TakeAStepBack

Gold Member

- Mar 29, 2011

- 13,935

- 1,742

- 245

Authority and responsibility for money and debt is with congress ( from The United States Constitution - The U.S. Constitution Online - USConstitution.net )--First off, the treasury isn't responsible for controlling the amount of money; the Federal Reserve is. The treasury issues debt...

--and according to The United States Constitution - The U.S. Constitution Online - USConstitution.net the President with his cabinet (including the Treasury) are responsible for carrying out the will of Congress. What happened is that (from FRB: What is the difference between monetary policy and fiscal policy, and how are they related? )--The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts...

To borrow money on the credit of the United States...

To coin Money, regulate the Value thereof...

Congress established maximum employment and price stability as the macroeconomic objectives for the Federal Reserve; they are sometimes referred to as the Federal Reserve's dual mandate. Apart from these overarching objectives, the Congress determined that operational conduct of monetary policy should be free from political influence. As a result, the Federal Reserve is an independent agency of the federal government. Fiscal policy is a broad term used to refer to the tax and spending policies of the federal government. Fiscal policy decisions are determined by the Congress and the Administration; the Federal Reserve plays no role in determining fiscal policy.

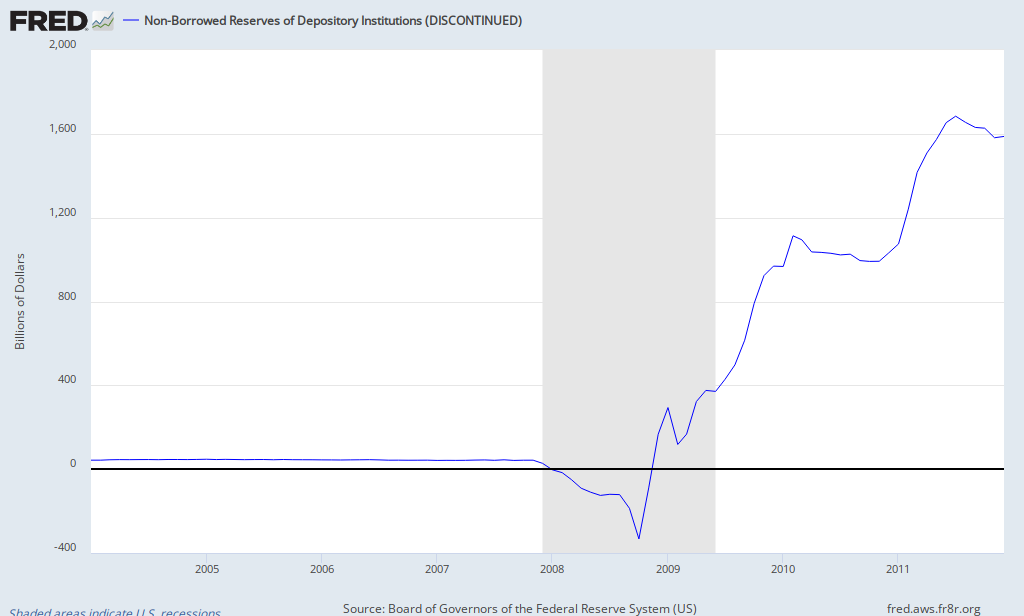

Except for that 16 trillion in secret loans that we found out about from the first audit in the history of the fed.

...

...