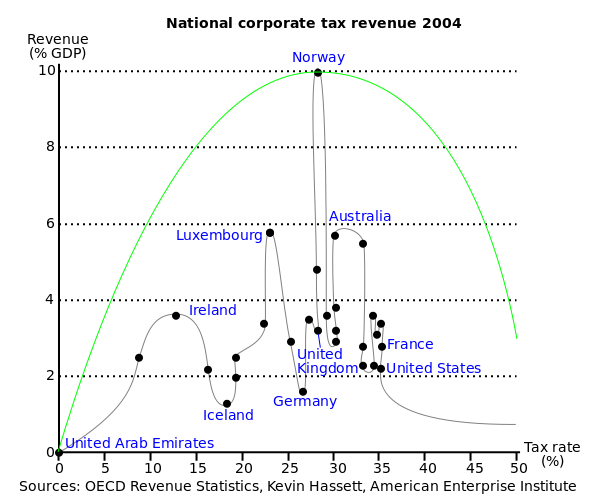

USA world highest corporate tax but not much revenue.

To optimize the tax revenue a lower tax is needed and loopholes and populistic political decission must be ended.

A lower corporate tax will in the Laffer curve give a higher tax income for the government. The curve shows that a medium tax rate is the optimum, and Norway maximises its proffits with a medium tax rate. USA has the highest tax rate and one of the lowest revenues. I also find it odd that what they call the land of freedom etc. has the highest corporate tax in the world? Who would investe and create jobs if the taxes are the highest in the world. Socialist Norway actually has a lower corporate tax than USA. To low taxes as for Ireland isn’t great that either. It is theoretical, but loopholes and populistic politicians destroys the theory that works so well in Norway.

However I think USA has a lot of tax loopholes made by populistic politcians, but with no loopholes it works perfect for Norway. Socialist Norway with a lower tax than USA and also a higher profitt. So why not tighten the loopholes and cut the corporate tax to a lower/medium level

To optimize the tax revenue a lower tax is needed and loopholes and populistic political decission must be ended.

A lower corporate tax will in the Laffer curve give a higher tax income for the government. The curve shows that a medium tax rate is the optimum, and Norway maximises its proffits with a medium tax rate. USA has the highest tax rate and one of the lowest revenues. I also find it odd that what they call the land of freedom etc. has the highest corporate tax in the world? Who would investe and create jobs if the taxes are the highest in the world. Socialist Norway actually has a lower corporate tax than USA. To low taxes as for Ireland isn’t great that either. It is theoretical, but loopholes and populistic politicians destroys the theory that works so well in Norway.

However I think USA has a lot of tax loopholes made by populistic politcians, but with no loopholes it works perfect for Norway. Socialist Norway with a lower tax than USA and also a higher profitt. So why not tighten the loopholes and cut the corporate tax to a lower/medium level

Last edited: